Monthly Market Outlook – Mar 2024

19th April, 2024

U.S.

The US equity market in March 2024 demonstrated significant dynamism, reflecting a range of economic stimuli and sector-specific developments. The S&P 500 index saw a notable return of 3.22%, contributing to a YTD return of 10.55%. This rise was mirrored in the performance of the Dow Jones Industrial Average, which went up by 2.21% for the month, culminating in a 6.14% YTD return. Particularly impressive was the S&P Mid-Cap 400, which gained 5.60% in March alone.

In terms of individual stocks, Microsoft and NVIDIA stood out with substantial gains. Microsoft's share price increased by 12.09% in 2024, pushing its market cap over $3 trillion. NVIDIA experienced an even more dramatic surge, increasing by 82.46% in Q1 2024, which boosted its market cap to $2.26 trillion. Conversely, Tesla faced a significant decline, with its shares dropping by 29.25% in Q1, reducing its market cap to $560 billion.

The broader market's resilience can be attributed to strong corporate earnings, particularly in sectors like technology, which have benefitted from ongoing advancements in AI. However, the market also faces challenges such as rising core inflation, which could signal tighter monetary policy ahead. This situation is compounded by geopolitical tensions, particularly in the Middle East, which could affect commodity prices and market stability moving forward. Overall, while the US equity market has shown robust performance in early 2024, investors remain cautious amidst a complex global economic landscape.

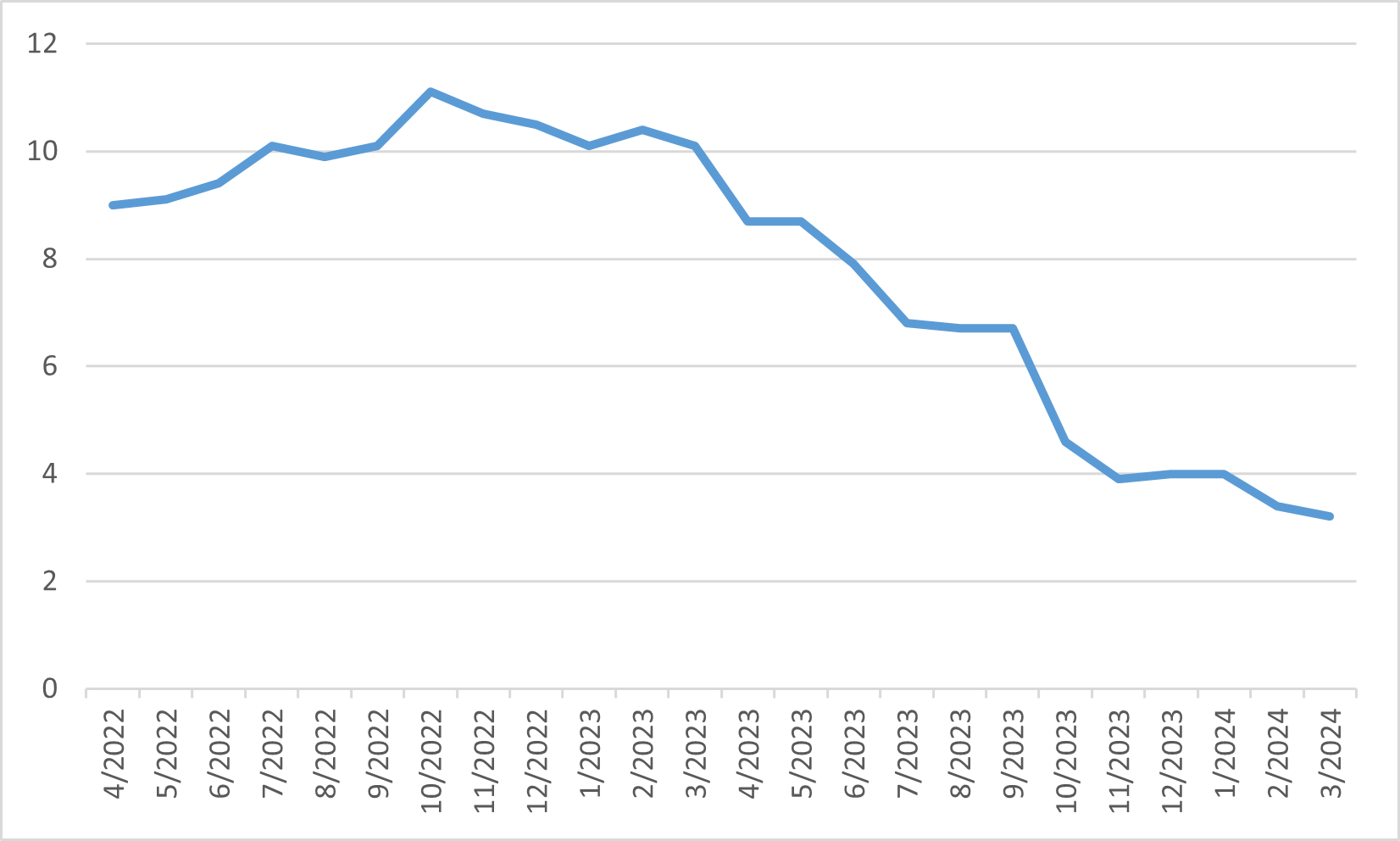

S&P 500 YTD return

Japan

The Japanese equity market experienced a notable rebound in March 2024, influenced by both domestic factors and international market dynamics. Nikkei 225 and TOPIX indexes with a total return of 3.17% and 3.69% in March, respectively. Initially, the market faced downward pressure due to the appreciation of the yen and higher-than-expected U.S. inflation, but it quickly recovered. The recovery was spurred by optimism following a dovish monetary policy meeting by the BoJ, which decided to maintain its accommodative financial stance. The Nikkei 225, reached an all-time high, marking a major turnaround from the beginning of the month when sectors like banks and semiconductors faced declines.

Internally, the Japanese market was buoyed by strong buying by foreign investors and positive corporate earnings expectations driven by sectors such as real estate, petroleum, coal, and mining. However, sectors like shipping, precision, and pharmaceuticals did not perform as well. The market dynamics were also influenced by labour negotiations and ongoing concerns about potential government and BoJ intervention in foreign exchange markets, which could impact the yen's value.

Looking ahead, expectations remain positive but cautious. The market anticipates solid performance from retailers, driven by increased consumption due to wage hikes and inbound demand. However, there are concerns about the sustainability of these gains due to potential interventions by the BoJ and the government in the forex markets, which might affect equity prices. Additionally, while corporate earnings are expected to benefit from the weak yen, there is a possibility that the profit margins forecasted in corporate plans might not meet market expectations, which could lead to some selling pressure. Despite these concerns, there is optimism that the market will continue to see an upward trend, supported by continuous domestic investment and favourable supply-demand dynamics.

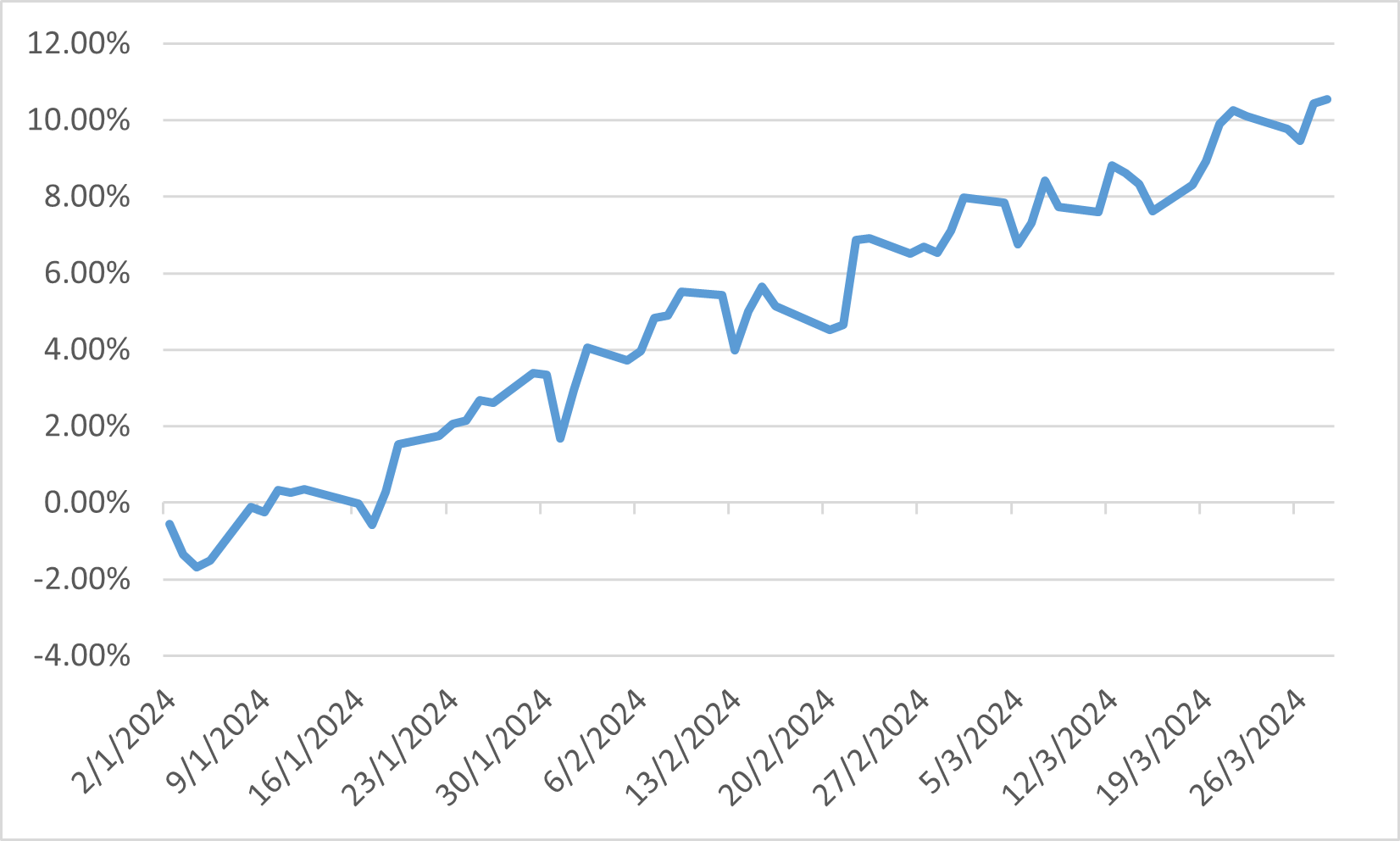

USD/JPY

China

In March 2024, the Chinese market experienced a range of dynamics influenced by monetary policies and global economic trends. Despite ongoing challenges in the housing sector and the broader economic recovery not meeting expectations, there were signs of stability and potential rebounds in certain areas.

Firstly, the Shanghai Composite and CSI 300 Index showed a promising rise, increasing by approximately 3.05% and 3.24% since the beginning of 2024. This uptick reflects a cautious optimism in the market, driven partly by favourable policy adjustments and a recovery in global markets. This was a continuation of the positive momentum from February, suggesting resilience in the Chinese equity markets amid fluctuating global conditions. Meanwhile, the broader Greater China region also demonstrated strong performance, with key indices like the TWSE in Taiwan making significant gains. This regional uplift was supported by a rally in technology stocks and improving investor sentiment towards Asian markets. The stability in monetary policy and interest rates provided by global central banks contributed to this positive outlook, allowing investors to focus on earnings performance and long-term returns.

On the economic front, despite some ongoing domestic challenges, there was an improvement in China's export performance, which significantly boosted industrial production. This was the fastest growth observed since early 2022, indicating a robust external demand for Chinese goods. However, the real estate sector remained sluggish, impacting financial conditions in local governments and the broader economic landscape.

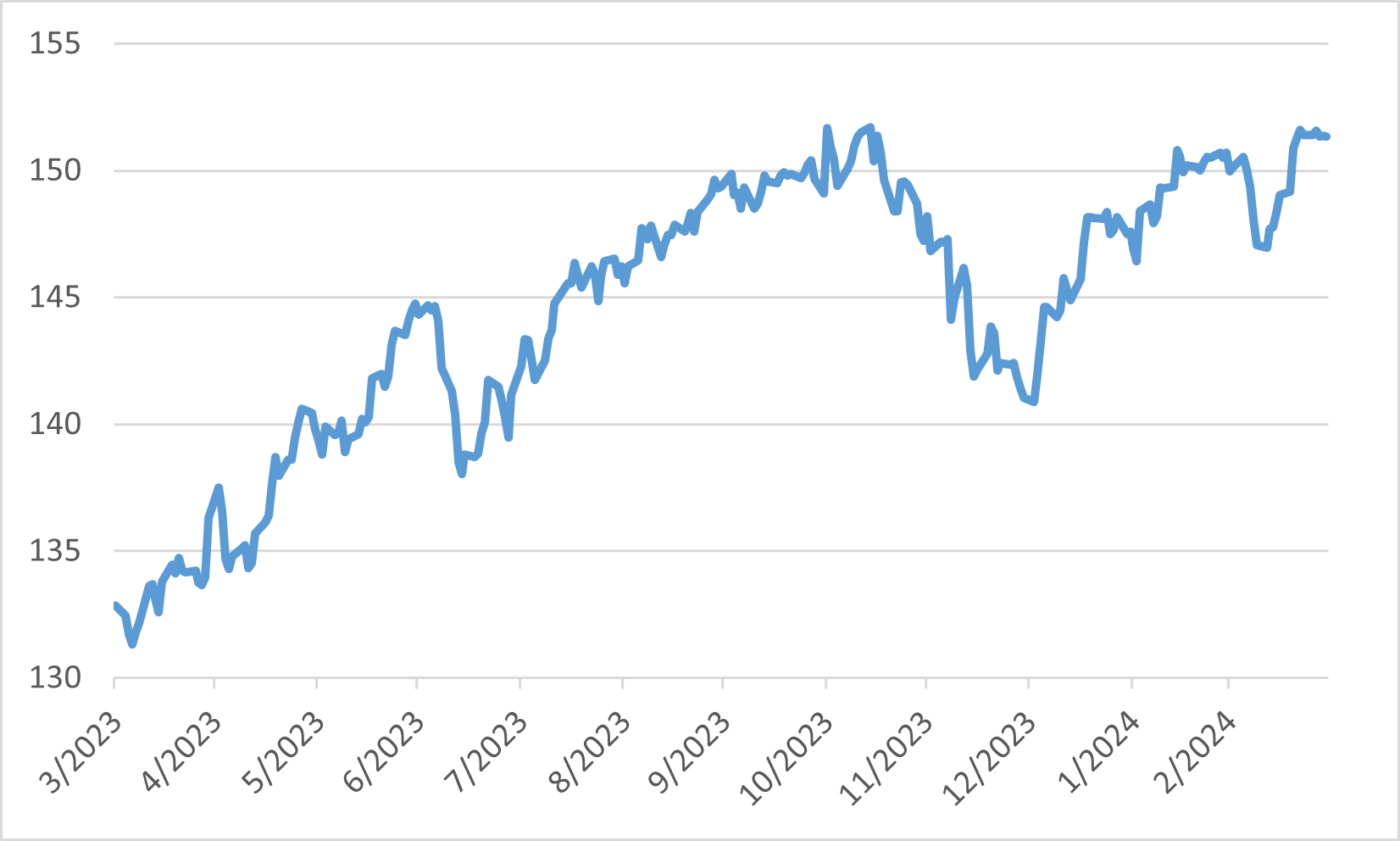

China Industrial Production

Europe

In March 2024, the European equity market exhibited a cautiously optimistic outlook, influenced by current market conditions and an encouraging global economic environment. The MSCI Europe Index, which measures equity market performance across developed European countries, reflected this sentiment with 4.06% gained, indicating a generally favourable perspective among investors to the market. This optimism was bolstered by the broader gains observed in global equity markets during the month, suggesting a continued recovery and stability within European markets.

Furthermore, there was a notable performance improvement in several sectors across Europe, backed by solid economic indicators and a stabilizing political environment within the region. The overall positive movements in equity markets were supported by a decrease in UK inflation and predictions of further declines due to lower energy costs, providing a more stable backdrop for economic growth and investment in Europe.

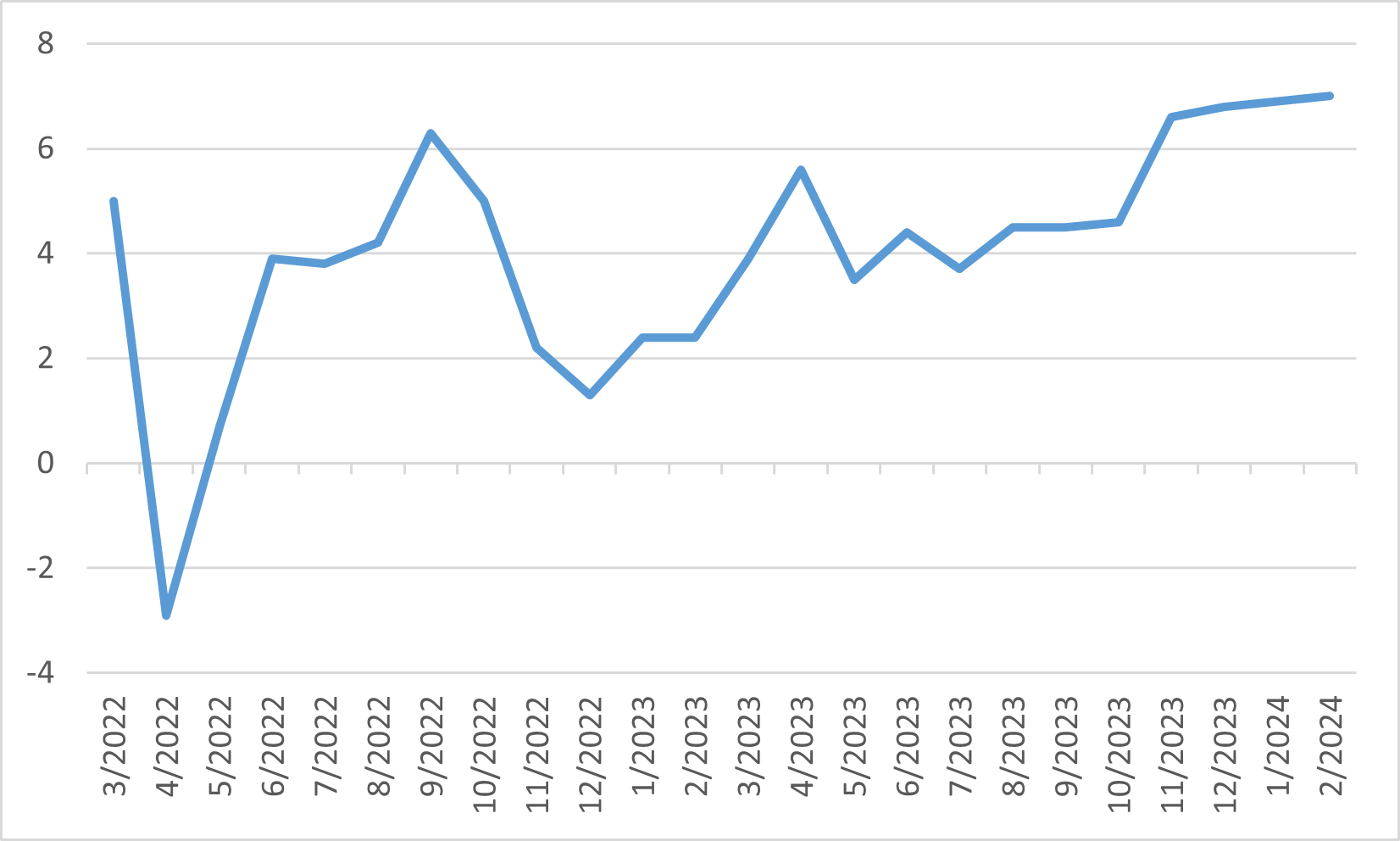

UK CPI