Monthly Market Outlook – Jun2024

19th July, 2024

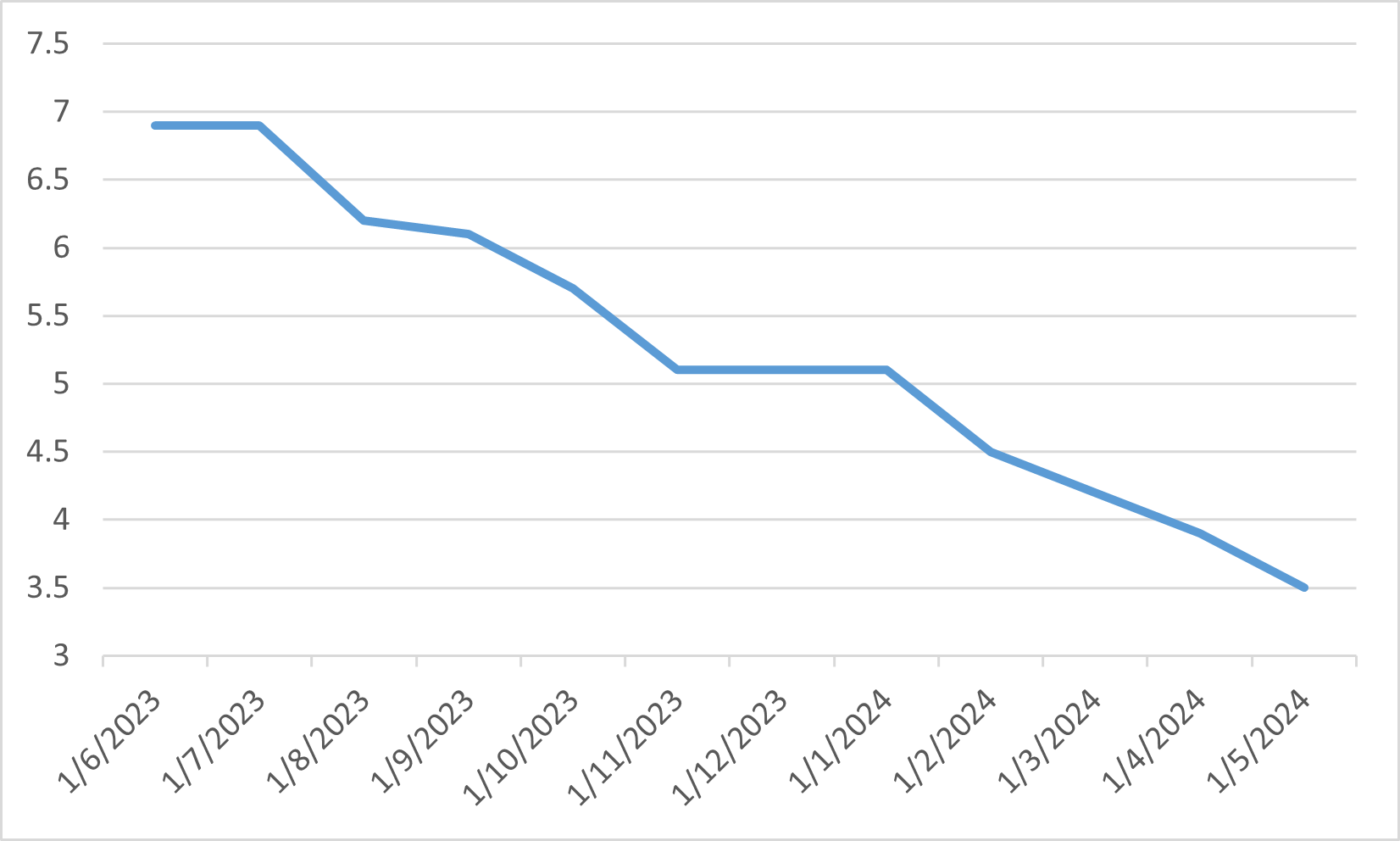

U.S.

In June 2024, the US equity markets continued their upward trajectory, driven by strong performances in the technology sector and overall positive economic indicators. The S&P 500 rose by 3.59%, bringing its year-to-date gains to 15.29%. The NASDAQ outperformed with a 6.03% increase for the month, reflecting the ongoing investor enthusiasm for tech stocks, particularly those related to artificial intelligence and semiconductor industries. Companies like NVIDIA and Super Micro Computer led the gains, highlighting the market's focus on tech-driven growth.

Despite the overall positive market performance, economic data presented a mixed picture. The Federal Reserve's decision to maintain the federal funds rate at 5.5% underscored ongoing concerns about inflation, which remained stubbornly high. Core inflation rose by 0.2% in May, slightly below market expectations, but the broader economic indicators showed signs of cooling. Retail sales were flat, and industrial production fell by 0.3%, indicating some slowing in economic activity. Housing data was also mixed, with housing starts increasing by 5.7%, but new home sales falling by 4.7% due to higher mortgage rates.

Geopolitical factors and fiscal policies also influenced market dynamics. The extension of production cuts by OPEC+ and ongoing trade tensions with China contributed to economic uncertainty. Additionally, the Congressional Budget Office raised its federal budget deficit forecast for fiscal 2024, citing increased spending and lower-than-expected corporate tax revenues. This fiscal outlook, combined with the Federal Reserve's cautious approach to interest rate cuts, created a complex backdrop for investors. Nonetheless, the resilience of the tech sector and strong corporate earnings provided a solid foundation for the market's gains in June 2024.

S&P 500 performance as of 28/06/24

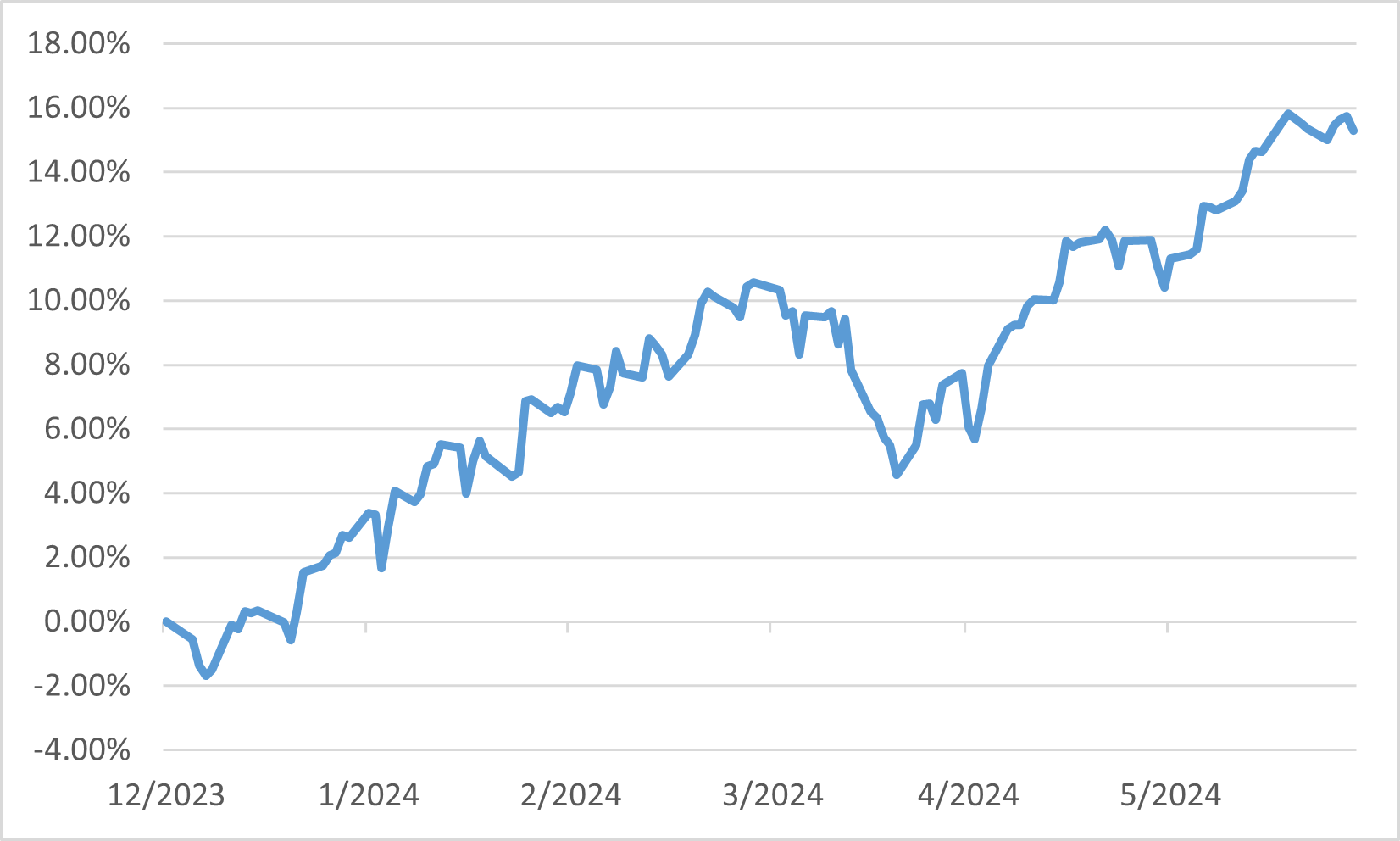

Japan

In June 2024, the Japanese equity market exhibited modest gains despite a complex economic backdrop. The Nikkei 225 edged up by 2.94%, while the TOPIX index rose by 1.45%. This growth was primarily driven by strong performances in high-tech sectors, particularly semiconductor-related stocks, buoyed by robust earnings from major U.S. tech firms. However, rising long-term interest rates in Japan tempered the overall gains, making equities appear richly valued. Additionally, sectors such as insurance and electric power saw significant gains, while real estate and transportation sectors experienced declines.

Economic conditions in Japan revealed a mixed picture. Wage growth continued to be a focal point, influenced by an increasing number of part-time workers, which affects average wage statistics. Despite this, consumer spending remained resilient, supported by substantial household savings accumulated during the pandemic. The Bank of Japan (BOJ) maintained its cautious approach towards policy normalization, gradually moving away from its ultra-loose monetary stance. Exiting from negative interest rates and focusing on increasing capital efficiency within Japanese firms are expected to support long-term economic stability and growth.

Global factors also played a significant role in shaping Japan's equity market performance in June. The ongoing depreciation of the yen contributed to export competitiveness but also highlighted the importance of domestic demand in sustaining economic growth. The Japanese government and the BOJ's coordinated efforts towards gradual policy normalization aim to mitigate any abrupt market disruptions. Meanwhile, Japan's focus on enhancing corporate governance and encouraging mergers and acquisitions is expected to attract more global investors, further supporting the equity market.

USDJPY Spot Exchange Rate

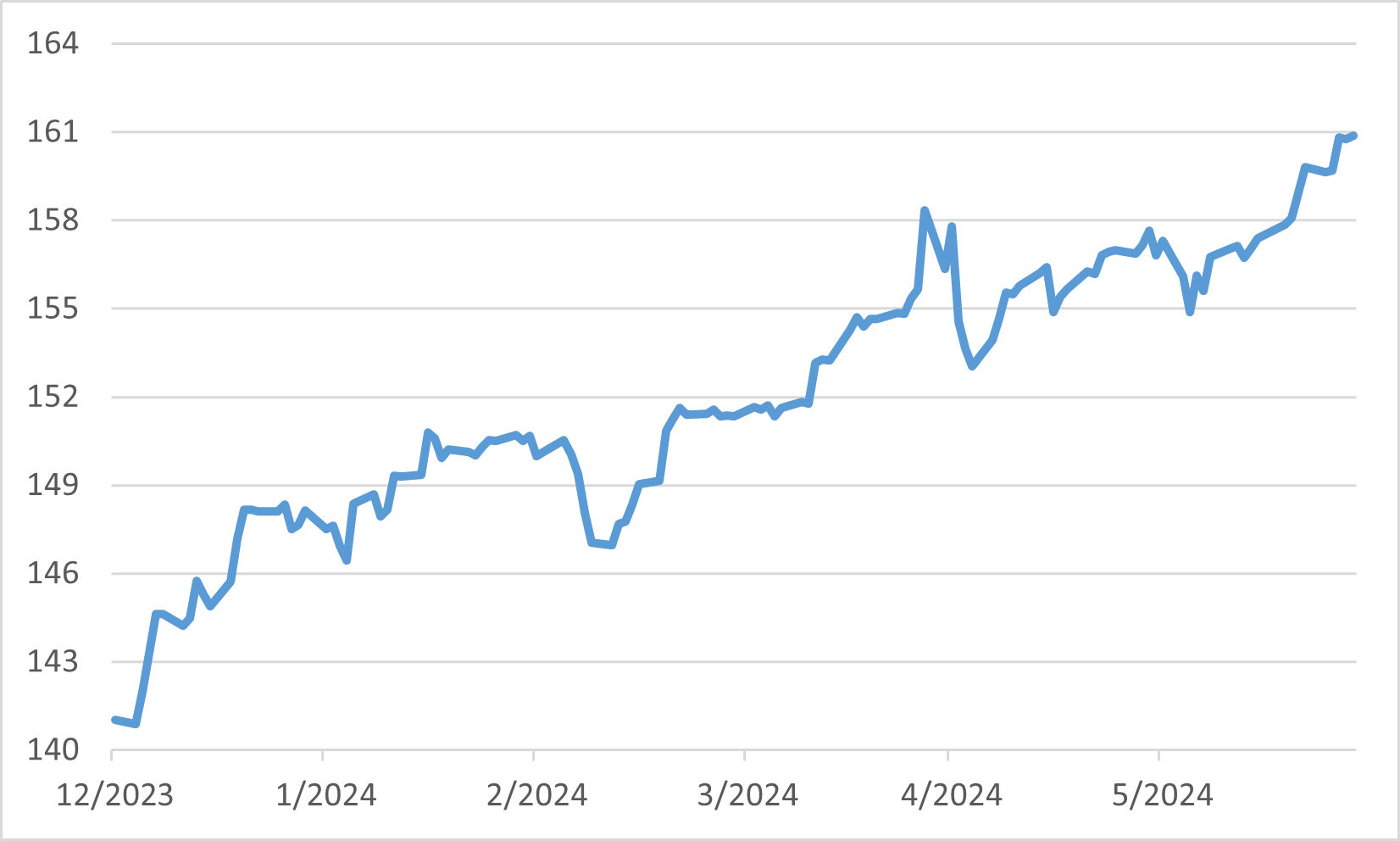

China

In June 2024, the Chinese equity markets experienced a mixed performance, influenced by a combination of positive economic indicators and ongoing challenges in consumer sentiment. Despite a significant rebound earlier in the year, Chinese equities showed signs of volatility. The Shanghai Composite and CSI300 Indexes saw a decline of 2.91% and 2.52% for the month, reflecting investor caution amid a lack of new economic stimulus and cautious consumer behaviour.

Economic data from China remained robust, with GDP growth for the first quarter reported at 5.3% year-over-year, surpassing market expectations. Industrial production and exports also showed positive trends, indicating strong business activity and production momentum. Exports to regions like ASEAN, Latin America, and Africa increased, highlighting China's expanding global market reach. However, consumer confidence and retail sales continued to recover slowly, which kept the overall market sentiment mixed.

The Chinese government's efforts to support the real estate sector provided some stability to the market. These measures, along with strong performances from sectors related to artificial intelligence and technology, helped offset some of the negative impacts. Nonetheless, the broader market faced challenges due to persistent issues in the property sector and cautious domestic demand. Looking ahead, the continued focus on boosting exports and domestic consumption is expected to play a crucial role in sustaining China's economic recovery and market performance.

Chinese indexes performance in June

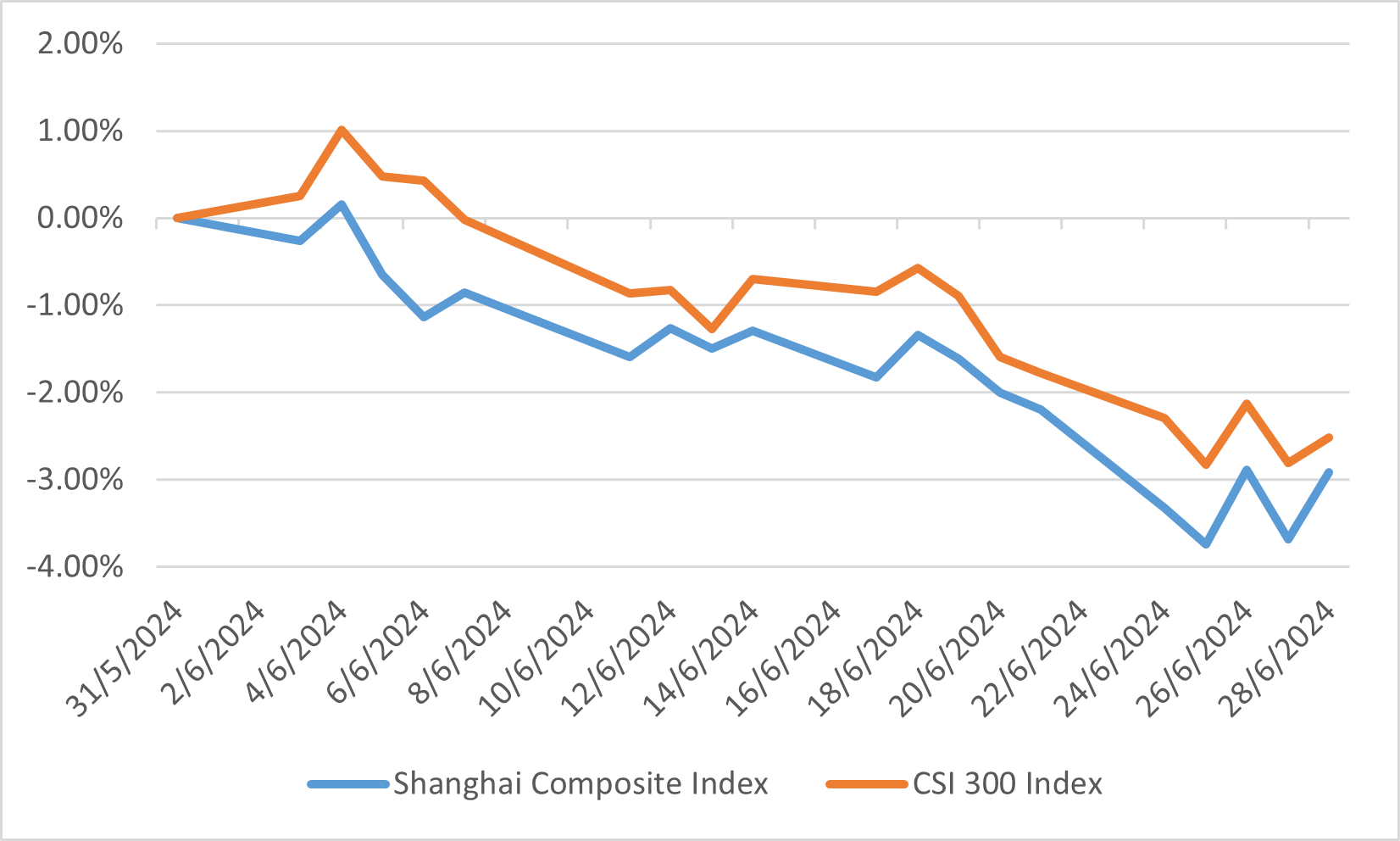

Europe

In June 2024, the European equity markets experienced a challenging month characterized by political uncertainty and mixed economic signals. The overall market sentiment was dampened by political developments, including President Macron's announcement of a snap election in France, which introduced significant volatility. The Stoxx 600 Index fell by 1.13%, reflecting concerns about potential changes to the business and economic environment. However, some sectors like technology and healthcare managed to post gains amid the broader market downturn.

Economic indicators presented a mixed picture for Europe. While the Eurozone continued to experience inflationary pressures, with inflation rising above 3% in May, business surveys indicated ongoing economic expansion. The European Central Bank (ECB) commenced its easing cycle, cutting interest rates in response to the persistent inflation. Despite these efforts, services inflation remained particularly sticky, complicating the ECB's policy decisions. The UK saw some positive economic data with strong retail sales in May and a slight reduction in inflation to the Bank of England’s target of 2%. However, core inflation in the UK remained high at 3.5%, keeping monetary policy under scrutiny.

UK core CPI YoY%