Be prepared for a shift in strategic asset re-allocation in late cycle

30th April, 2018

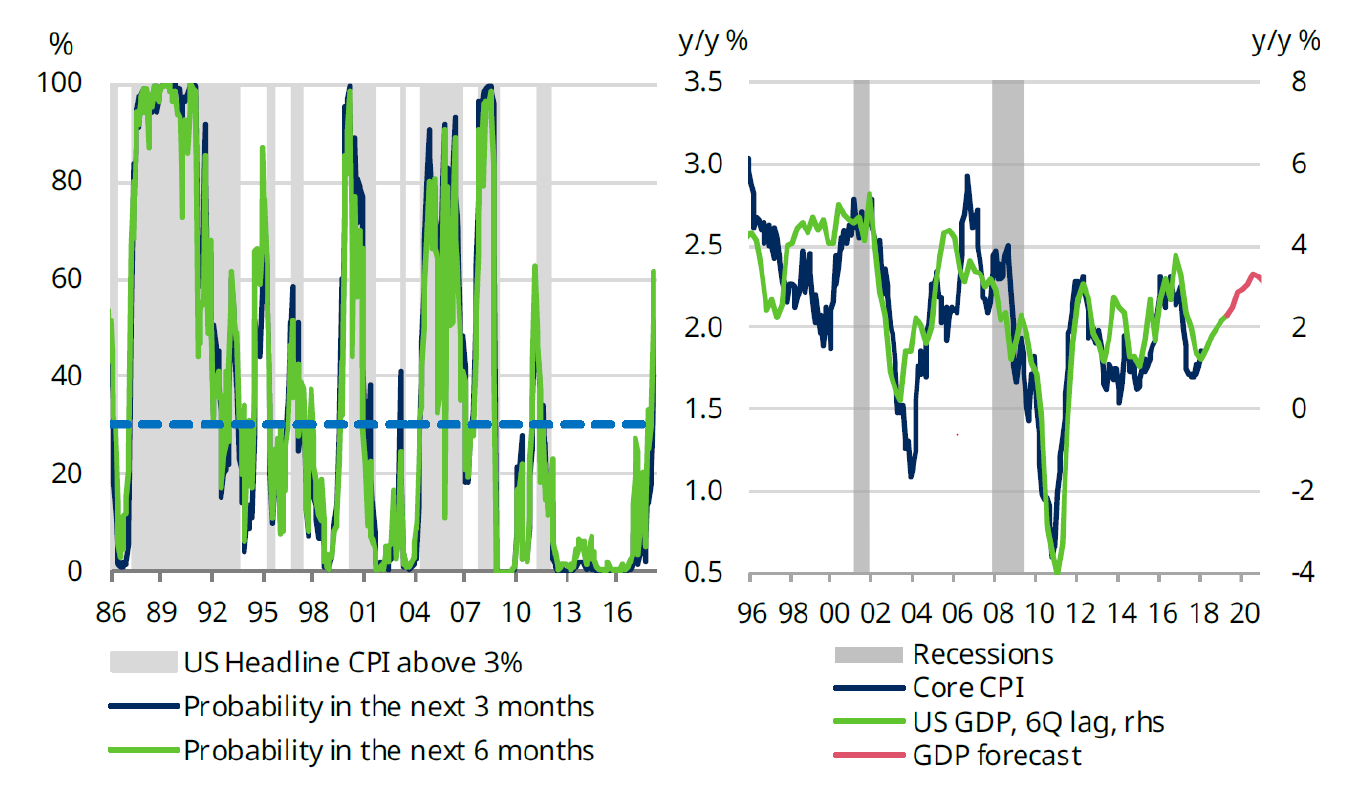

The US economy is going to march into its second longest period of expansion on record. The current expansion which began July 2009 will equal and then surpass the 106 months recorded between 1961 and 1969. Such figures naturally raise questions about the sustainability of the cycle and the impact of shifts in economic phases on our portfolios. In US history a recession is usually associated with excessive leverage, inflation or external shocks, and among all of them we stick to our belief that inflation pick-up is the greatest threat. There are often lags between inflation and economic growth, and similarly between inflation and the effect of rate hikes by the Fed. The central bank is faced with the difficult task in determining the optimal stopping point as monetary policies act with long and variable lags. It is not uncommon to see central banks worldwide overtightened and created recessions. In the current US cycle, we expect growth to peak in 2019 with the fading of fiscal stimulus after the year. The end of the expansion cycle shall most likely occur in 2020, where tax cuts and spending increases will evaporate and higher interest rates are having their maximum impact.

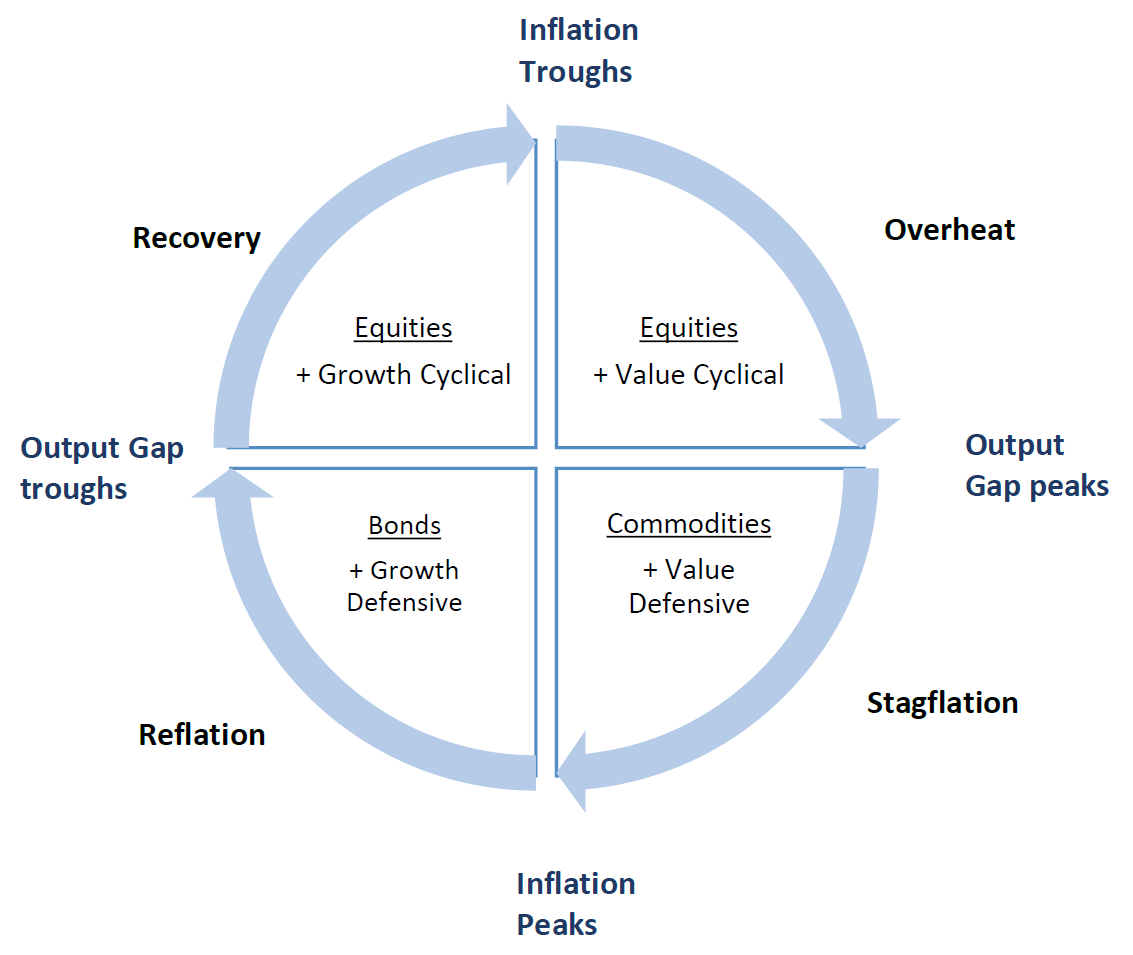

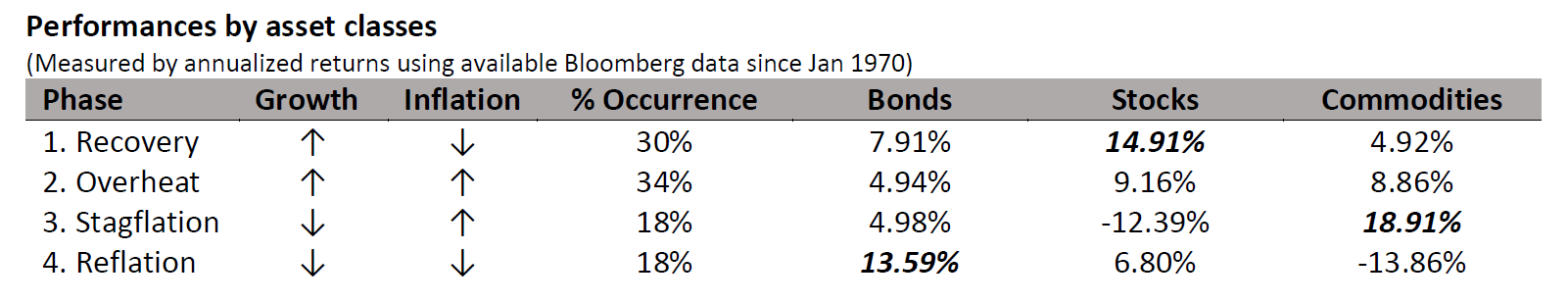

To answer the second part of the question, we built an investment clock model that examines the performances of various asset classes and equity sectors in US across different economic phases in history and see how asset allocation could be adjusted accordingly.

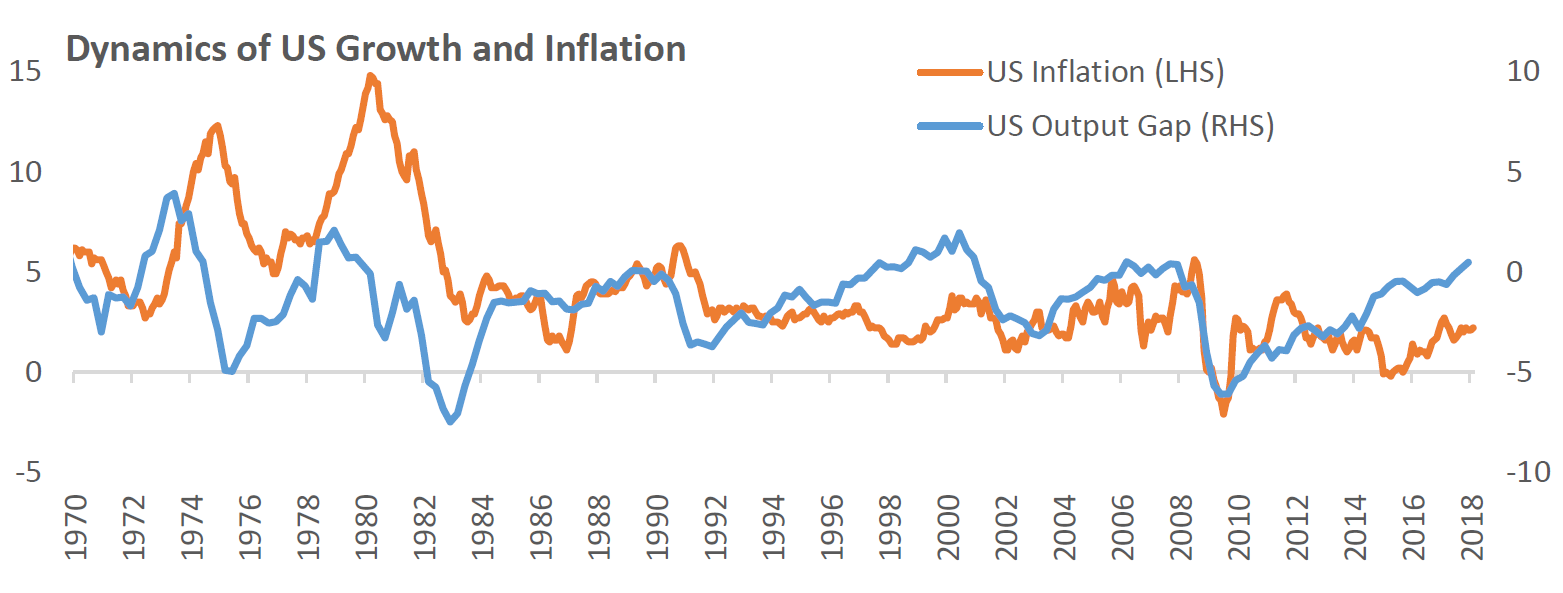

We use “output gap” estimates by the Congressional Budget Office (CBO) and CPI inflation data to identify the historic phases and confirm that bonds, stocks and commodities outperform in turn as the cycle progresses.

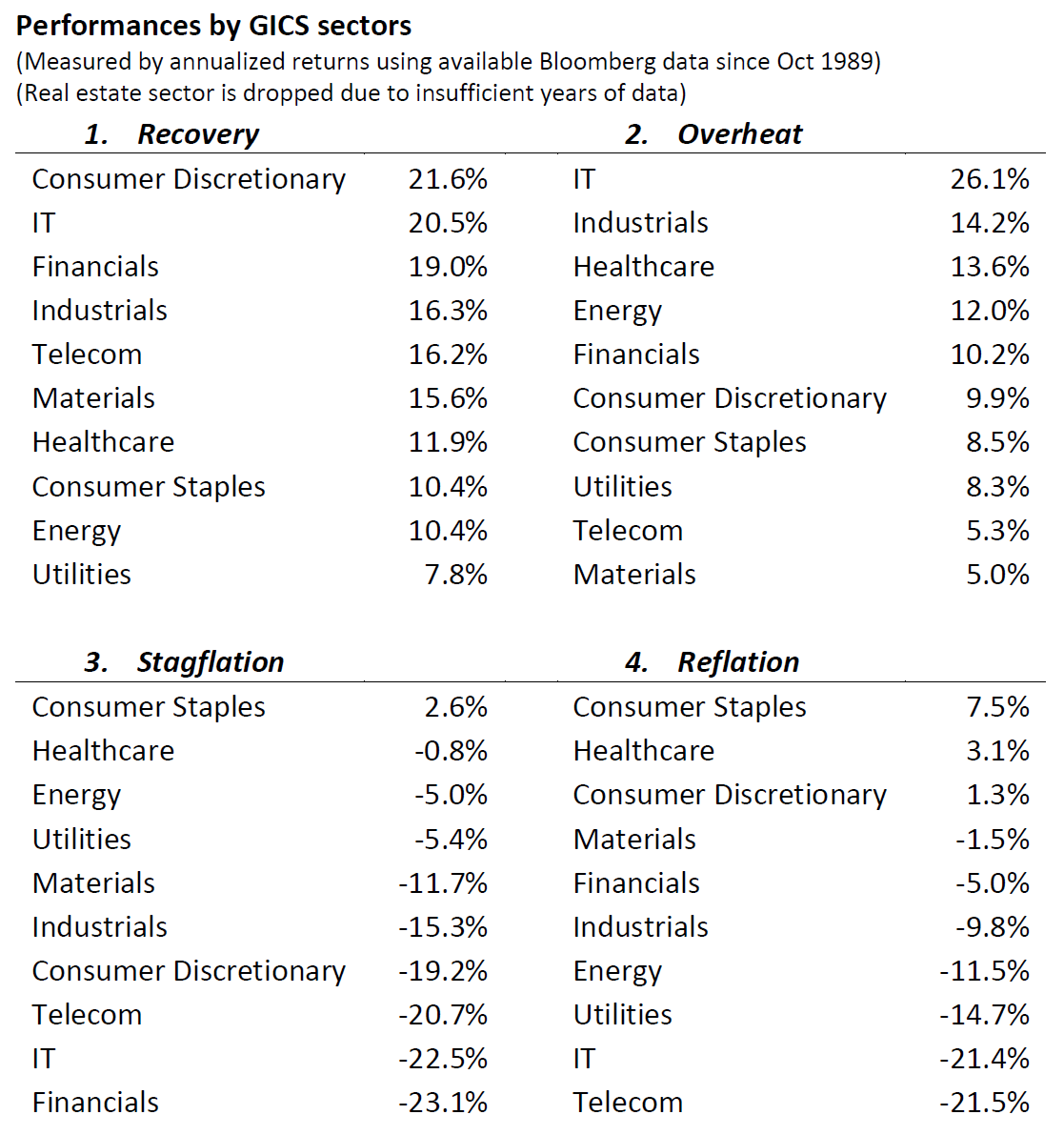

The model is not a real-time, quantitative trading rule, but it shows that a correct macro view and appropriate asset allocation ought to make a difference in portfolio returns. Recent macro data indicated that the US is most likely in the transition from phase 2 to 3. This confirms our view of underweight in bonds and gradual accumulation of selected commodities according to our model. Significant difference in returns can also be observed across US equity sectors. If there is further signs towards stagflation, defensive values such as the healthcare sector, which is currently valued inexpensively, could outperform other sectors.