Monthly Market Outlook – Feb 2024

22nd March, 2024

U.S.

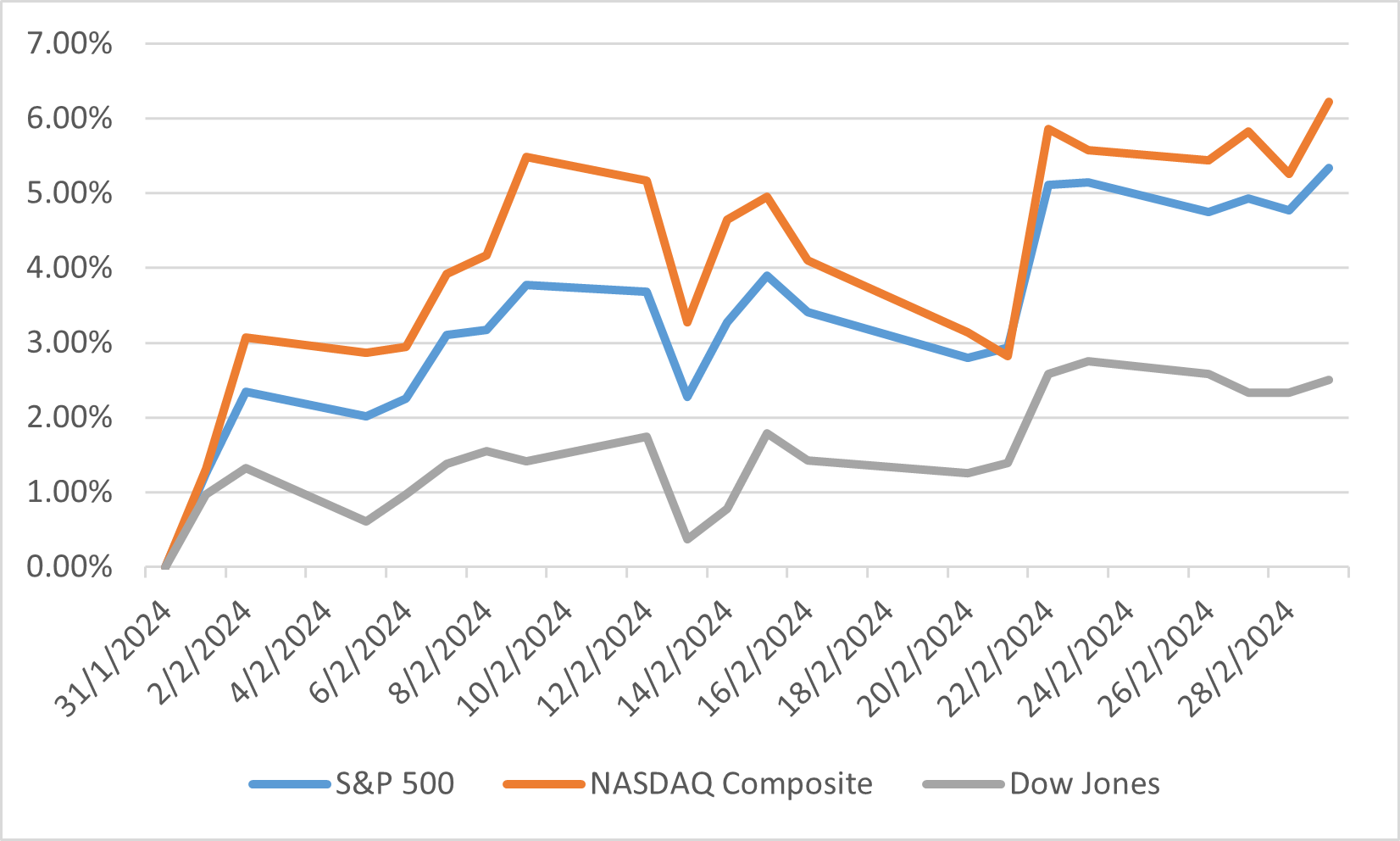

In February 2024, the US equity market experienced a notable surge, with global equities rising by 4.28% in USD terms, showcasing a robust performance amidst a complex global backdrop. This rise in stock indices to new highs, despite the upward movement in bond yields, underscored the market's resilience and the prevailing economic disinflation trends. The geopolitical landscape, however, remained tense, particularly in the Middle East and Ukraine, adding layers of uncertainty to the investment climate. Despite these challenges, the S&P 500, NASDAQ Composite and Dow Jones rose by 5.34%, 6.22% and 2.50%, respectively in total return, with the S&P 500 reaching record levels, reflecting broadened regional and sector returns. The performance of growth stocks continued to lead the market, although the Magnificent Seven stocks showed fragmented results, highlighting the divergent paths within the tech sector.

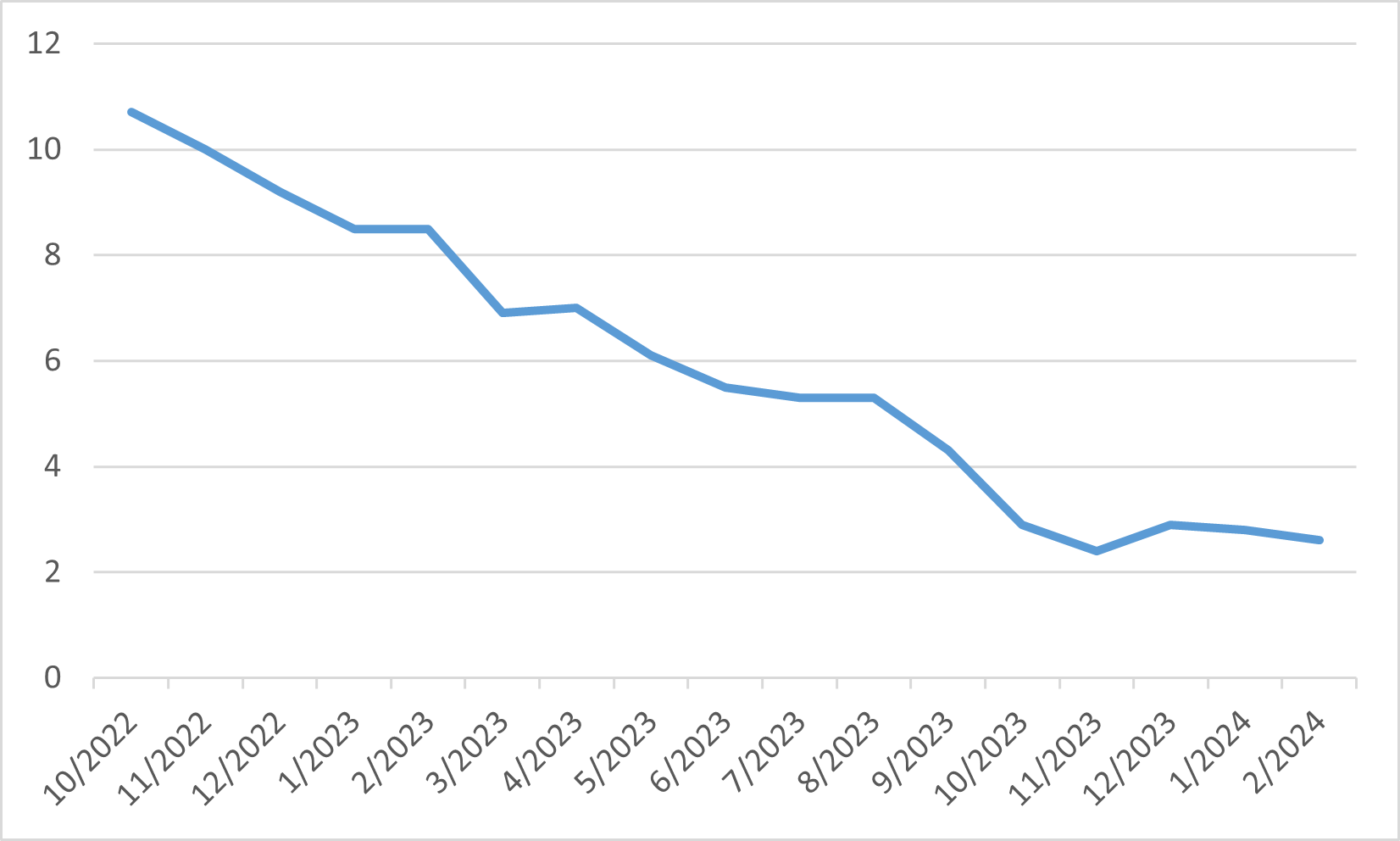

The economic backdrop in the US showed signs of softening at the year's start, with retail sales and industrial production declining in January. However, early estimates for Q1 GDP growth remained healthy, suggesting underlying economic strength. The labour market continued to exhibit tightness, maintaining an unemployment rate of 3.7%, while headline inflation cooled to 3.1% in January.

Policy-wise, there was no rush to cut interest rates, with several Federal Open Market Committee members emphasising a higher for longer approach to interest rates. This stance led to moderated expectations for rate cuts in 2024, reflecting a cautious outlook from central banks across the globe. Meanwhile, regional banking stress in the US briefly resurfaced but quickly dissipated, highlighting the financial system's underlying stability.

Indexes performance in February

Japan

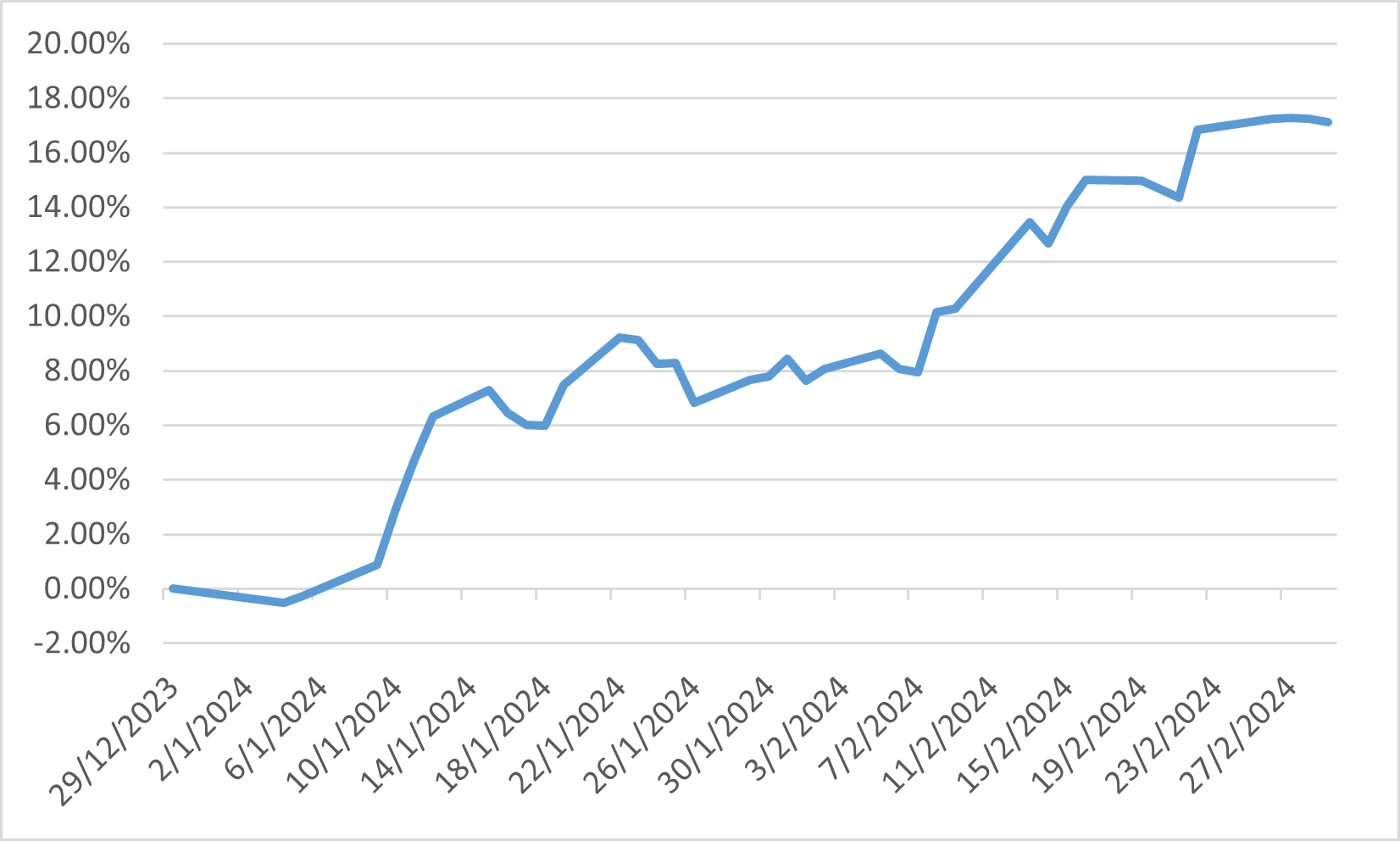

The Japanese equity market embarked on a remarkable journey in early 2024, with the Nikkei Stock Average reaching a 34-year peak at the end of February, boasting a 17.11% increase in just two months. This surge, however, raised more questions than it answered, particularly regarding the rally's drivers in the absence of new market catalysts. While a weaker yen and the revamped Nippon Individual Savings Account with enhanced tax benefits were considered potential factors, the correlation between stock prices and the dollar/yen levels weakened, and TSE data indicated net selling by individuals in the early weeks. This scenario suggests that the rally might have been propelled by fundamental demand typical of the year's start rather than specific incentives, leaving the market vulnerable to corrections, especially with the BoJ hinting at a shift towards higher interest rates.

Amidst this backdrop, the semiconductor sector emerged as a potential growth narrative for Japan, with semiconductor-related shares showing robust performance. This sector's recovery, supported by the semiconductor cycle bottoming out and active government support, positions Japan's semiconductor industry as a key player in the global market. The sector's resurgence, coupled with strategic partnerships and supply chain realignment, could stabilize the market against potential turbulence from monetary policy shifts.

The BoJ's policy stance in late January maintained its ultra-loose monetary policy. Still, it introduced a slightly hawkish tone, with Governor Kazuo Ueda indicating a growing likelihood of achieving the 2% inflation target. This stance raised market expectations for an end to NIRP within months, yet the BOJ emphasized a gradual approach to policy normalization, suggesting that ending NIRP would not lead to steep rate hikes. This careful communication aims to mitigate market shocks, underscoring the BOJ's data-dependent approach similar to the Federal Reserve's.

Nikkei 225 YTD performance

China

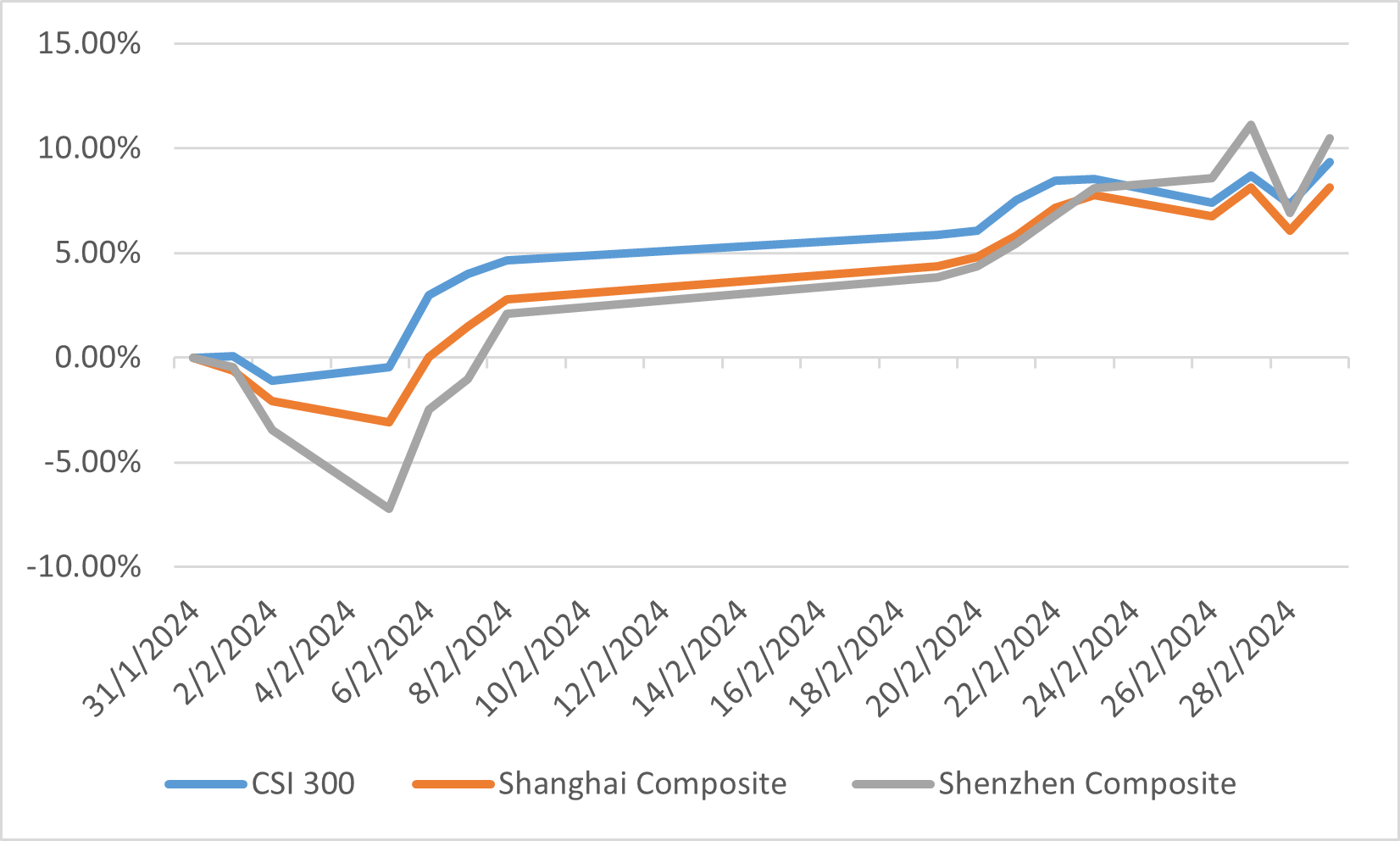

In February 2024, the Chinese equity market witnessed a notable rebound, contributing to the overall strength observed in emerging markets, with CSI300, Shanghai Composite and Shenzhen Composite gaining 9.35%, 8.13% and 10.49%, respectively. This recovery was set against a backdrop of global stock market gains, with Chinese shares advancing amidst a broader context where fixed income yields generally increased, leading to a decline in prices as the anticipation for central bank rate cuts was pushed further out.

February also marked a period of rejuvenation for the Chinese market, given the volatile start to the year, marked by investor apprehension due to the previous year's GDP figures and concerns over the implementation of policies by Chinese policymakers and coinciding with the Chinese New Year celebrations, the first full-scale observance since the pandemic. This break provided a much-needed respite and served as a litmus test for consumer spending resilience. The period saw a surge in domestic travel, exceeding 2019's figures by 19%, and significant increases in service usage, including ridesharing and retail, indicating a robust recovery in consumer activity. This resurgence in domestic consumption and tourism underscored the potential for a economic rebound.

The performance of the Chinese market in February 2024 can be attributed to a combination of factors, including governmental interventions aimed at stabilizing the market and improving investor sentiment. These measures, alongside the positive momentum from the Chinese New Year celebrations and the subsequent surge in domestic travel and consumer spending, provided a much-needed boost to the market. Looking ahead, the focus for investors and policymakers alike will be on sustaining this recovery trajectory, navigating the challenges posed by the global economic environment, and capitalizing on the opportunities presented by China's evolving market landscape.

Indexes performance in February

Europe

In February 2024, the European equity markets experienced a period of advancement, with STOXX 50 and DAX indexes surging 4.58% and 5.34%, respectively. The sectors leading the charge in Europe included consumer discretionary, industrials, and information technology, reflecting a diverse range of drivers behind the market's upward movement. This period was marked by strong performances from luxury goods and automotive companies, buoyed by impressive results from key industry players. The information technology sector, in particular, benefited from the ongoing enthusiasm around the potential of AI, further propelled by robust earnings from both local and global tech companies.

The economic backdrop in Europe showed signs of improvement, with eurozone inflation easing to 2.6% from 2.8% in January, alongside indications of better business activity. The flash eurozone PMI rose to 48.9 from 47.9 in January, suggesting a potential turnaround in the continent's growth weakness. However, European Central Bank President Christine Lagarde maintained a cautious stance, emphasizing the risks associated with premature interest rate cuts and the central bank's reluctance to reverse any such decisions hastily.

European CPI