Monthly Market Outlook – Apr 2024

24th May, 2024

U.S.

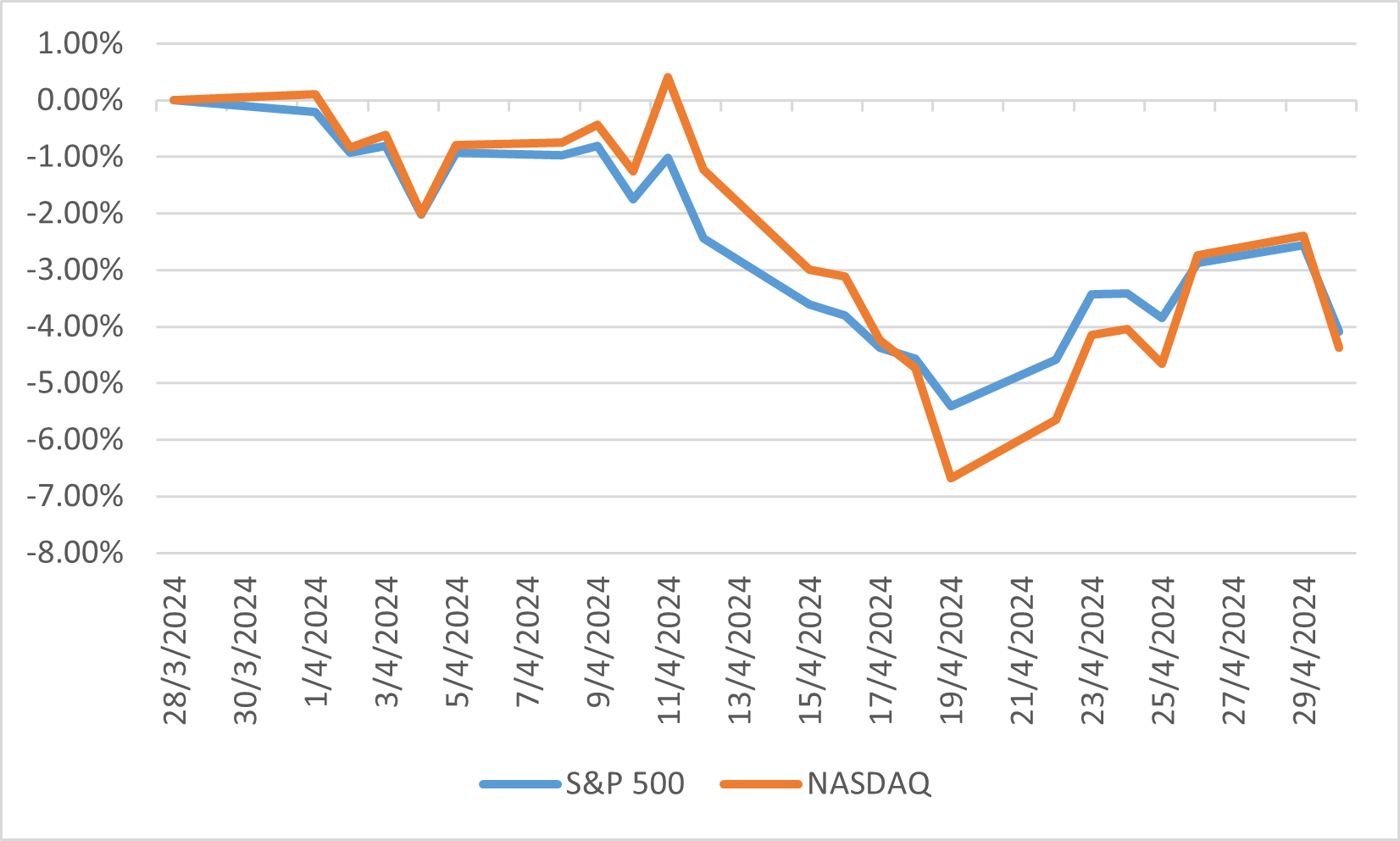

April 2024 witnessed a dynamic and volatile period for the US equity markets, driven by a mix of economic indicators, corporate earnings, and geopolitical events. Early in the month, markets reacted positively to the latest employment data, which showed a lower-than-expected increase in unemployment claims, suggesting a resilient labor market. This was further bolstered by strong retail sales figures, indicating robust consumer spending despite ongoing inflationary pressures. However, investor sentiment was dampened mid-month by concerns over rising interest rates, as the Federal Reserve hinted at the possibility of further rate hikes to combat persistent inflation. This news led to increased volatility, with major indices experiencing significant swings, leading the S&P and NASDAQ indexes to end with a total loss of 4.08% and 4.38% in April.

Corporate earnings reports played a crucial role in shaping market movements throughout April. Several high-profile companies across various sectors, including technology, healthcare, and financials, reported better-than-expected earnings, providing a temporary boost to their stock prices. Notably, tech giants such as Apple and Microsoft exceeded earnings expectations, driven by strong demand for their products and services. However, the market's overall reaction was mixed, as investors also focused on forward guidance and potential challenges, such as supply chain disruptions and higher input costs. This cautious outlook contributed to a more subdued performance in some sectors, particularly those sensitive to economic cycles.

Geopolitical tensions and global economic developments also influenced the US equity markets in April 2024. Escalating conflicts in certain regions led to increased uncertainty, prompting investors to seek safer assets, which in turn affected equity prices. Additionally, fluctuations in oil prices due to production cuts by major exporters added another layer of complexity to the market dynamics.

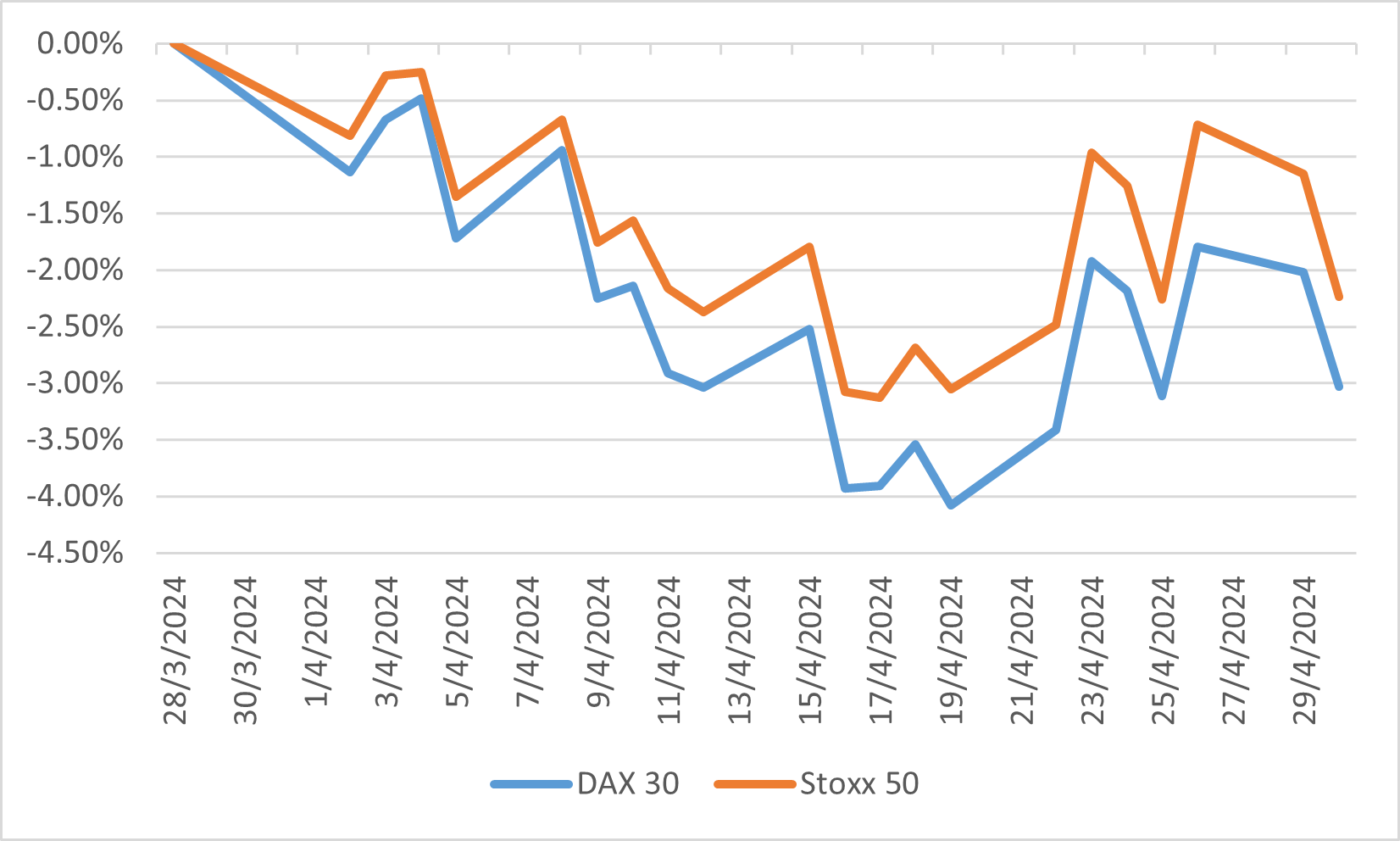

S&P 500 and NASDAQ Indexes performance

Japan

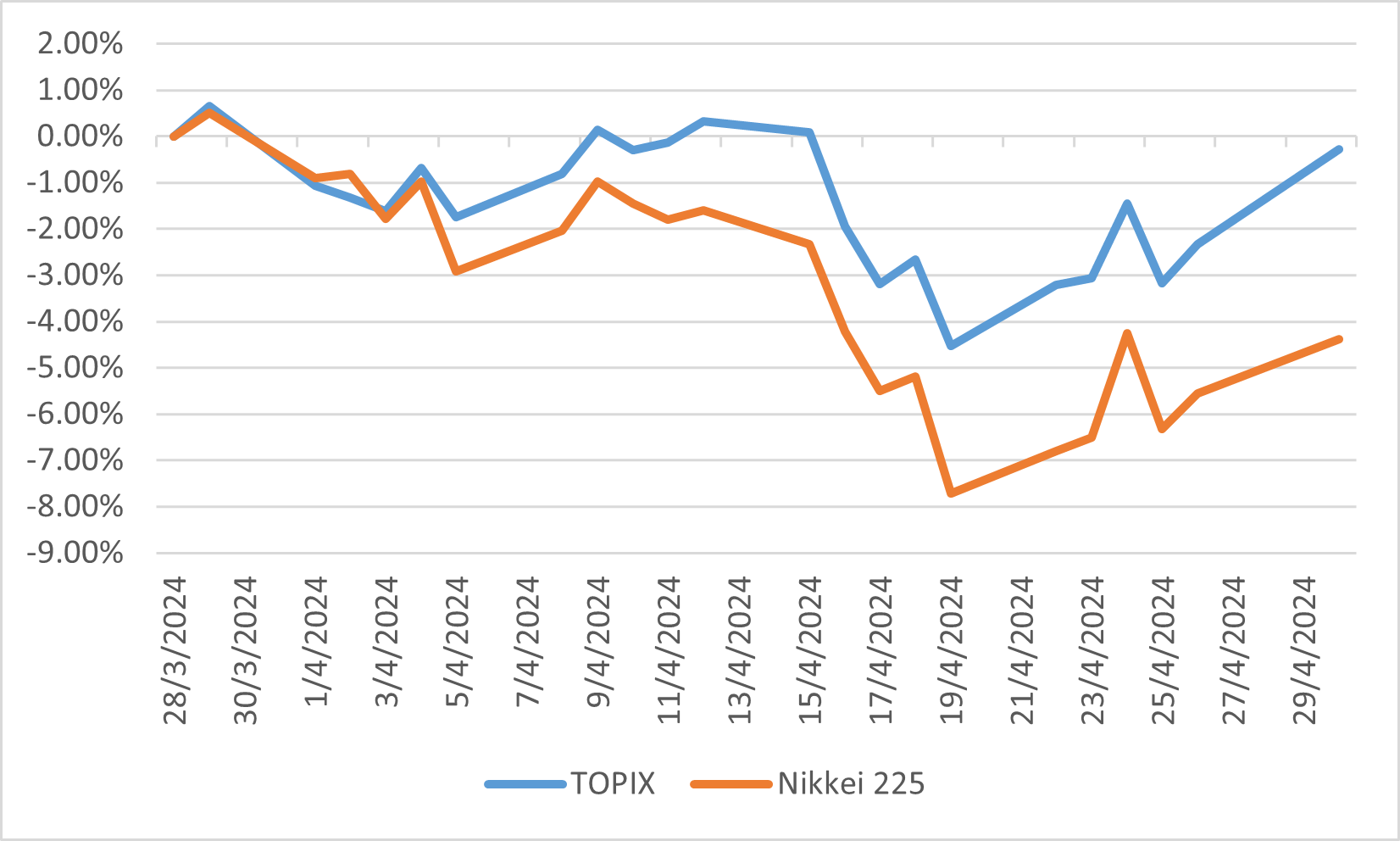

In early April, the Japanese equity market entered a correction phase but exhibited a slight recovery towards the end of the month, largely due to robust earnings reports. The TOPIX saw a modest decline of only -0.92% in Japanese yen terms. However, the Nikkei 225, which is a large-cap-oriented index, experienced a more significant drop, falling by -4.86% for the month of April. This market correction predominantly impacted large-cap and semiconductor-related stocks, with notable selling pressures arising from profit-taking activities. Additionally, escalating tensions in the Middle East negatively influenced market sentiment.

The Japanese yen experienced further depreciation, driven primarily by the strength of the U.S. economy and diminishing market expectations for a rate cut by the Fed. Conversely, the BoJ refrained from implementing additional policy tightening measures during its April meeting, which spurred speculative movements in the currency market. Consequently, the yen weakened to a level of 160 yen against the U.S. dollar. This depreciation raised concerns within the Japanese government regarding its potential impact on inflationary pressures, as it could lead to delays in real-term wage growth. Such delays may, in turn, suppress consumption and hinder domestic demand-oriented economic growth in Japan.

In response, the Ministry of Finance has undertaken market interventions, though the efficacy of these actions remains uncertain. Despite these challenges, the spring wage negotiation process, known as "Shunto," concluded with historically high outcomes, with wage growth surpassing 5%. Furthermore, Japan continues to witness a rising influx of visitors, which bolsters consumption.

TOPIX and Nikkei 225 Indexes performance

China

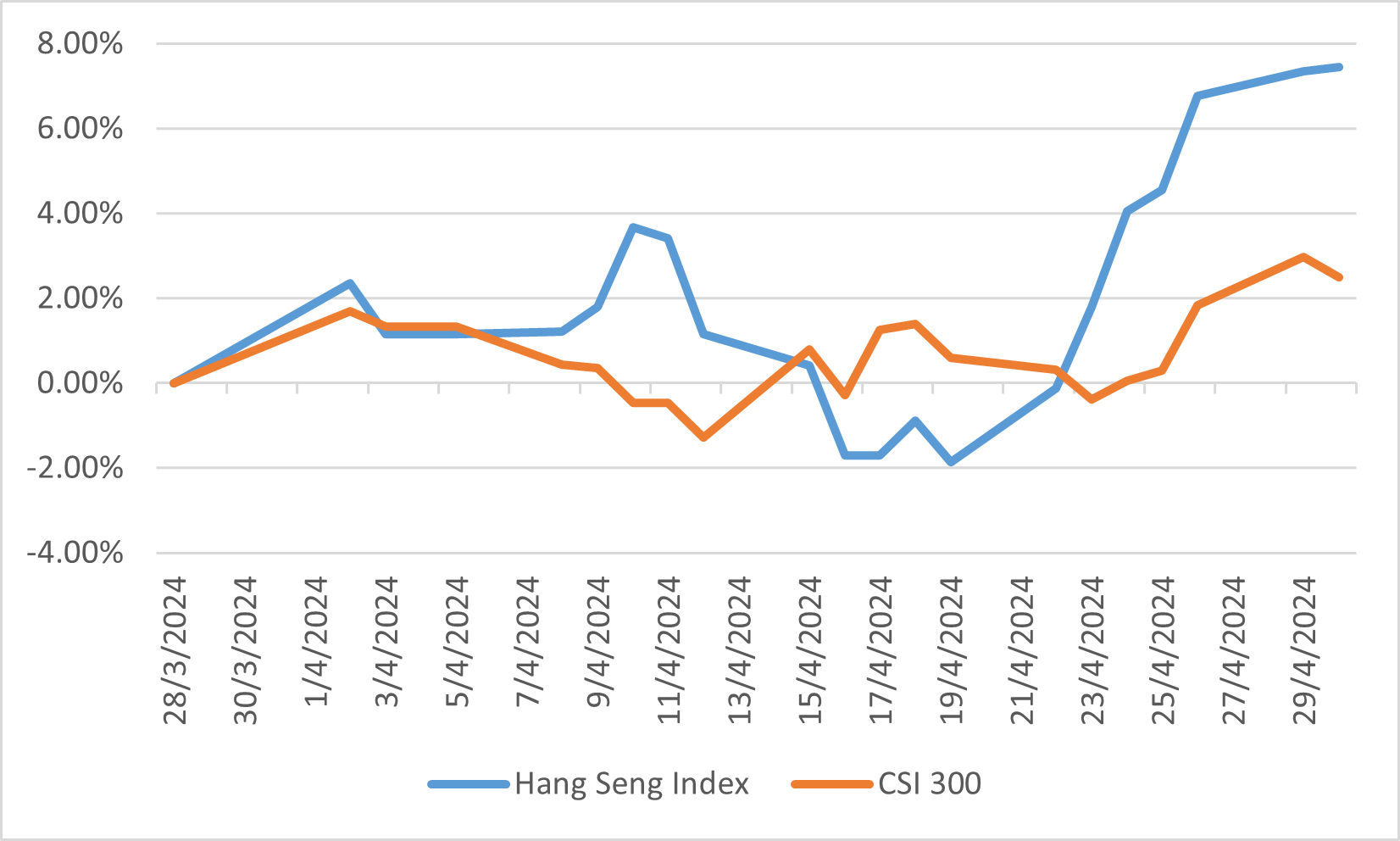

April 2024 was a dynamic month for the Chinese equity markets, characterized by a blend of economic recovery signals and regulatory developments. The Shanghai Composite Index and the Shenzhen Component Index saw significant fluctuations, reflecting both investor optimism and caution. Early in the month, economic data indicated a robust recovery, with GDP growth surpassing expectations due to strong domestic consumption and industrial production. The government's fiscal stimulus measures, aimed at boosting infrastructure projects and supporting small and medium enterprises, played a crucial role in sustaining economic momentum. This positive economic backdrop encouraged investor confidence, leading to a rally in key sectors such as technology, healthcare, and consumer goods, share prices in Hong Kong also moved higher in April, driven by foreign investors seeking lower-valued Hong Kong-listed shares that pay higher dividends as optimism towards companies with exposure to mainland China improves. The total return of CSI300 and Hang Seng Indexes ended at 2.49% and 7.45%.

However, regulatory developments introduced a degree of uncertainty and volatility in the markets. The Chinese government continued its efforts to tighten regulations on various sectors, including technology and real estate, to address issues such as data security, anti-competitive practices, and financial stability. These regulatory actions led to sharp corrections in some high-profile tech stocks, which had previously been high-flyers. Investors were also wary of potential regulatory overreach, which could stifle innovation and growth. Despite these concerns, the broader market sentiment remained resilient, supported by strong corporate earnings and the government's commitment to maintaining economic stability.

Hang Seng and CSI300 Indexes performance

Europe

Eurozone shares weakened in April, influenced by diminishing prospects of U.S. interest rate cuts, a mixed bag of corporate earnings, and evolving economic policies. Prominent indices, including the Stoxx 50 and DAX 30, recorded losses, with information technology and consumer discretionary sectors being the weakest performers. While U.S. rate cuts now seem less likely, European economic data suggested the possibility of an interest rate cut by the European Central Bank in June remains viable, with a flash estimate by Eurostat indicating that eurozone inflation was expected to remain stable at 2.4% in April, unchanged from March.

DAX 30 and Stoxx 50 Indexes performance