Monthly Market Outlook – Dec 2023

19th January, 2024

U.S.

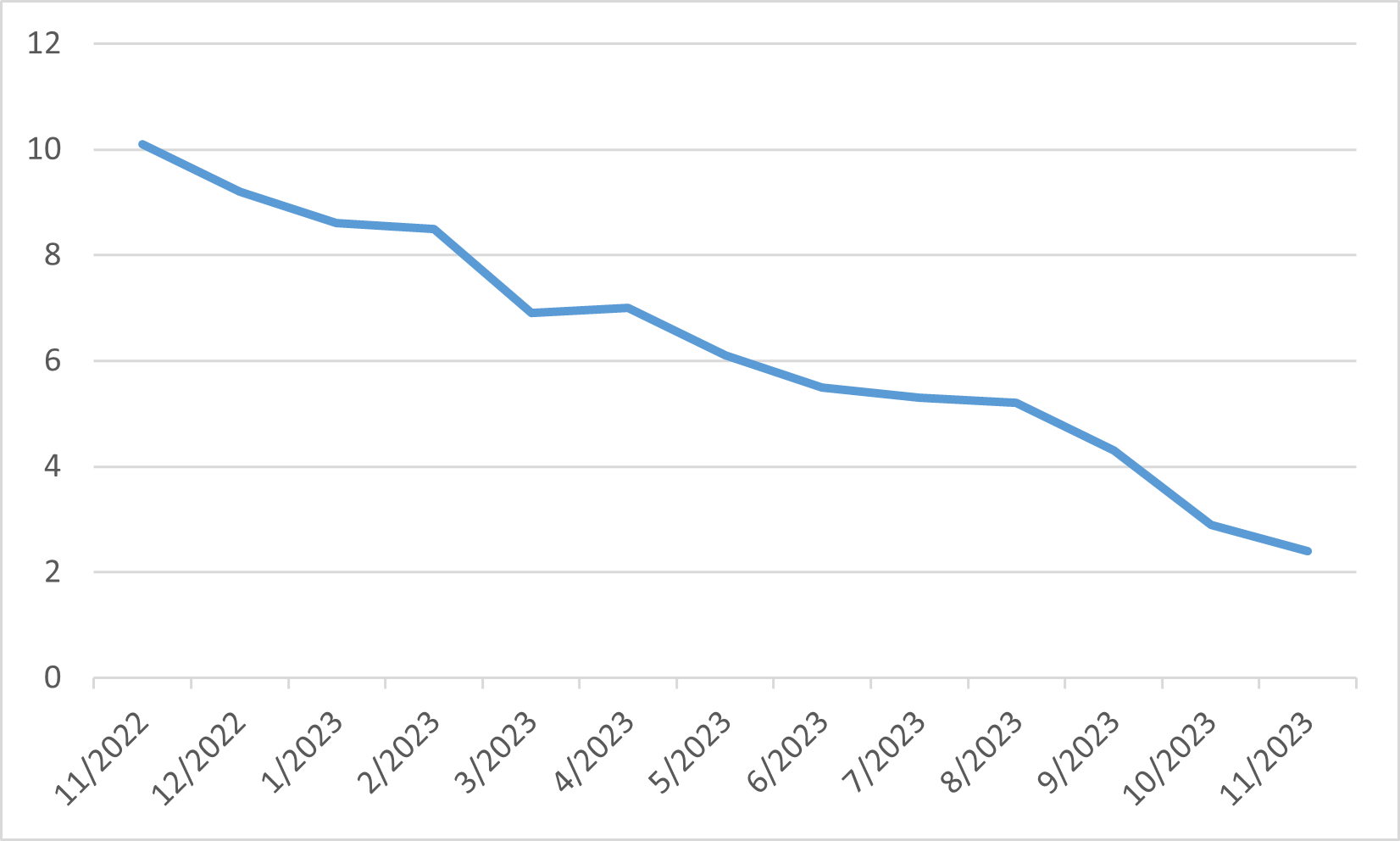

US equities experienced significant gains in the last quarter of the year, driven by the growing anticipation of impending interest rate reductions. The S&P 500 index concluded the year just below its record peak achieved in early 2022.

The annual US inflation rate, as measured by the consumer price index, decelerated from 3.7% in September to 3.2% in October, and further to 3.1% in November. The core personal consumption expenditure index, the Fed's preferred inflation gauge, showed a more subdued increase than anticipated, rising by 0.1% month-on-month in November. Additionally, the US economic growth rate for the third quarter was adjusted downwards to an annualised 4.9%, a revision from the initial estimate of 5.2%.

These developments have solidified market expectations that the Fed has concluded its cycle of rate hikes and is likely to shift towards rate cuts in 2024. Fed Chair Jerome Powell has acknowledged the risks associated with maintaining excessively restrictive interest rates. Minutes from the Federal Open Market Committee’s recent policy meeting suggest that policymakers anticipate the rates to settle between 4.5%-4.75% by the end of the next year, a decrease from the current range of 5.25%-5.5%.

US stocks rallied robustly, buoyed by the prospect of imminent rate reductions. Sectors most responsive to interest rate changes, such as information technology, real estate, and consumer discretionary, were among the top performers. In contrast, the energy sector recorded a decline, mirroring the drop in crude oil prices over the quarter.

S&P 500 2023 performance

Japan

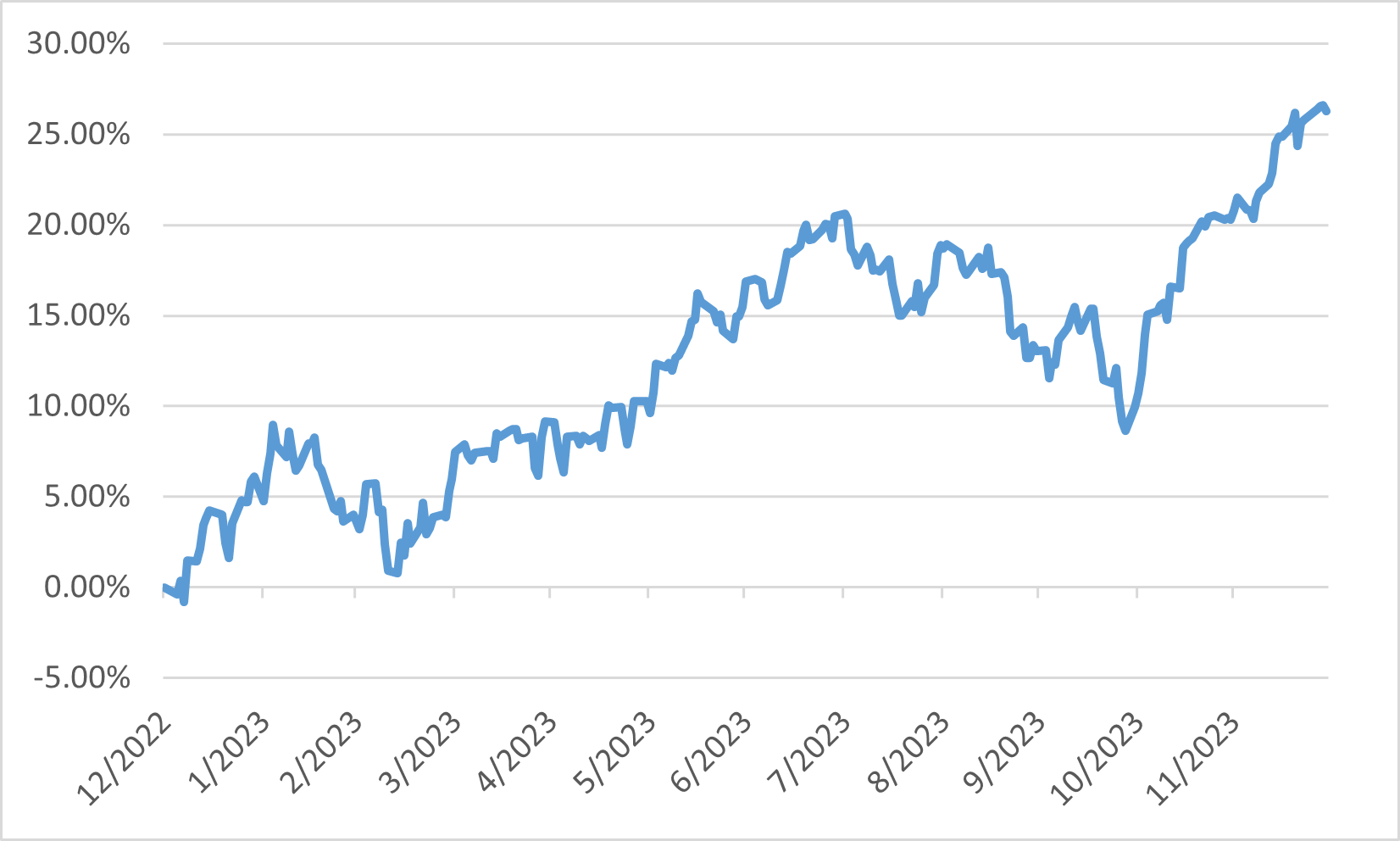

Despite some fluctuations in October and December, the Japanese equity market achieved a positive total return of 2.0% in the fourth quarter, as measured by the TOPIX Total Return index. The quarter witnessed significant shifts in market trends. In October, concerns that US interest rates might remain elevated for an extended period due to persistent inflation adversely affected market sentiment. Additionally, escalating geopolitical tensions, including renewed conflicts in the Middle East, raised alarms. However, investor sentiment improved later, primarily driven by weaker-than-expected US macroeconomic data, which fuelled expectations of impending US rate cuts.

While the US market sustained its upward trajectory in December, the Japanese equity market underperformed, with investor concerns centring around the potential appreciation of the yen. The reversal in market trends saw growth-style stocks outperforming value stocks over the quarter, and small caps recovered from their significant underperformance relative to large caps.

From a corporate fundamentals perspective, the first half of the fiscal year concluded with robust earnings results. The depreciation of the yen was a contributing factor, but the resilience of pricing power was also evident. An increasing number of companies disclosed strategies to address undervaluation issues, such as price-to-book ratios below 1x. Additionally, there was steady progress in the unwinding of cross-shareholdings, marking another positive development.

The overall macroeconomic landscape in Japan continued to show signs of improvement. The somewhat tepid GDP data for Q3 was attributed to higher inflation and slower wage growth. However, the BOJ's Tankan survey in December indicated ongoing improvements in business sentiment across both manufacturing and non-manufacturing sectors. Capital expenditure plans also pointed towards sustained strong demand in machinery and IT service sectors.

TOPIX Q4 performance

China

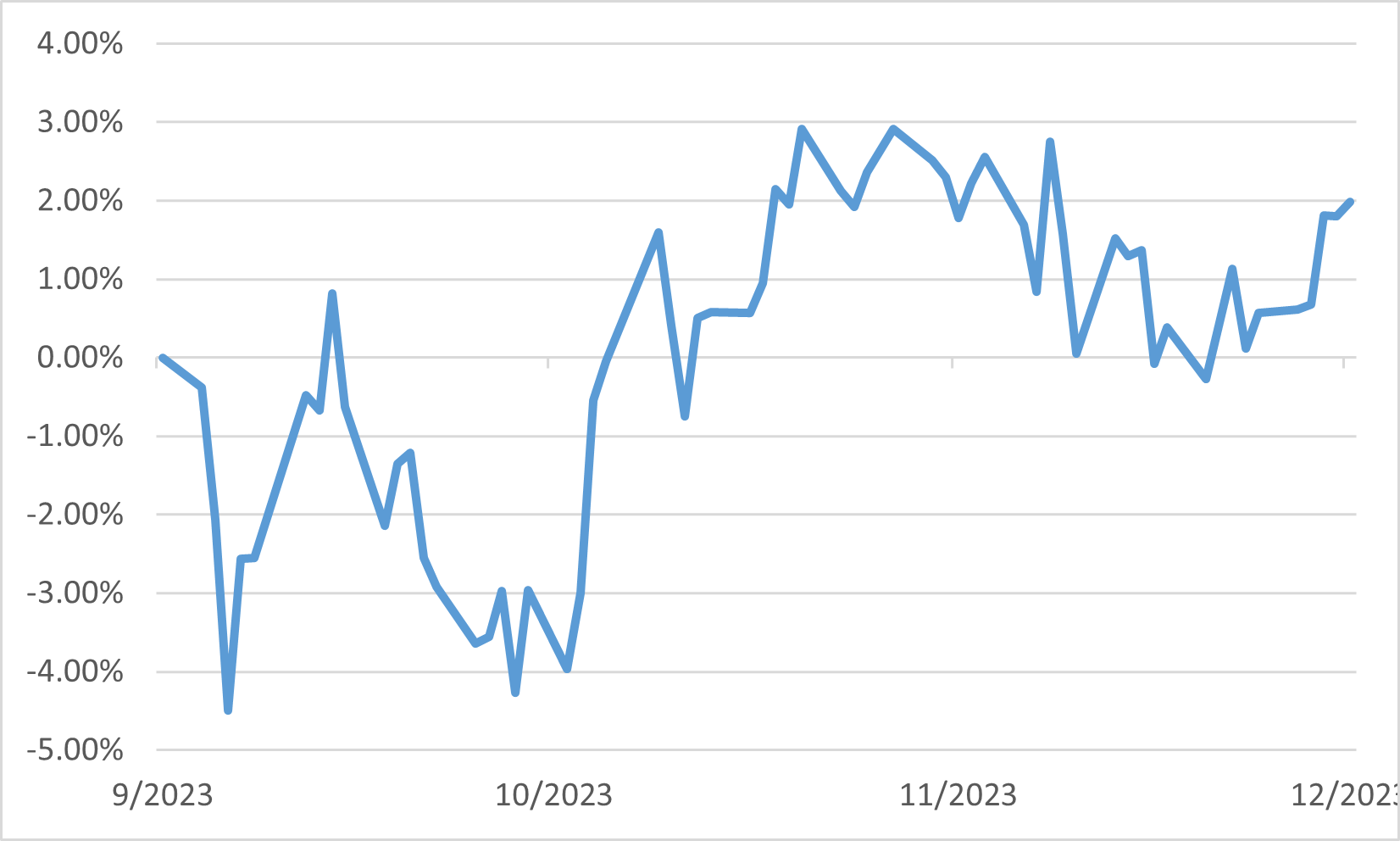

Chinese equities experienced a downturn following the government's announcement of new regulations in the gaming sector, sparking concerns over a potential intensification of regulatory measures. The MSCI China Index declined by 2.42%.

The market sentiment was further dampened by ongoing deflationary pressures. China's consumer price index decreased by 0.5% in November year-on-year, a more pronounced decline than October's 0.2% contraction, marking the most significant drop since November 2020. Additionally, the producer price index fell by a larger-than-anticipated 3% from the previous year, continuing its downward trend for the 14th consecutive month.

Towards the end of December, Chinese regulators approved over 100 new online games, indicating a potential easing of their previously stringent stance on the gaming industry. This move came after a draft of new regulations aimed at reducing expenditure on video games triggered a sell-off in stock markets earlier in the month. These regulations had erased nearly USD 80 billion in market value from some of China's major gaming companies, amid fears that Beijing would reinforce its control over the technology sector, following a two-year crackdown that began in 2021. Nevertheless, by the end of the month, stocks of key technology companies had regained some of their earlier losses.

Moody’s downgraded its outlook on China’s government bonds from “stable” to “negative,” citing the debt burden of local governments and state-owned enterprises as potential risks to the economy. This ratings adjustment marked a significant blow to China’s financial markets, which have been grappling with a prolonged property market slump and declining consumer and business confidence. In response, Beijing announced a series of pro-growth initiatives for 2024 to bolster demand. However, many analysts remain sceptical about the adequacy of these measures to rejuvenate the economy.

MSCI China Index performance

Europe

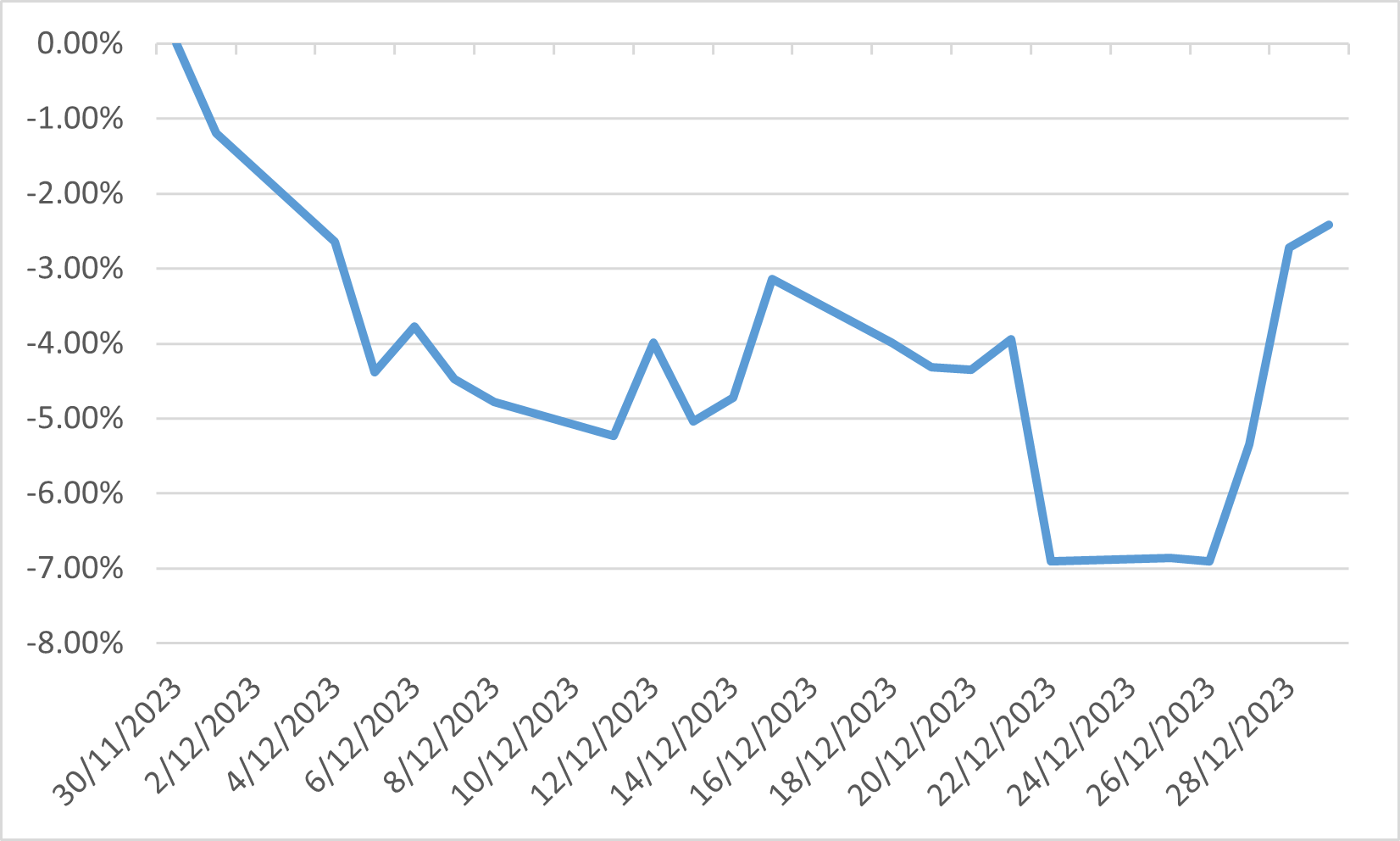

The final quarter proved to be robust for eurozone equities, buoyed by declining inflation rates in both the eurozone and the US, fuelling speculation that not only might interest rates have reached their zenith, but also that rate cuts could be imminent in 2024. This sentiment propelled the MSCI EMU index to a 7.8% gain in the final quarter.

In the euro area, annual inflation decreased to 2.4% in November, down from 2.9% in October, a significant drop from the 10.1% rate recorded a year earlier. The impact of higher interest rates has been palpable in the eurozone economy. According to Eurostat data, the region's GDP dipped by 0.1% quarter-on-quarter in the third quarter. Furthermore, the HCOB flash eurozone PMI declined to 47.0 in December, indicating that the eurozone economy is likely to have experienced further contraction in the fourth quarter as well.

Eurozone headline inflation