Monthly Market Outlook – Jan 2024

23rd February, 2024

U.S.

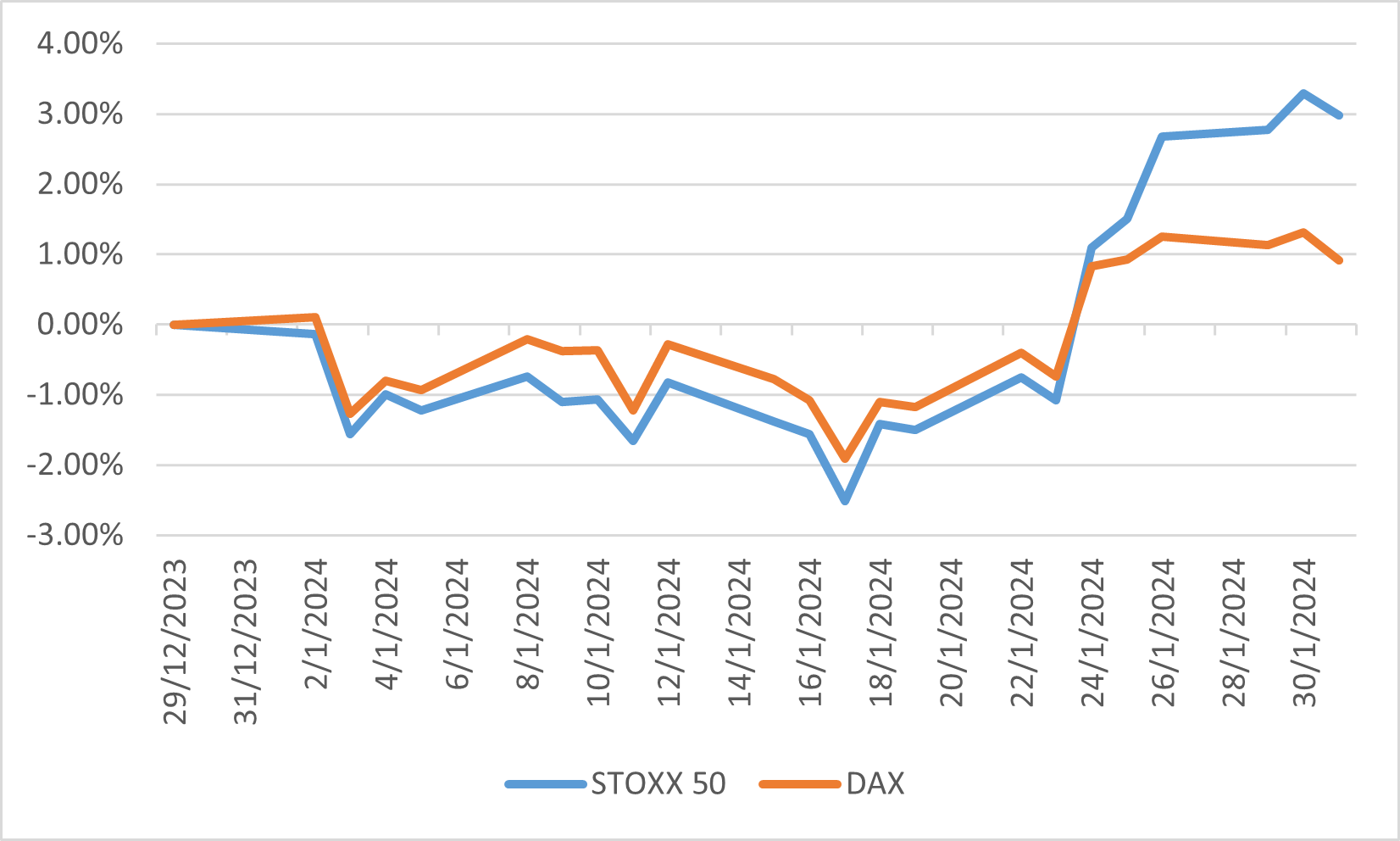

In January 2024, the U.S. equity market experienced modest gains, setting a positive tone for the year. The Dow Jones Industrial Average saw an increase of 1.31%, while the S&P 500 and NASDAQ advanced by 1.68% and 1.04%, respectively. This period was characterized by large-cap stocks outperforming small-cap stocks, with the Russell 1000 index rising by 1.39% and the Russell 2000 index falling by 3.89%. Growth stocks outpaced value stocks across both indices, indicating a market preference for growth-oriented investment strategies. The sector performance was mixed, with Communication Services leading the gains, followed by Financials. Conversely, Materials, Consumer Discretionary, and Real Estate sectors lagged.

The U.S. economy demonstrated robustness, adding 353,000 jobs in January, nearly doubling the anticipated 185,000, while the unemployment and labour force participation rates held steady at 3.7% and 62.5%, respectively. This job growth, coupled with strong new home sales and stable mortgage rates, underscored the economy's resilience.

The Federal Reserve's stance in January was marked by a careful balancing act, as it navigated through elevated market volatility and shifting rate expectations. Initially, the market was poised for a 70% likelihood of a March rate cut, but sentiments shifted dramatically following remarks from Fed officials, which tempered expectations and underscored the Fed's cautious approach towards ensuring sustainable inflation targets. Despite the uncertainty, the overall market sentiment leaned towards a higher trajectory, fuelled by expectations of forthcoming rate cuts and a tapering of the quantitative tightening program. This period of cautious optimism was, however, tempered by concerns over narrow market leadership and stretched sentiment indicators, even as indices flirted with all-time highs.

US market January performance

Japan

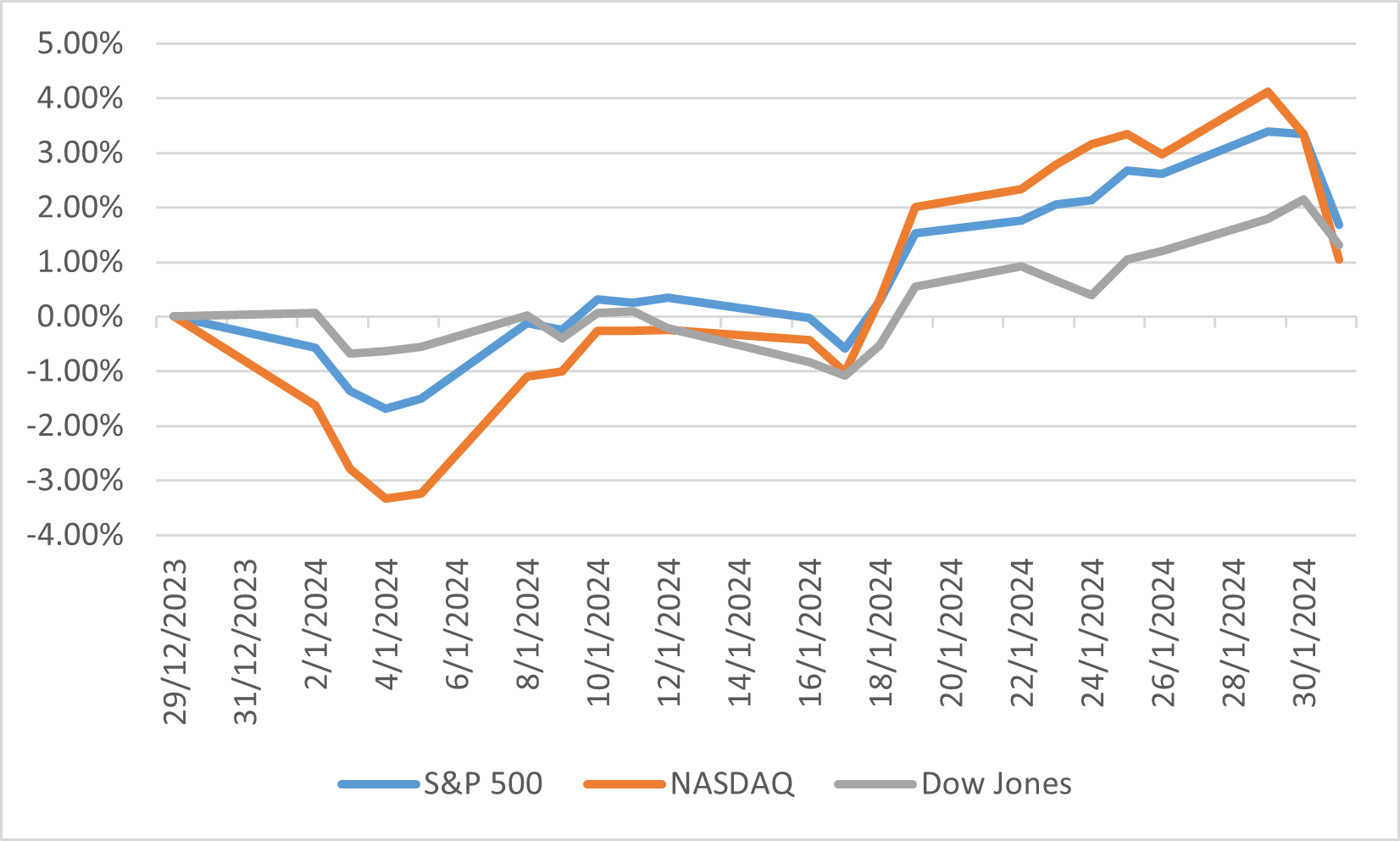

In January 2024, the Japanese equity market witnessed a significant rebound, driven by a combination of a weakening yen and an uptick in U.S. stock prices, marking a notable period of growth for the region's financial markets. The TOPIX index surged by 7.81%, reaching its highest point in the past two months, while the Nikkei 225 index climbed to the 36,000-yen level, an increase of 8.44%, achieving its highest level in 34 years. This rally in the Japanese equity market was further supported by the Bank of Japan's continued monetary easing policy, despite the central bank's cautious stance in the wake of a tragic earthquake on the Noto Peninsula. Market expectations are leaning towards a potential shift in the BoJ's policy in the coming months, which has acted as a tailwind for Japanese equities.

Throughout the month, growth factors initially dominated the market dynamics but were eventually overtaken by value factors towards the latter half, indicating a shift in investor sentiment and strategy. Large-cap stocks, in particular, outperformed, highlighting a preference for more stable and established companies among investors. This performance is reflective of broader global economic trends and the interplay between domestic factors such as monetary policy and external influences like the performance of the U.S. stock market and currency fluctuations.

Looking ahead, the Japanese equity market's trajectory will likely be influenced by several key factors, including the Bank of Japan's monetary policy direction, global economic conditions, and currency movements. The strong start to 2024 sets an optimistic tone for the market, but investors will be closely monitoring these variables for signs of sustained growth or potential volatility. As Japan continues to navigate its economic recovery and the BoJ contemplates its next steps, the equity market's performance will be a critical area to watch for insights into the country's financial health and investment climate.

Japanese market January performance

China

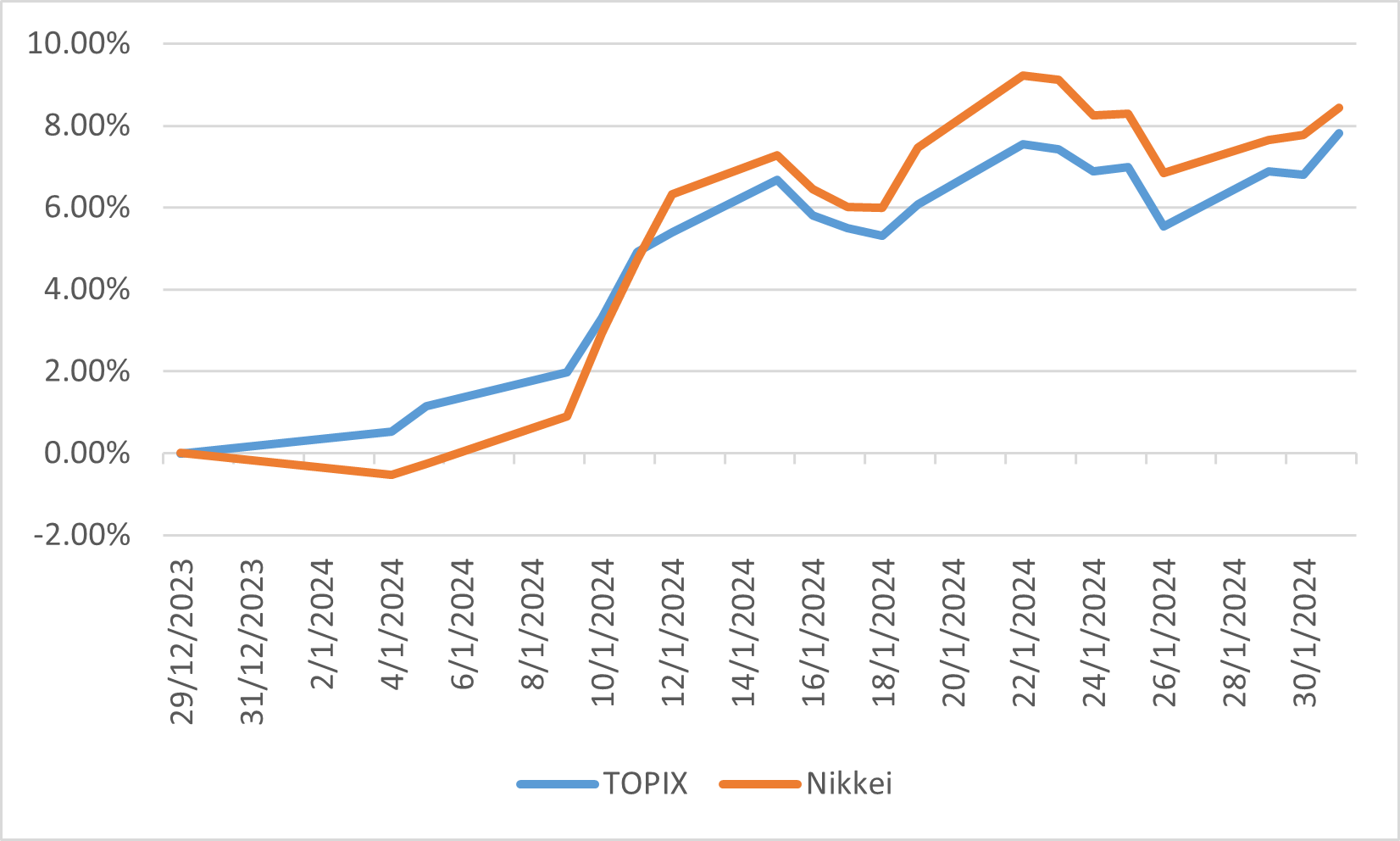

As 2024 unfolds, the Chinese equity market finds itself at a crossroads, following a tumultuous period that has left investors navigating through a maze of economic uncertainties and policy adjustments. The year began on a note of cautious optimism, with policymakers signalling potential market support measures to counteract the slipping sentiment and ongoing challenges within the property sector. Despite these efforts, a pervasive lack of confidence shadows the market, necessitating more decisive policy actions to avert a deflationary spiral. Meanwhile, the market continued to show a pessimistic sign in the first month of the year, CSI 300, Shanghai Composite and Shenzhen Composite downed 6.29%, 6.26% and 15.94%, respectively.

The backdrop to the current scenario is a challenging 2023, where the initial post-lockdown economic rebound quickly dissipated, giving way to deepening troubles in the property market. The distress of major private sector developers, exemplified by the plight of Country Garden, has significantly eroded business and investor confidence, exacerbating the downturn in consumer sentiment and straining local government finances. Despite some policy easing measures aimed at stabilizing the economy, the effectiveness of these interventions has been limited, leaving the market yearning for a more robust stimulus to kickstart economic activity and restore confidence.

Looking ahead, the Chinese equity market in 2024 is poised on the edge of significant headwinds, with the housing market's downturn, export challenges, and wavering business sentiment forming a triad of critical areas to watch. The government's efforts to support the property sector and stimulate the economy through urbanization projects and fiscal policies are steps in the right direction, yet their impact remains uncertain amid complex implementation challenges.

Chinese market January performance

Europe

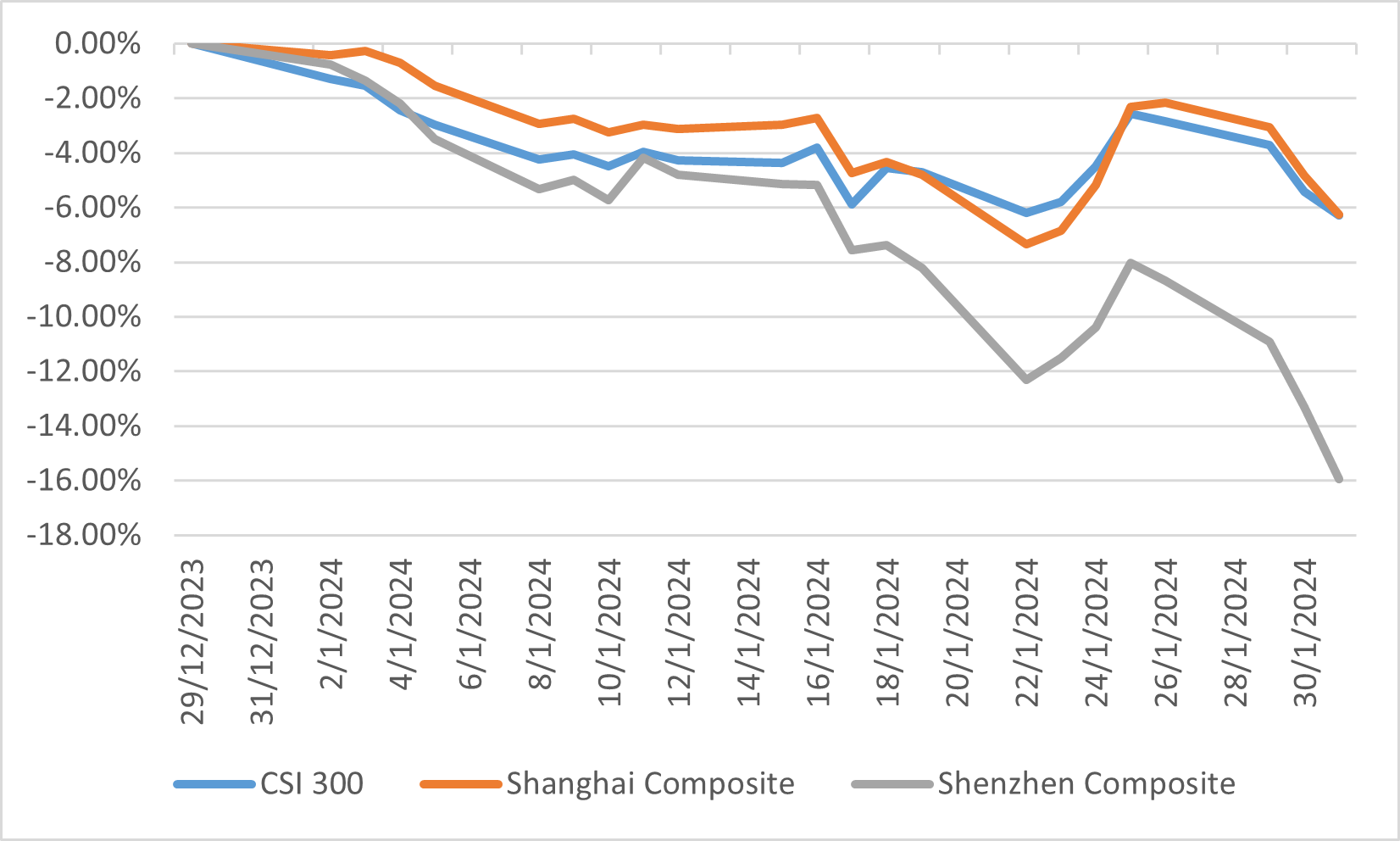

In January 2024, the European equity market presented a mixed picture, reflecting a broader global economic landscape marked by cautious optimism and underlying challenges. STOXX 50 and DAX index experienced a modest rise of 2.97% and 0.91%, respectively, with European markets showing resilience amidst a tense geopolitical backdrop and softer economic activity compared to the US. Despite the European Central Bank (ECB) and other major central banks maintaining policy rates unchanged, the anticipation of future rate cuts became a focal point of market speculation. The ongoing conflict in the Middle East and the lack of a significant response from China following the Taiwan elections added layers of complexity to the investment climate, influencing market sentiment and investor strategies.

The fourth-quarter earnings season in Europe, where actual earnings growth lagged, reflecting the continent's softer economic activity. Government bond prices in Europe weakened, mirroring a global trend, as investors navigated the implications of unchanged policy rates and the potential for future easing.

European market January performance