Monthly Market Outlook – Jul 2024

23rd August, 2024

U.S.

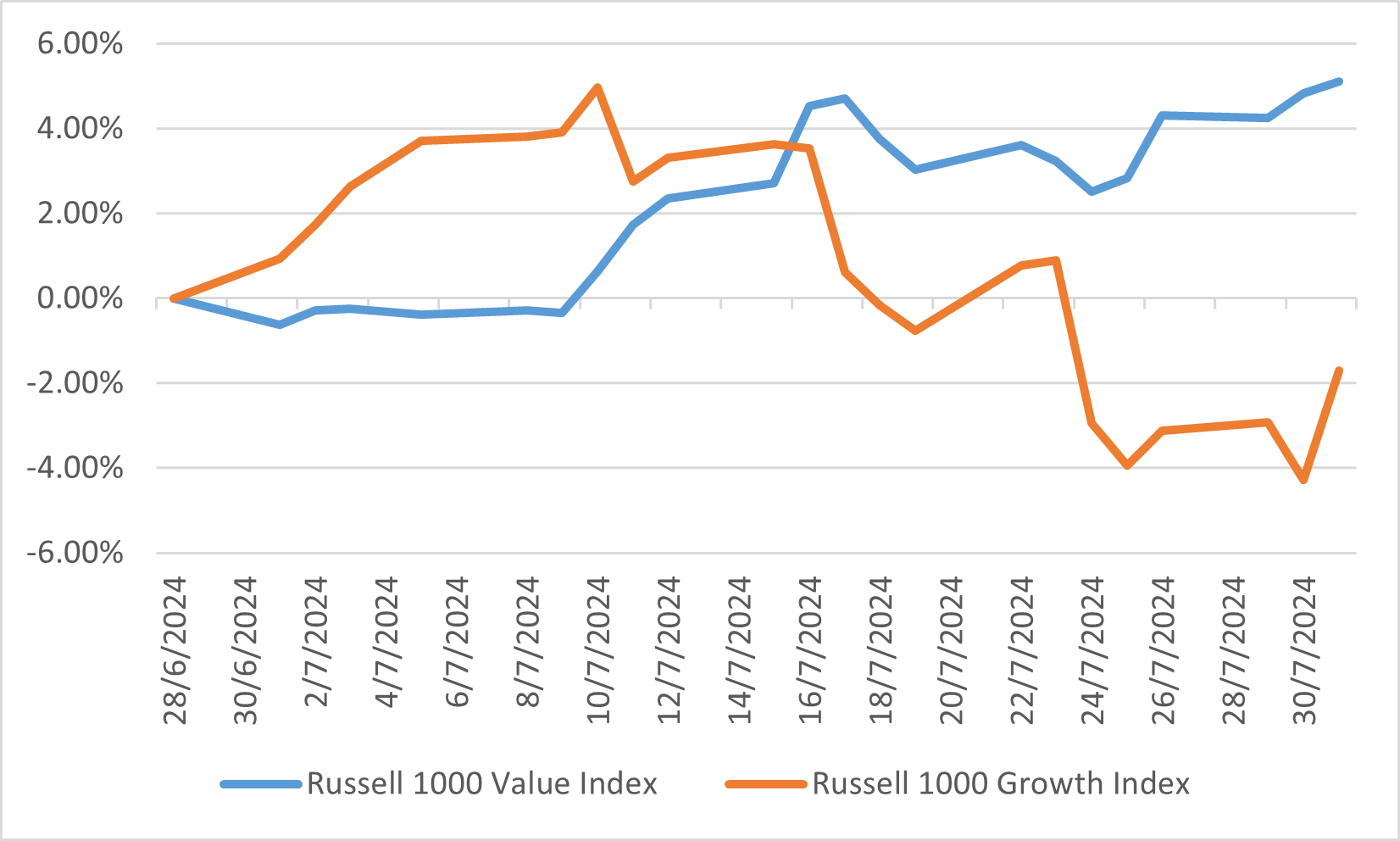

In July 2024, the U.S. equity markets experienced a significant shift as investor sentiment moved away from mega-cap technology stocks toward smaller-cap value stocks. This rotation was driven by cooling inflation, a weakening labour market, and growing expectations of Federal Reserve rate cuts later in the year. The Russell 2000 and Russell Microcap indices led the charge, gaining 10.2% and 11.9%, respectively, while the Nasdaq-100, heavily weighted in tech, lost 1.6%. This movement highlighted a broader market shift from growth to value, with the Russell 1000 Value Index outperforming the Russell 1000 Growth Index.

Economic data for July showed a mixed picture. The U.S. Department of Labor reported better-than-expected job creation, but also noted a cooling labour market with a slight increase in the unemployment rate to 4.1%. Inflation continued its downward trend, with the Consumer Price Index rising by just 3.0% year-over-year, the lowest since May 2021. These developments reinforced the narrative of a potential economic "soft landing," where inflation slows without triggering a recession, raising the odds of multiple rate cuts by the Federal Reserve.

Corporate earnings also played a crucial role in shaping market dynamics. As of late July, about 60% of S&P 500 companies had reported their Q2 earnings, with nearly 80% exceeding expectations. This positive earnings season, coupled with the anticipation of Fed rate cuts, provided support for the broader market despite the selloff in tech stocks. Overall, July was a month of transition, with the market adapting to new economic realities and shifting investor preferences.

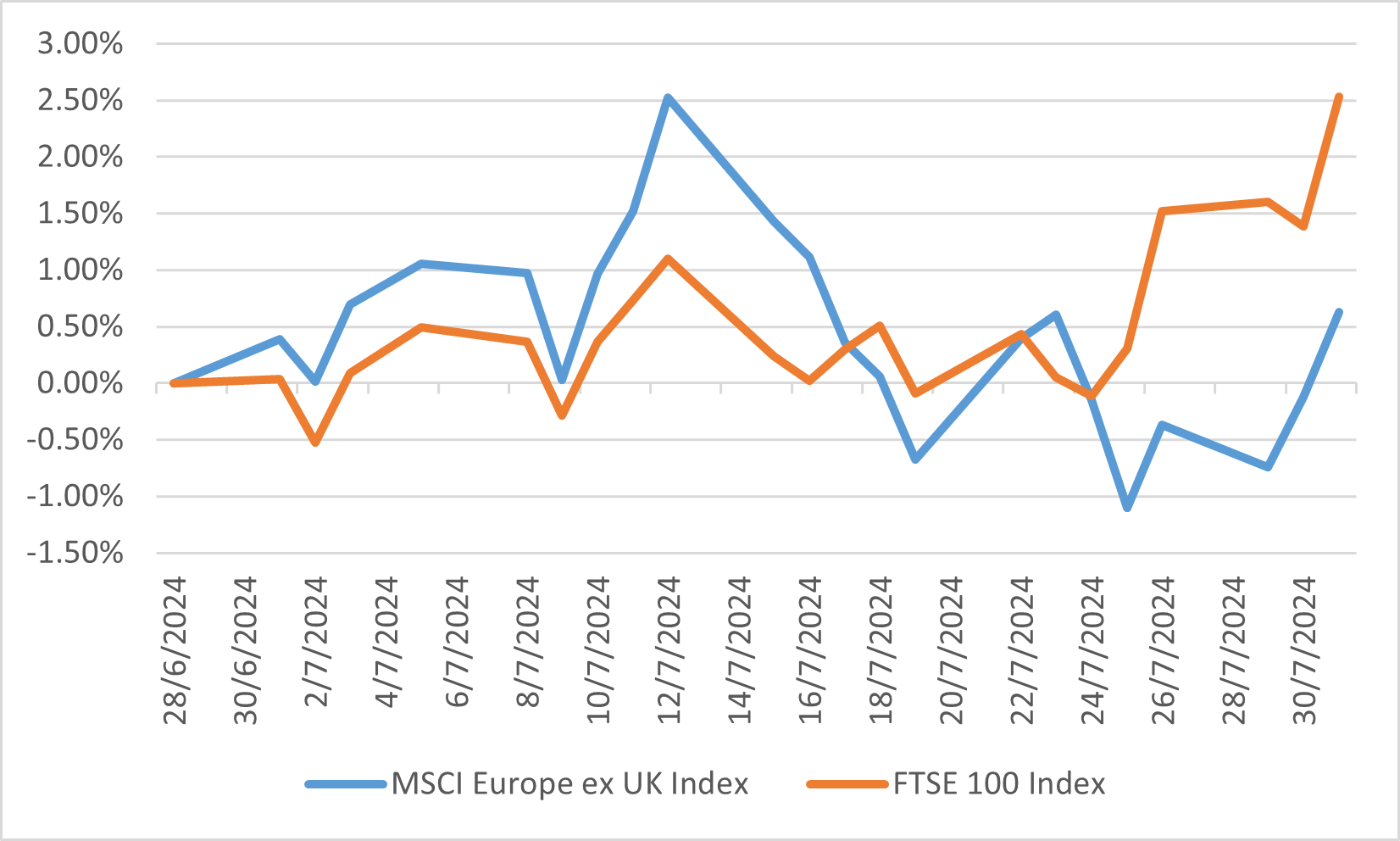

Russell 1000 Value vs Growth

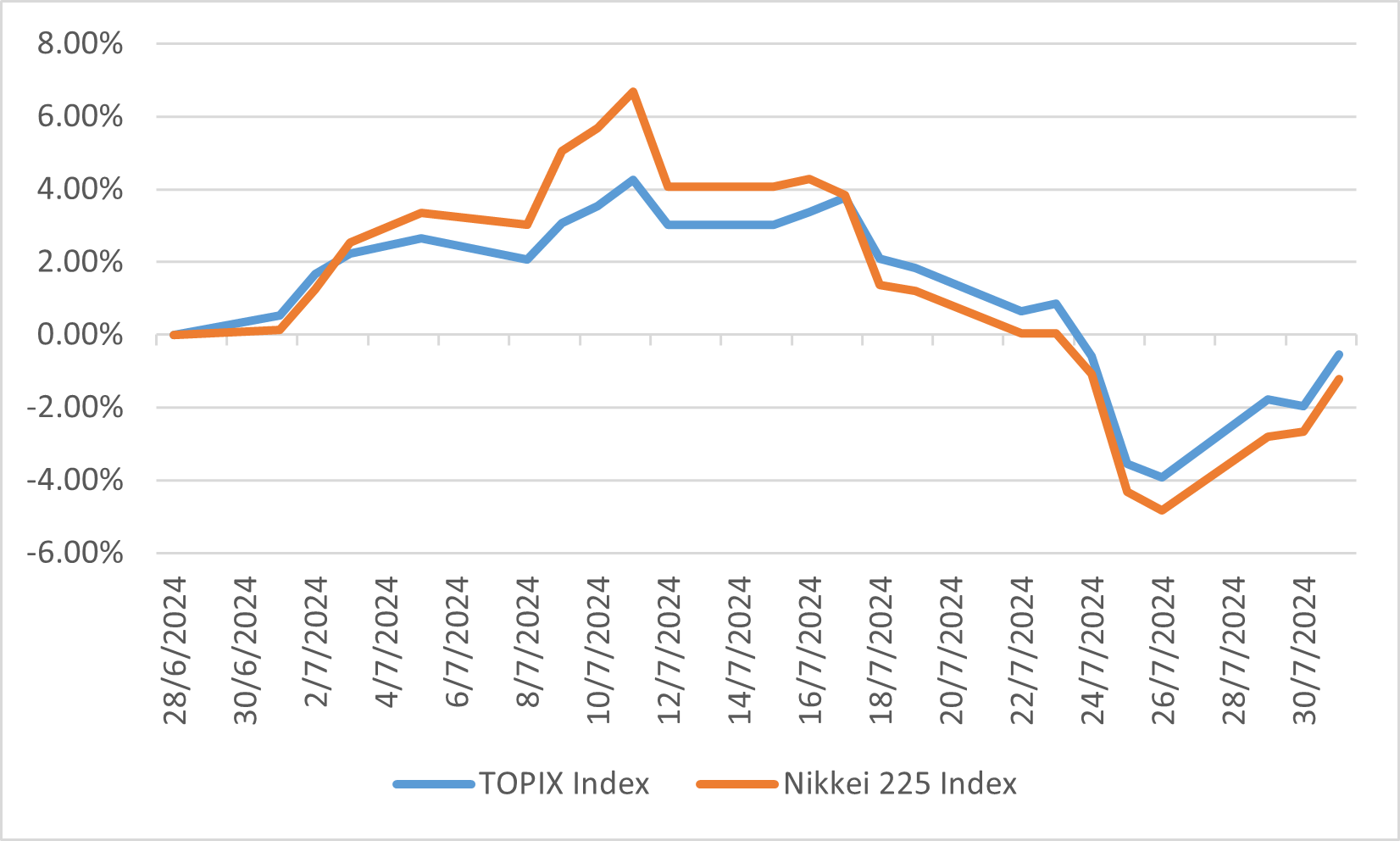

Japan

In July 2024, the Japanese equity markets experienced a slight decline, with the TOPIX index falling by 0.54% and the Nikkei 225 dropping by 1.21%. This downturn was largely influenced by the strengthening yen and concerns about tighter U.S. restrictions on semiconductor exports to China. Early in the month, both indices reached record highs due to strong earnings from major overseas semiconductor and IT companies. However, as the yen appreciated and concerns about the global semiconductor industry grew, investor sentiment weakened, leading to declines in key sectors such as Transportation Equipment and Electric Power & Gas.

Despite the market's overall decline, certain sectors performed well. Pharmaceuticals, Construction, and Real Estate were among the top gainers, driven by strong domestic demand and continued wage growth in Japan. The labour market showed positive signs, with real wages rising in June for the first time in 27 months. This increase in wages is expected to boost domestic consumption, potentially supporting a recovery in Japanese equities in the coming months. However, the market remains cautious, particularly regarding the impact of ongoing global economic uncertainties and the potential for further currency fluctuations.

Looking ahead, the outlook for Japanese equities is mixed. While domestic factors such as rising wages and strong consumer demand continue to provide support, external challenges, including U.S. monetary policy shifts and geopolitical tensions, are likely to keep the market volatile. Investors are closely watching for any further developments in these areas, which could significantly influence market performance in the coming months.

Japanese stock indexes performance

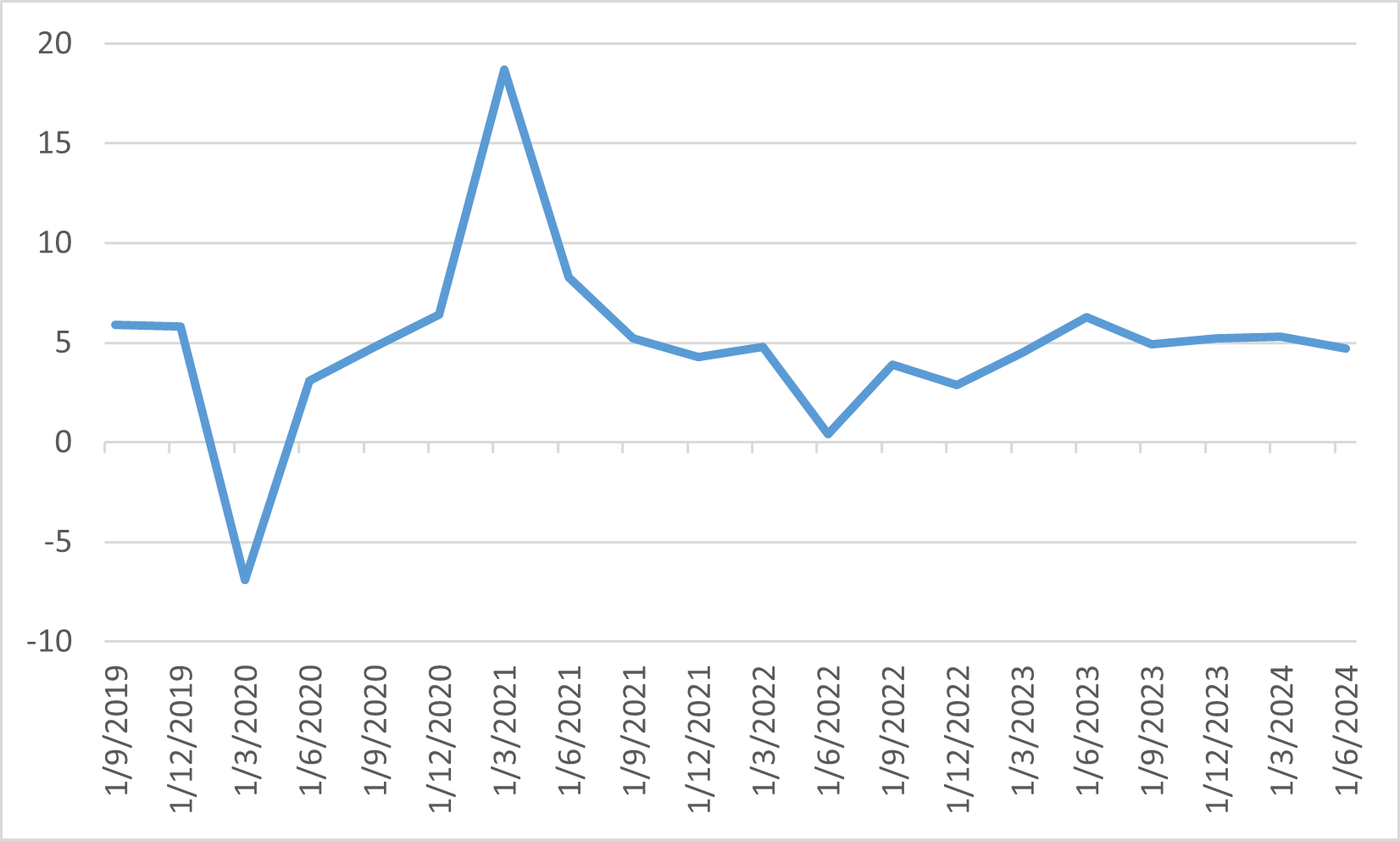

China

In July 2024, the Chinese equity markets experienced continued challenges, with the MSCI China Index declining by 1.2% in U.S. dollar terms. This downturn was driven by weak economic data and a lacklustre response from policymakers during the Third Plenum. The Plenum did not introduce significant new policy initiatives, instead reiterating the government's long-term focus on high-end manufacturing and industrial upgrades, rather than addressing immediate concerns such as boosting household consumption or the struggling property market. The economic backdrop remained weak, with China's second-quarter GDP growth coming in at 4.7%, below the government's target, further dampening market sentiment.

The Chinese government did implement some measures to support the economy, including cutting the 7-day reverse repo rate and lowering the benchmark loan prime rates. However, these actions were not enough to counterbalance the negative market sentiment, as concerns about the property sector, local government debt, and deflationary pressures persisted. Investors were disappointed by the lack of stronger, more immediate stimulus, and this contributed to the continued outflow of foreign capital from Chinese equities.

Despite these challenges, some positive signs were observed, particularly in industrial production and manufacturing, which were supported by national policies. However, the overall outlook remained cautious as the market awaited more significant policy shifts or economic improvements to restore investor confidence. The combination of weak domestic demand, geopolitical tensions, and structural issues in the economy kept Chinese equities under pressure throughout July.

China GDP Growth rate (%)

Europe

In July 2024, European equity markets experienced modest gains, but they lagged behind their U.S. and UK counterparts. The MSCI Europe ex-UK Index returned only 0.6% for the month, impacted by weaker-than-expected economic data. The Eurozone’s Purchasing Managers' Index (PMI) indicated a slight slowdown in economic growth, contributing to a cautious market sentiment. Additionally, uncertainties surrounding the French parliamentary elections created additional headwinds for the region's equities.

Despite the overall subdued performance, certain sectors showed resilience. European stocks benefited from stronger-than-expected economic momentum in some areas, particularly in the UK, where the FTSE All-Share Index rose by 2.5%. However, the Eurozone faced inflationary pressures, with inflation unexpectedly rising to 2.6%, which fueled concerns about the European Central Bank's next moves. Meanwhile, peripheral European government bonds outperformed core bonds as investors sought higher yields, anticipating further ECB interest rate cuts later in the year.

Europe stock indexes performance