Monthly Market Outlook – May 2024

21st June, 2024

U.S.

In May 2024, the US equity markets rebounded strongly, reversing losses from April. The major indices saw significant gains, driven by better-than-expected first-quarter earnings across various sectors. The Dow Jones Industrial Average, S&P 500 and NASDAQ increased by 2.58%, 4.96% and 6.98% respectively, buoyed by robust corporate performance, particularly from technology and consumer goods companies. This recovery was supported by positive economic data, including a rise in the Flash PMI, which showed improvements in both the manufacturing and services sectors.

Despite the positive market performance, economic indicators presented a mixed picture. Inflation remained persistent, with the April data showing only modest reductions in headline and core inflation rates, which stood at 3.4% and 3.6% respectively. The Federal Reserve maintained its interest rates, signalling a cautious approach to any potential easing due to the ongoing inflationary pressures. Employment data also reflected some challenges, with the unemployment rate edging up to 3.9% and a slower pace of job gains.

Global factors continued to influence the US equity markets. Geopolitical tensions, particularly in the Middle East and Taiwan, added an element of uncertainty, while the ongoing trade dynamics with China, including new tariffs, impacted market sentiment. Despite these challenges, the overall outlook for US equities remained positive, supported by solid corporate fundamentals and investor optimism. The combination of strong earnings and cautious yet supportive monetary policy created a favourable environment for risk assets, driving market gains in May.

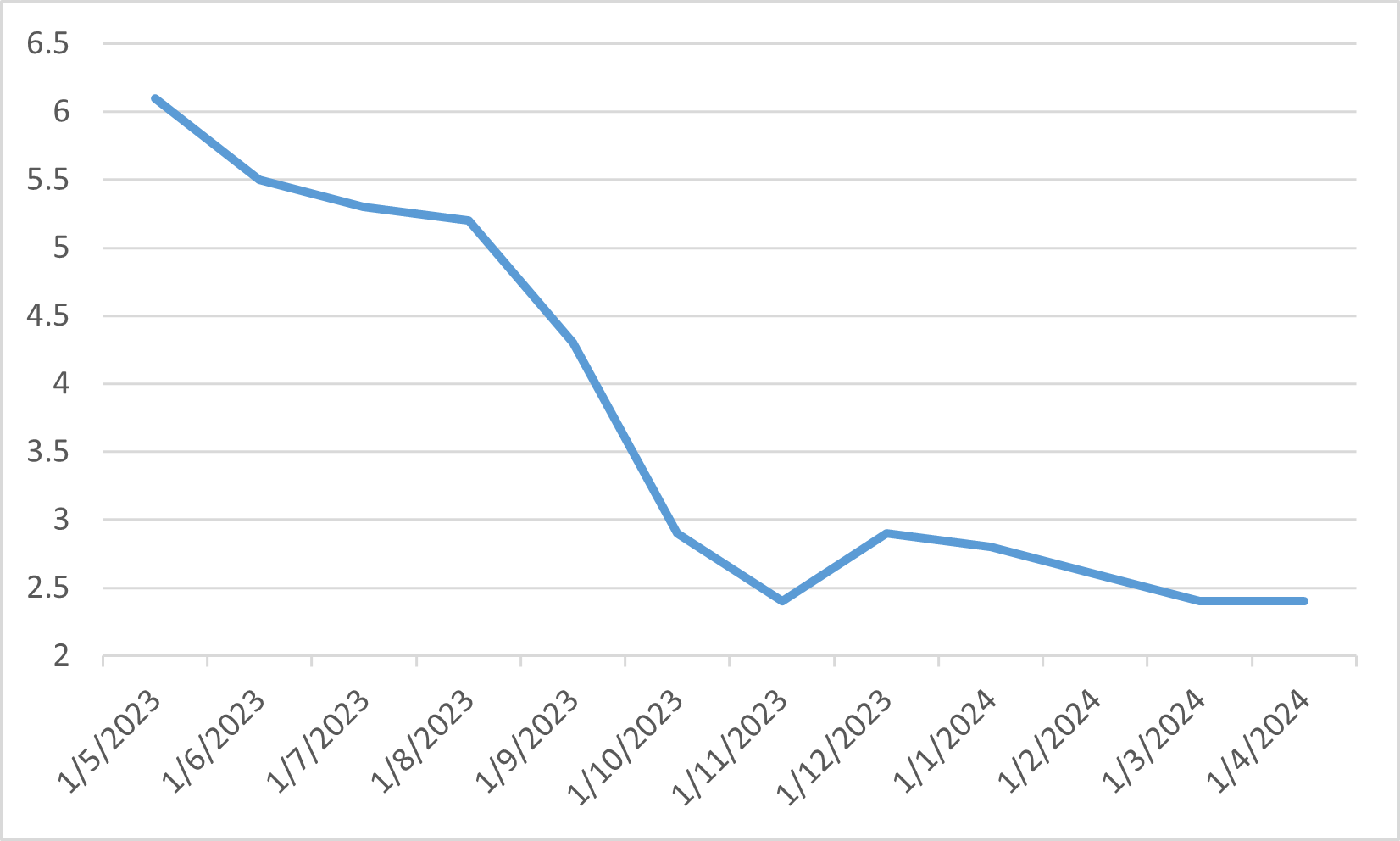

US Composite PMI

Japan

In May 2024, the Japanese equity market experienced a period of mixed performance, driven by various economic factors and investor sentiment. The Nikkei 225 and TOPIX indices showed modest gains, rising by 0.21% and 1.07%, respectively. Early in the month, small-cap stocks outperformed, but as May progressed, larger-cap names took the lead. This shift was partly due to increased interest from foreign investors, who were attracted by the relatively low valuations and strong corporate earnings of Japanese firms.

Economic indicators presented a nuanced picture of Japan's recovery. The weakening yen, typically favourable for Japan's export-heavy economy, started to weigh on consumer sentiment as import costs rose. This currency effect, combined with persistent inflationary pressures, created a challenging environment for domestic consumption. Despite these headwinds, corporate earnings remained robust, particularly in sectors such as technology and manufacturing, where demand for semiconductors and other high-tech components continued to drive growth.

On the policy front, the Bank of Japan maintained its ultra-loose monetary policy to support the economy, but there were growing discussions about potential normalization. Governor Ueda's comments indicated a cautious approach towards ending the negative interest rate policy, dependent on sustained wage growth and stable inflation. The central bank's data-dependent stance helped mitigate market volatility, ensuring that any policy shifts would be communicated clearly to avoid surprises. This careful balancing act between supporting economic growth and managing inflation expectations played a crucial role in shaping investor sentiment throughout May.

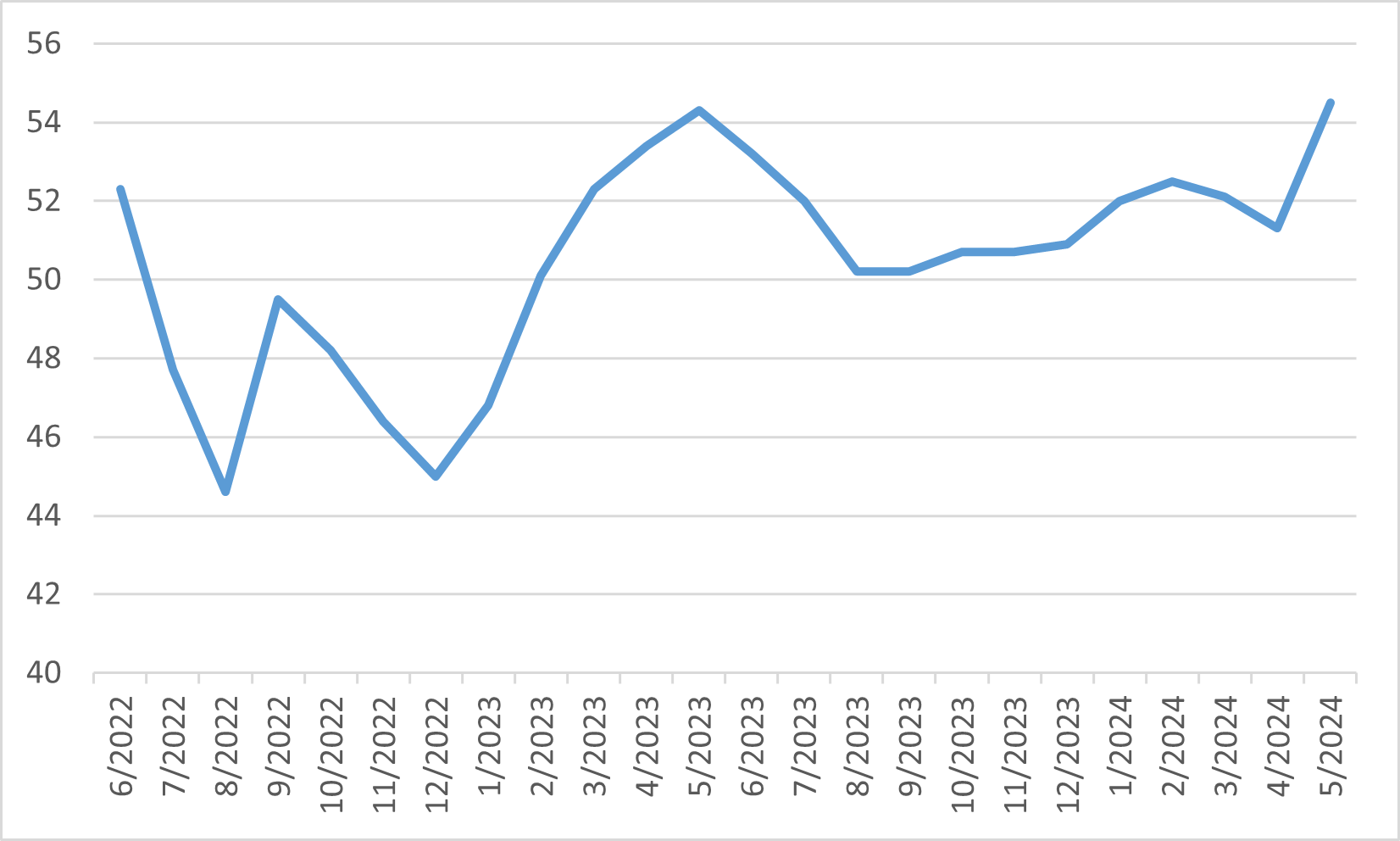

USDJPY Spot Exchange Rate

China

In May 2024, the Chinese equity markets experienced a notable rebound, supported by strong economic indicators and positive policy measures. The MSCI China and Hang Seng Indices rose significantly, with 2.43% and 2.54%, reflecting an overall market recovery. This uptrend was driven by the government's fiscal stimulus measures, including increased spending on infrastructure projects and supportive policies aimed at stabilizing the property sector. These interventions helped alleviate some of the concerns over structural issues and boosted investor confidence.

Economic data from China in May showed robust performance across several sectors. The country's GDP grew by 5.3% year-over-year in the first quarter, exceeding market expectations. Industrial production remained strong, and exports saw a positive turnaround, especially to regions like ASEAN, Latin America, and Africa. This growth in exports indicated increased business activity and production momentum within Chinese companies. Additionally, retail sales and consumer confidence showed signs of improvement, contributing to a more optimistic outlook for domestic demand.

Despite these positive developments, some challenges persisted. The real estate sector continued to struggle with issues related to unfinished projects and financial health of private developers. However, the government's proactive stance in addressing these issues through fiscal policies and support measures aimed to mitigate long-term risks. Overall, the combination of strong economic performance, government interventions, and improving consumer sentiment contributed to the positive momentum in the Chinese equity markets in May 2024.

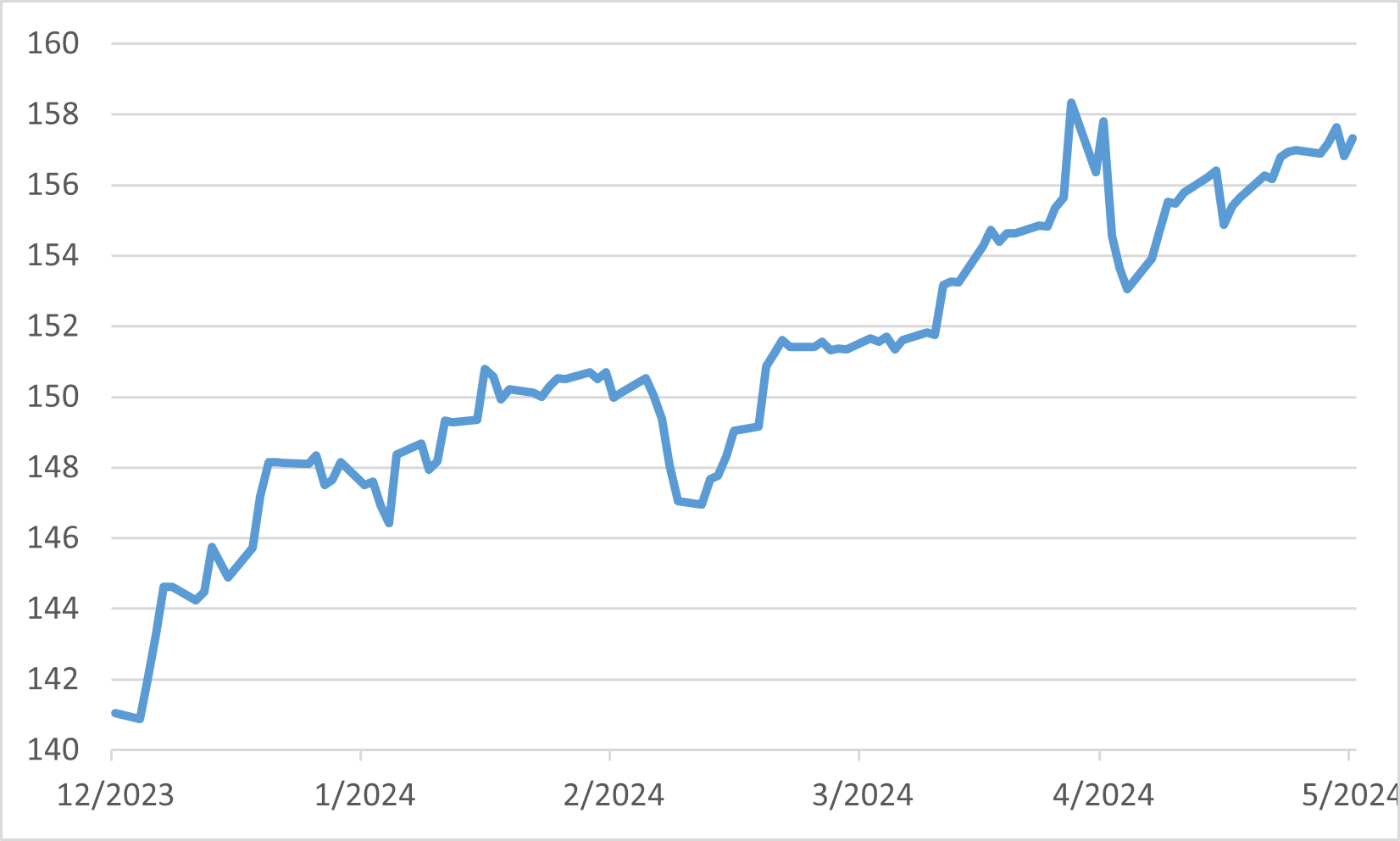

China Newly Built House Prices YoY Change

Europe

In May 2024, European equity markets experienced a robust rebound, driven by improving economic data and investor optimism. The Euro major indices in the region posted strong gains, UK FTSE100, Euro STOXX and German DAX indices surged 2.03%, 2.42% and 3.16% respectively, with the Eurozone PMI data indicating an upswing in both the manufacturing and services sectors. Corporate earnings surprised positively, further boosting market confidence. The first quarter GDP growth for the Eurozone was confirmed at 0.3% QoQ, reflecting a steady economic recovery.

Despite the positive trends, the European markets faced some challenges, particularly concerning inflation and monetary policy. The ECB maintained its cautious stance, with inflation rates in the Eurozone decelerating to 2.4% YoY. This persistent inflation deceleration prompted the ECB to signal potential interest rate cuts in the near future, though higher-than-expected inflation figures cast doubts on the aggressiveness of such cuts.

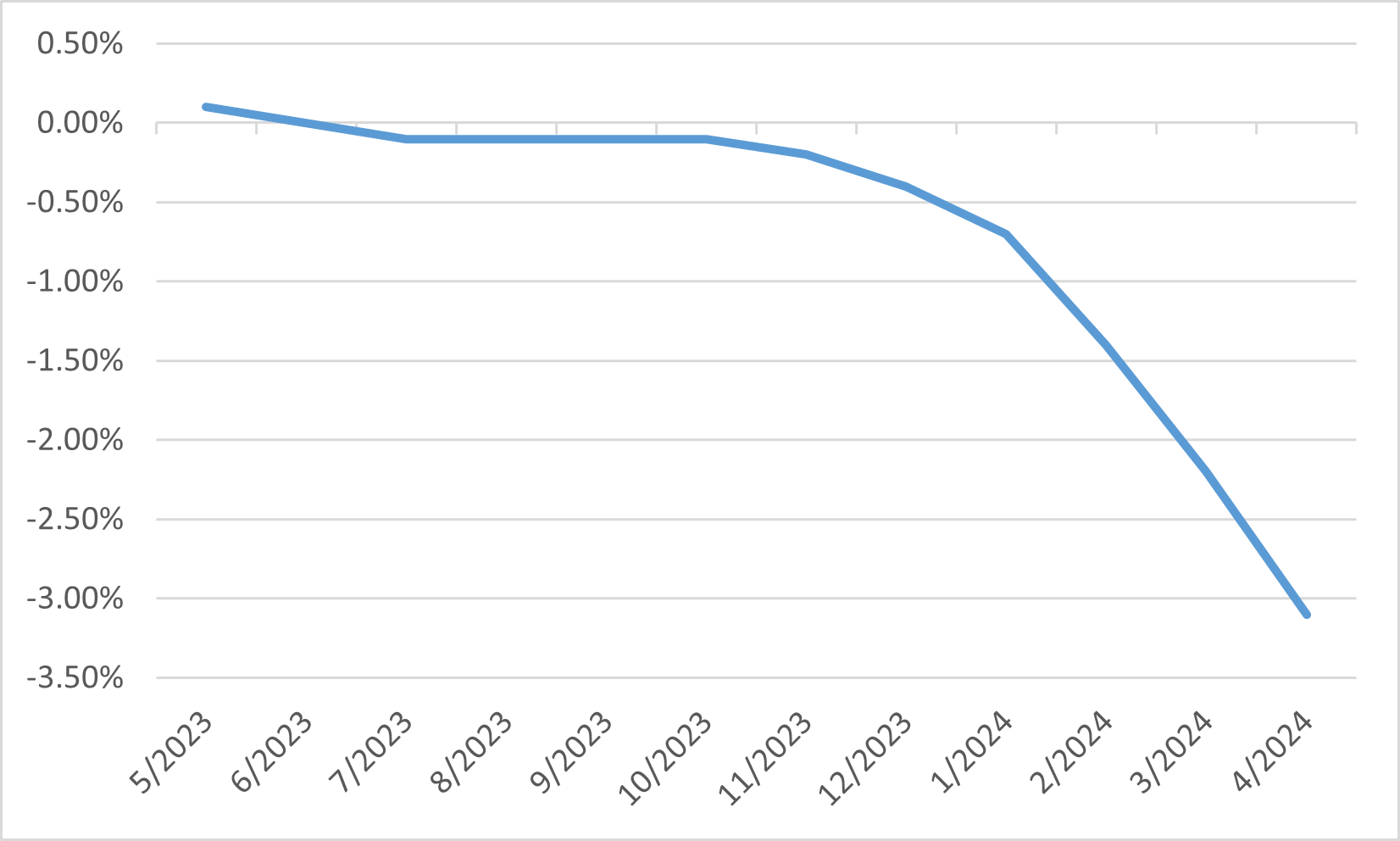

Eurozone CPI YoY