Monthly Market Outlook – Aug2024

20th September, 2024

US

In August 2024, U.S. equity markets started the month on a volatile note, heavily impacted by the unwinding of the yen carry trade. This followed the Bank of Japan’s decision to raise interest rates, making it less attractive for investors to borrow in yen and invest in U.S. assets, especially tech stocks like Nvidia and Microsoft. Consequently, large-cap technology stocks saw significant declines, with the Nasdaq dropping nearly 5% during the first week. Despite this rough start, the markets rebounded later in the month, driven by hopes of an imminent Federal Reserve rate cut amid weakening job market data and easing inflation.

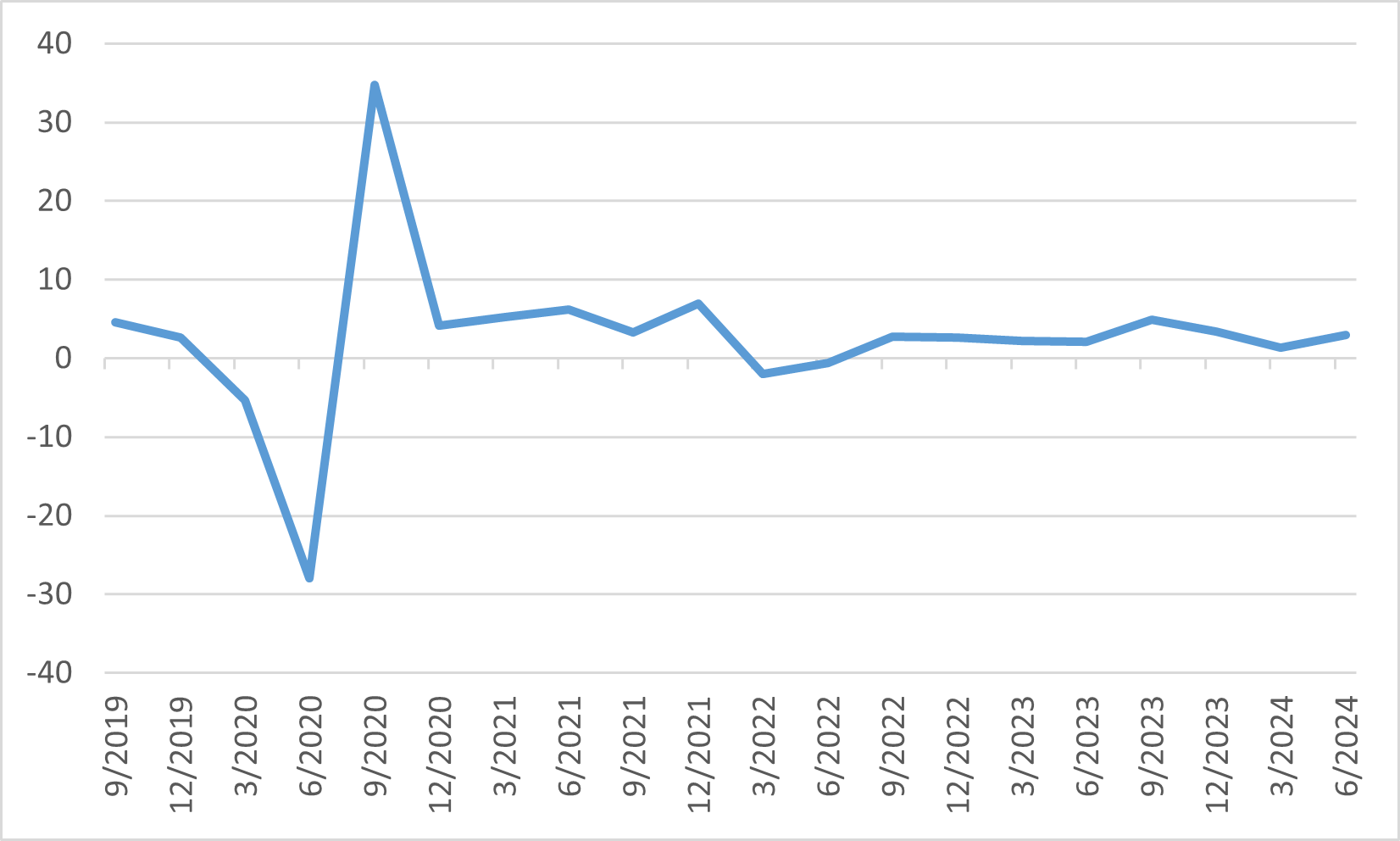

Economic data revealed both strengths and weaknesses. The U.S. GDP expanded by 3.0% in Q2 2024, boosted by strong consumer and business spending, suggesting continued economic momentum. However, the unemployment rate rose to 4.3%, its highest in nearly three years, while job gains slowed, sparking concerns about the labour market’s health. Inflation continued to cool, with the headline CPI falling to 2.9%, reinforcing market expectations for a Fed rate cut in September.

Sector-wise, there was a shift away from tech stocks toward more defensive sectors like consumer staples and healthcare, as investors sought stability amid market turbulence. Companies such as Walmart outperformed, while AI-focused companies saw their valuations reassessed. Overall, August was a month marked by significant volatility but also optimism about future rate cuts, which could provide further support to the markets moving into the fourth quarter.

US GDP Growth

Japan

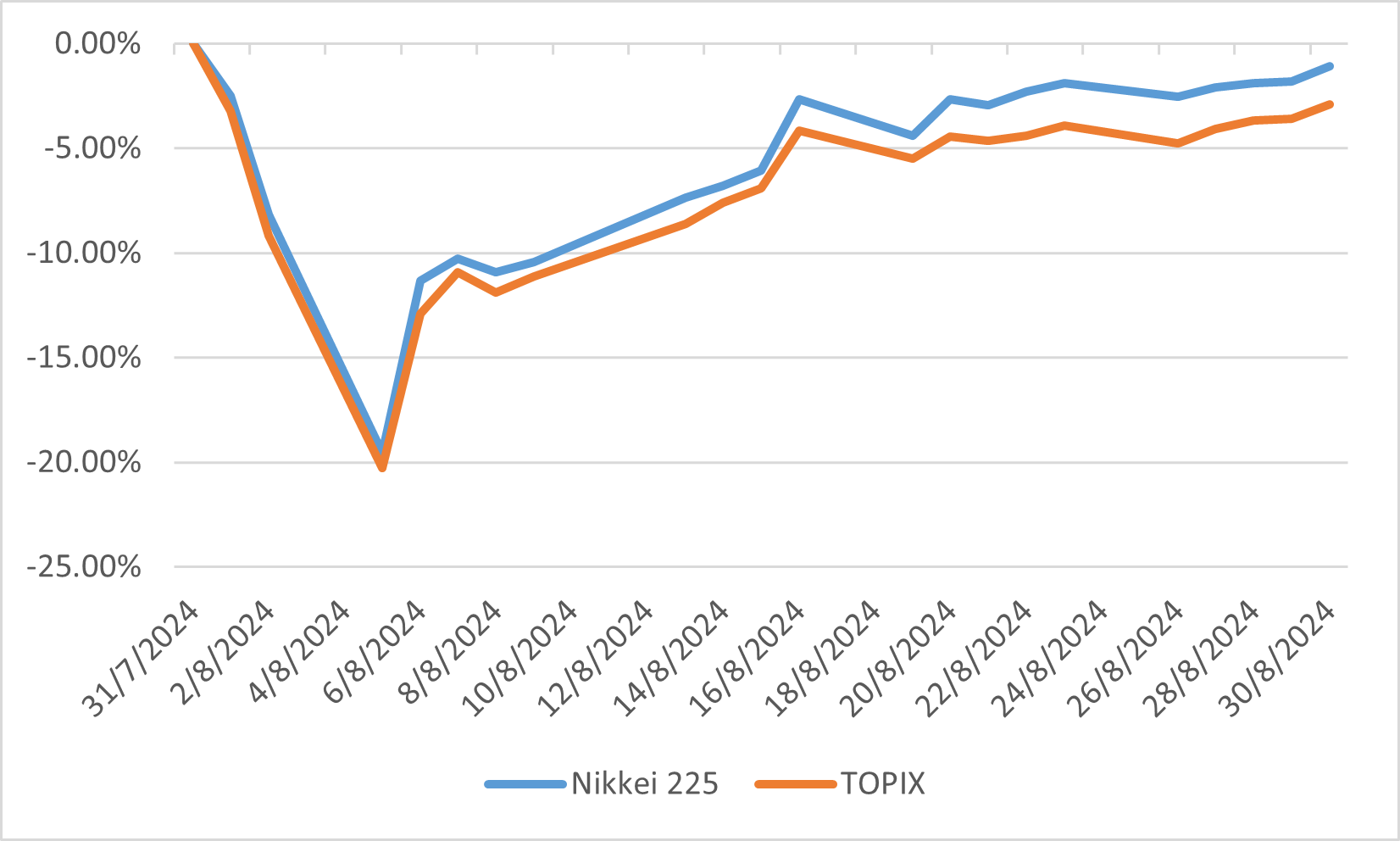

In August 2024, the Japanese equity market faced considerable volatility, primarily influenced by the yen's appreciation and global economic concerns. The Nikkei 225 fell by 1.09%, and the TOPIX index declined by 2.90%. The yen's strength negatively impacted export-driven sectors like machinery and automobiles, as investors anticipated lower earnings for Japanese exporters. The market also reacted to weaker U.S. labour market data, which heightened concerns about global economic growth.

However, despite these challenges, there were some positive developments. Japan’s April-to-June GDP growth exceeded expectations, bolstering investor confidence. Additionally, sectors like shipping, retail, and precision instruments outperformed during the month. Market sentiment improved later in August as U.S. economic indicators, including the ISM Non-Manufacturing PMI, suggested a more optimistic outlook. Expectations for potential interest rate cuts from the U.S. Federal Reserve also helped stabilize Japanese equities toward the end of the month.

Looking ahead, the outlook for Japanese equities remains cautious but hopeful. Although export-related sectors may continue to struggle due to the strong yen, domestic demand remains strong, supported by rising real wages. Investors are also closely watching for any monetary policy changes from both the Bank of Japan and the U.S. Federal Reserve, which could influence market dynamics in the coming months.

Japanese stock indexes performance

China

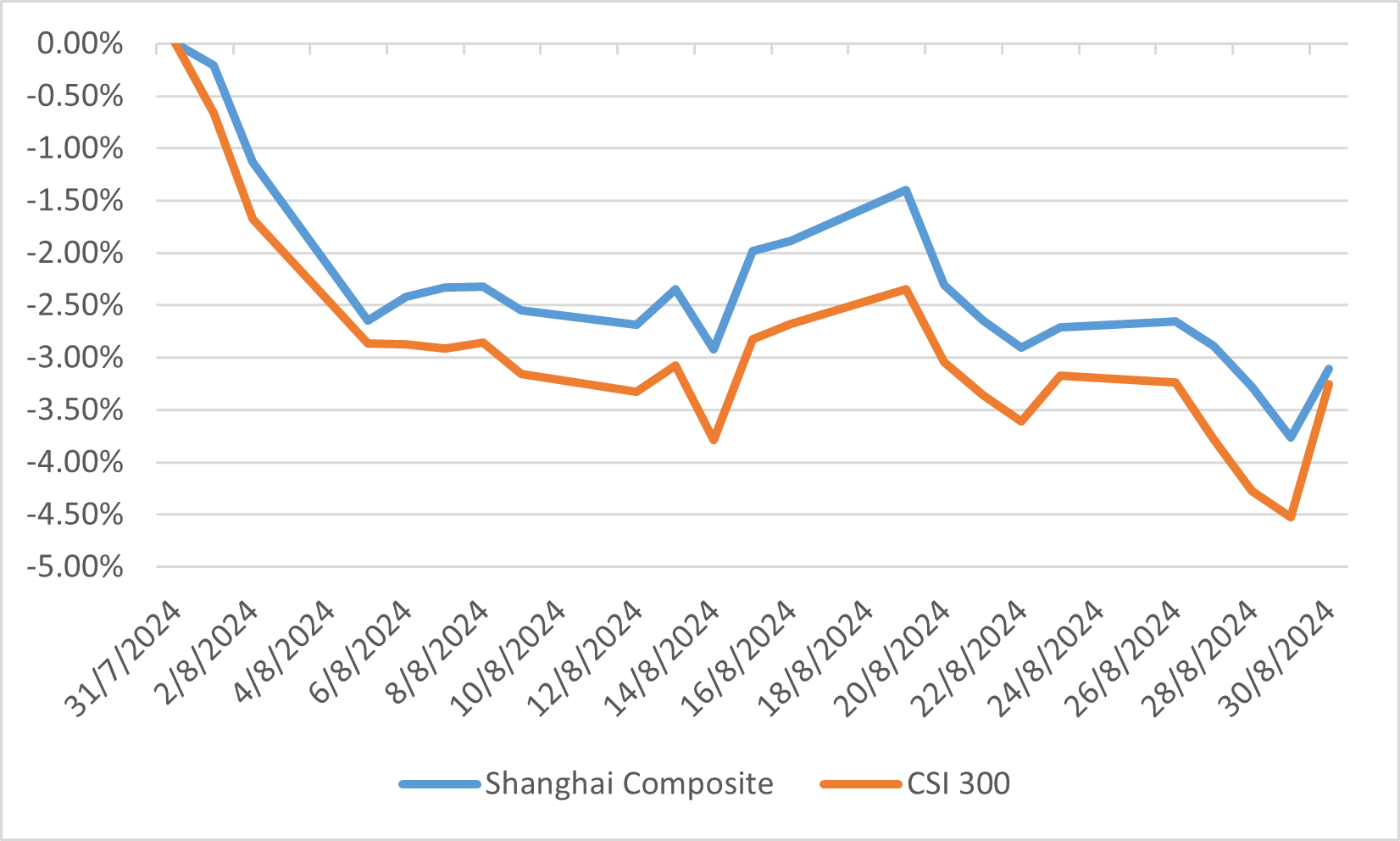

In August 2024, Chinese equity markets experienced continued challenges amid weak economic data and investor concerns over the real estate sector. The Shanghai Composite Index and CSI 300 Index slightly declined by 3.11% and 3.25% as market participants grappled with the government’s slow policy response to economic woes. One of the major drags on the market was the ongoing crisis in the property sector, where unfinished projects and liquidity issues among developers weighed heavily on investor sentiment. This weakness in real estate, which contributes significantly to China's GDP, continued to dampen consumption and business confidence.

On the positive side, there were glimpses of resilience in sectors such as technology and industrials, buoyed by the government’s efforts to support high-tech development. In response to U.S. sanctions aimed at constraining China's technological growth, the government continued to push for domestic innovation, especially in areas like semiconductors and AI. However, the size of these emerging industries remains too small to fully counterbalance the decline in real estate, highlighting the need for additional government intervention.

Overall, while some sectors showed promise, the broader Chinese market remained under pressure from structural and cyclical challenges. Investors remained cautious, awaiting more decisive policy moves to bolster economic growth. Looking ahead, China’s ability to manage the real estate slowdown and boost consumer confidence will be critical in stabilizing the equity market.

Chinese stock indexes performance

Europe

In August 2024, European equity markets experienced moderate gains despite early volatility. The month began with a sharp sell-off across global equities, largely driven by concerns over U.S. economic data and Japan's unexpected rate hike. However, European markets rebounded as investor sentiment improved, helped by expectations of interest rate cuts by the U.S. Federal Reserve. The Eurozone’s manufacturing sector remained weak, but service industries, particularly in France due to the Olympics, contributed to modest economic growth. Overall, the Euro Stoxx 50 and DAX Indexes gained by 1.80% and 2.15%, with defensive sectors like utilities and consumer staples leading the recovery.

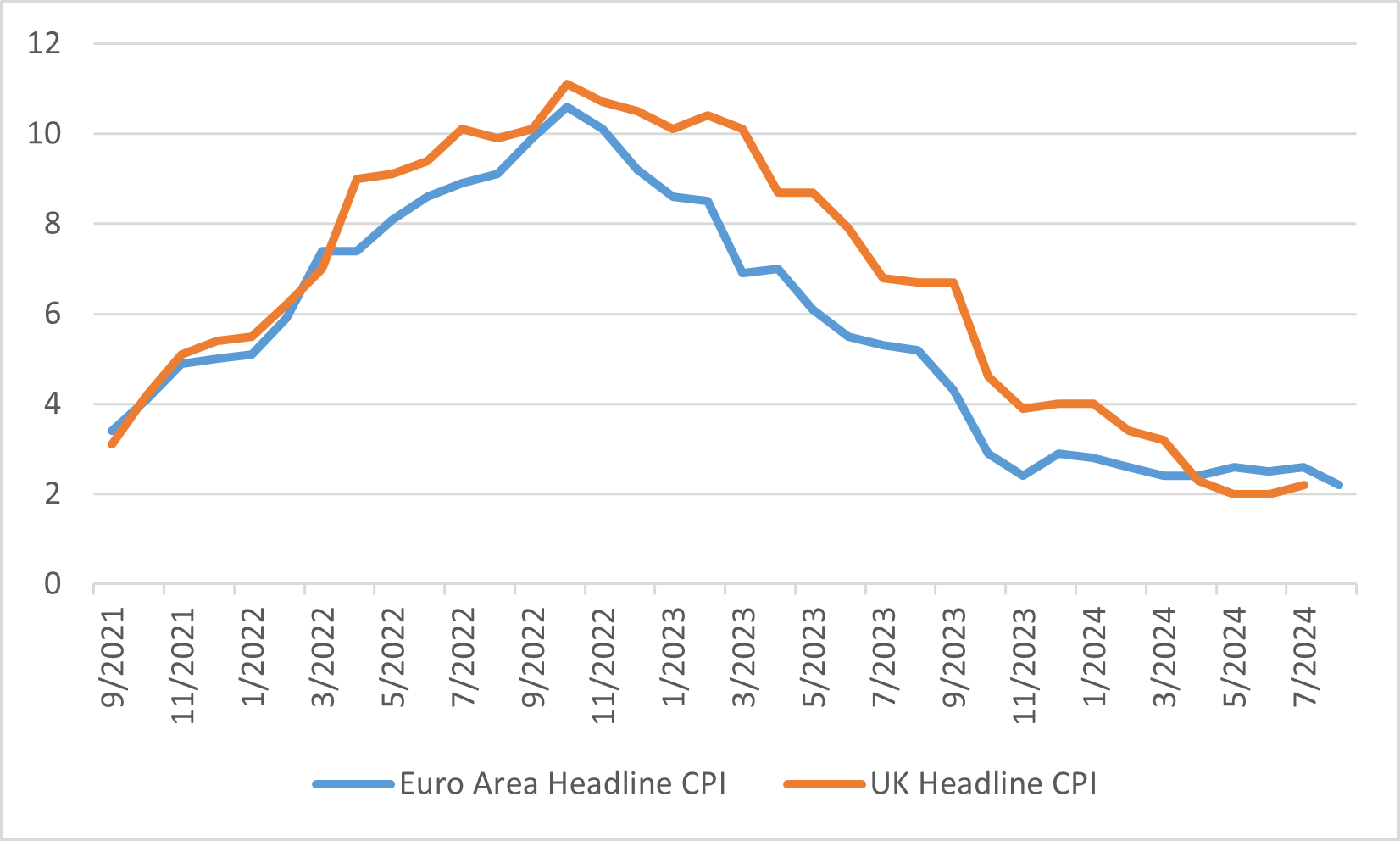

The inflation picture in Europe was mixed, with Eurozone inflation falling to 2.2%, but the UK saw inflation increase to the same level. Despite these concerns, the broader outlook was bolstered by resilient domestic demand, especially in the UK, which recorded the fastest growth among G7 economies in the first half of 2024. Investors were cautiously optimistic as central banks remained dovish, and global geopolitical tensions, such as the conflicts in Ukraine and the Middle East, were closely monitored. In general, August highlighted the delicate balance between inflation concerns and hopes for a more accommodative monetary policy.

Euro Area and UK CPI