Monthly Market Outlook – Oct 2024

18th November, 2024

U.S.

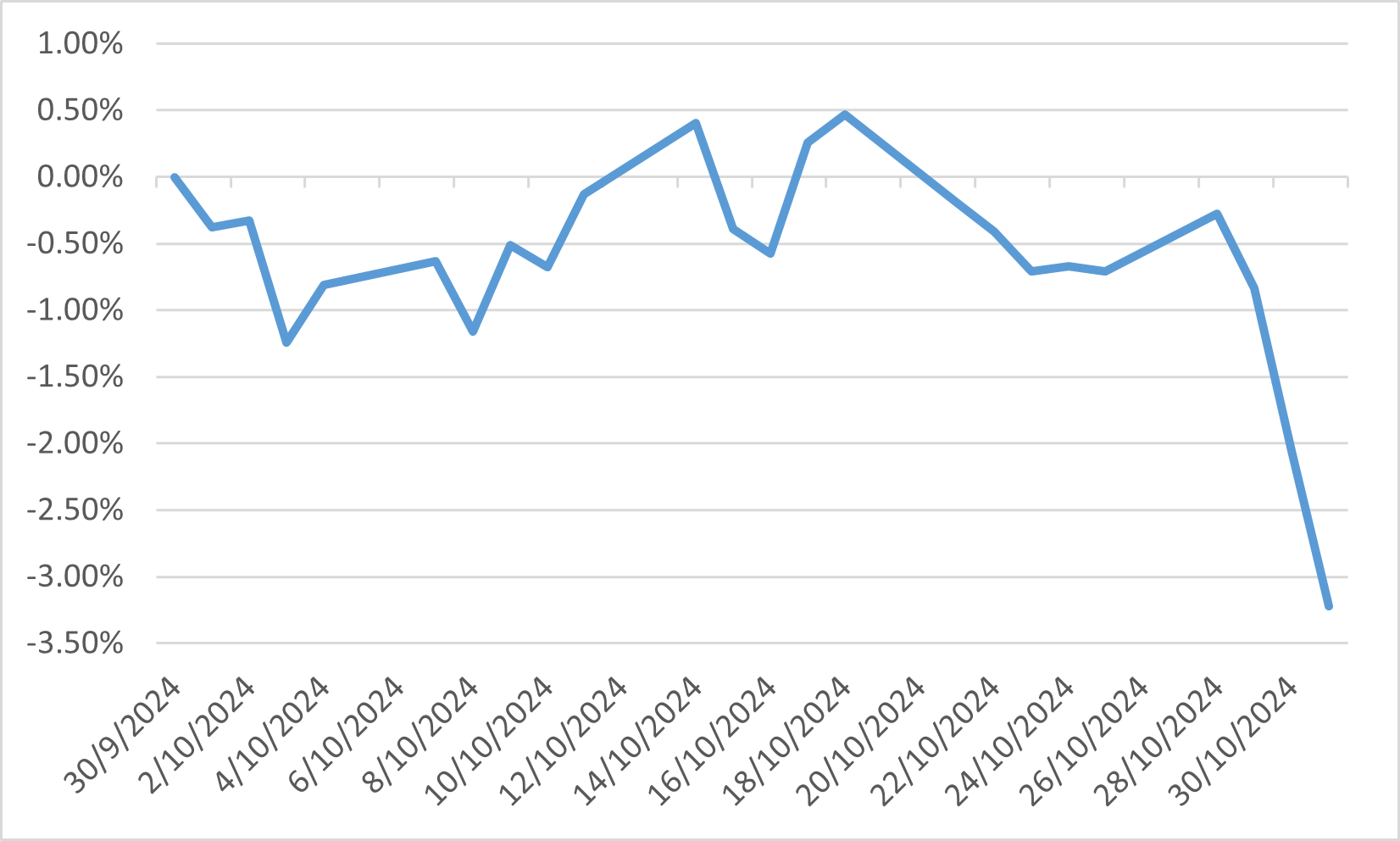

In October 2024, U.S. equity markets experienced notable volatility, with major indices ending the month in negative territory. The S&P 500 declined by approximately 1%, the Dow Jones Industrial Average by 1.3%, and the Nasdaq Composite by 0.5%. This downturn marked the end of a five-month streak of consecutive gains. The early part of the month saw a pullback in equities, primarily due to better-than-expected economic data that drove interest rates higher, altering market narratives and contributing to the decline.

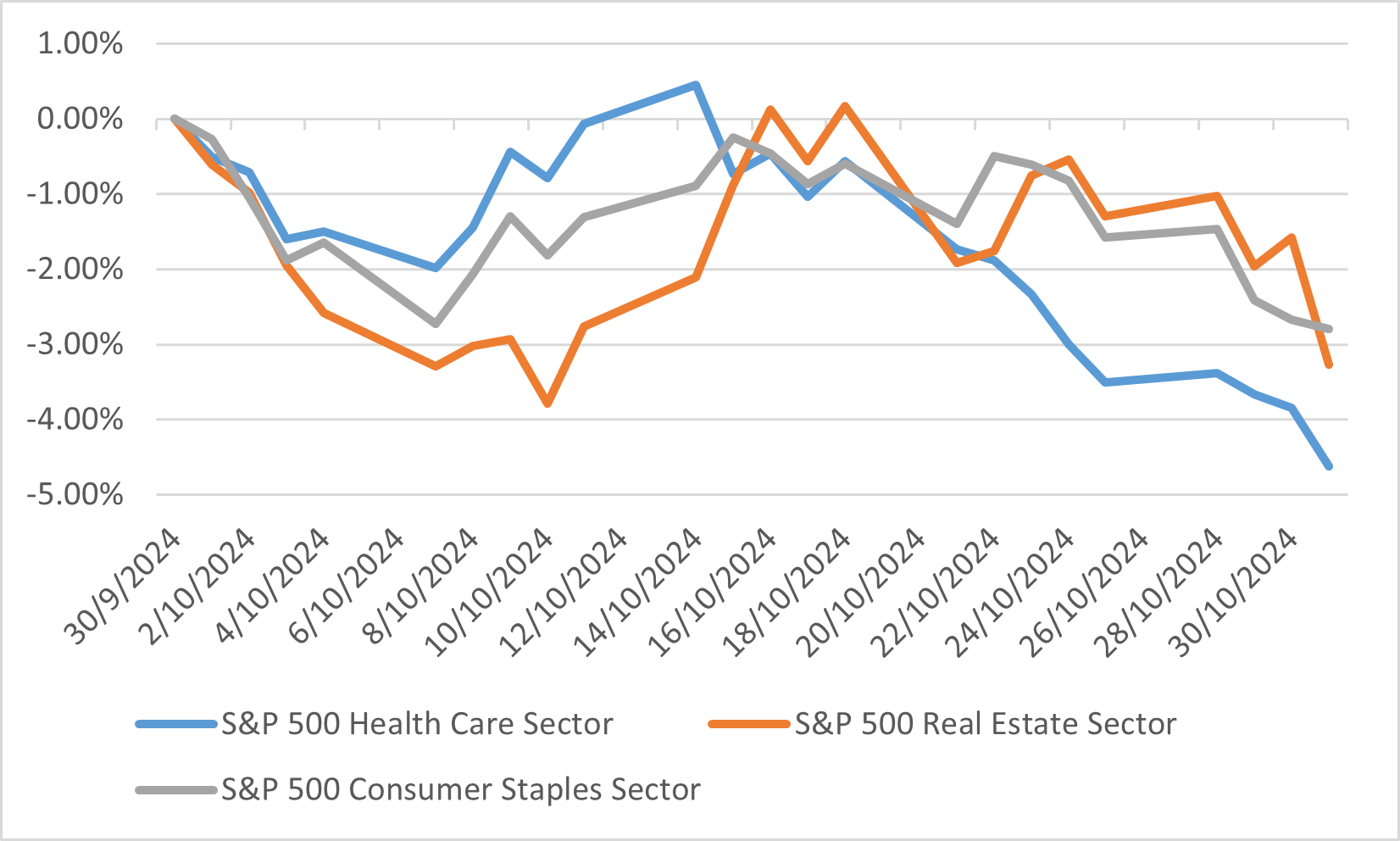

Despite the overall decline, certain sectors demonstrated resilience. The Financials, Communication Services, and Energy sectors posted positive returns for the month. Conversely, the Health Care sector was the worst performer, losing 4.6%, followed by Real Estate and Consumer Staples, which declined by 3.3% and 2.8%, respectively. The underperformance in these sectors was influenced by factors such as slowing home sales, rising mortgage rates, and sector-specific challenges.

Looking ahead, analysts anticipate continued volatility in U.S. equity markets, influenced by factors such as upcoming earnings reports, economic data releases, and potential policy changes. Investors are particularly focused on key earnings reports from major retailers and tech companies, as well as economic indicators like inflation measures and housing statistics. The Federal Reserve's preferred inflation gauge, the core PCE price index, is expected to show a 2.8% annual increase, highlighting ongoing inflationary pressures. These developments will be crucial in shaping market sentiment and guiding investment strategies in the coming months.

S&P 500 worst performer in October

Japan

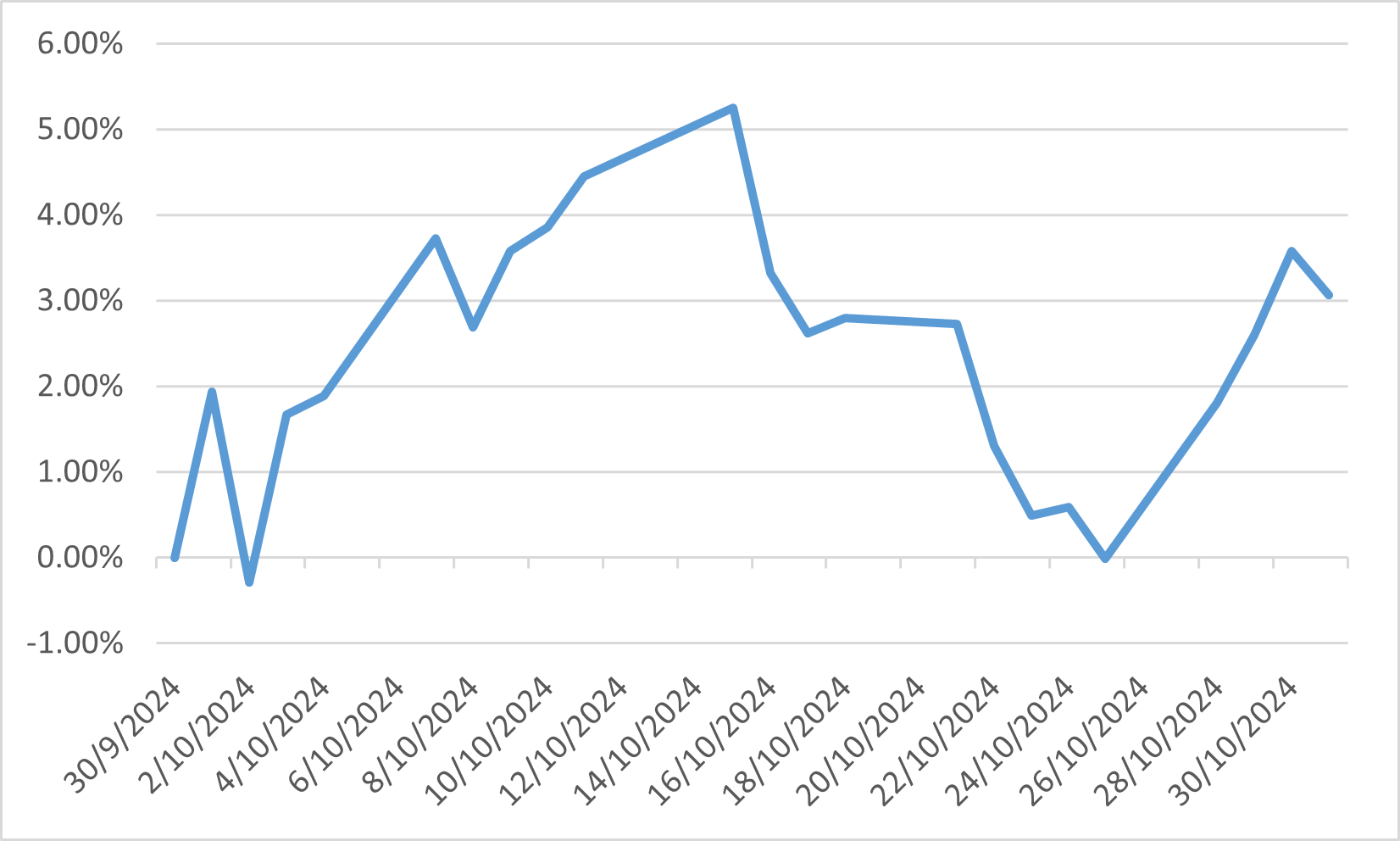

In October 2024, the Japanese equity market exhibited notable volatility, influenced by political developments and currency fluctuations. The Nikkei 225 index experienced a significant rally, closing up 1.82% on October 28, following the general election where Prime Minister Shigeru Ishiba's coalition lost its parliamentary majority. This political shift led to a depreciation of the yen, which reached a three-month low, benefiting export-oriented sectors by enhancing the competitiveness of Japanese goods abroad. Sectors such as transport equipment and chip-testing equipment saw substantial gains during this period.

Despite the initial rally, concerns about political instability and its potential impact on economic policies introduced caution among investors. The loss of the majority by the Liberal Democratic Party and its junior partner Komeito raised uncertainties regarding future fiscal and monetary policies, including the Bank of Japan's stance on interest rates. This uncertainty contributed to fluctuations in bond yields, with the 10-year Japanese government bond yield increasing, reflecting investor apprehension.

Looking ahead, analysts anticipate that the Japanese equity market will continue to be influenced by both domestic political developments and global economic conditions. The yen's depreciation is expected to support exporters, potentially boosting corporate earnings in the near term. However, sustained political uncertainty may pose risks to market stability. Investors are closely monitoring the government's policy responses and the Bank of Japan's monetary policy decisions, as these will play crucial roles in shaping the market's trajectory in the coming months.

Nikkei 225 Index in October

China

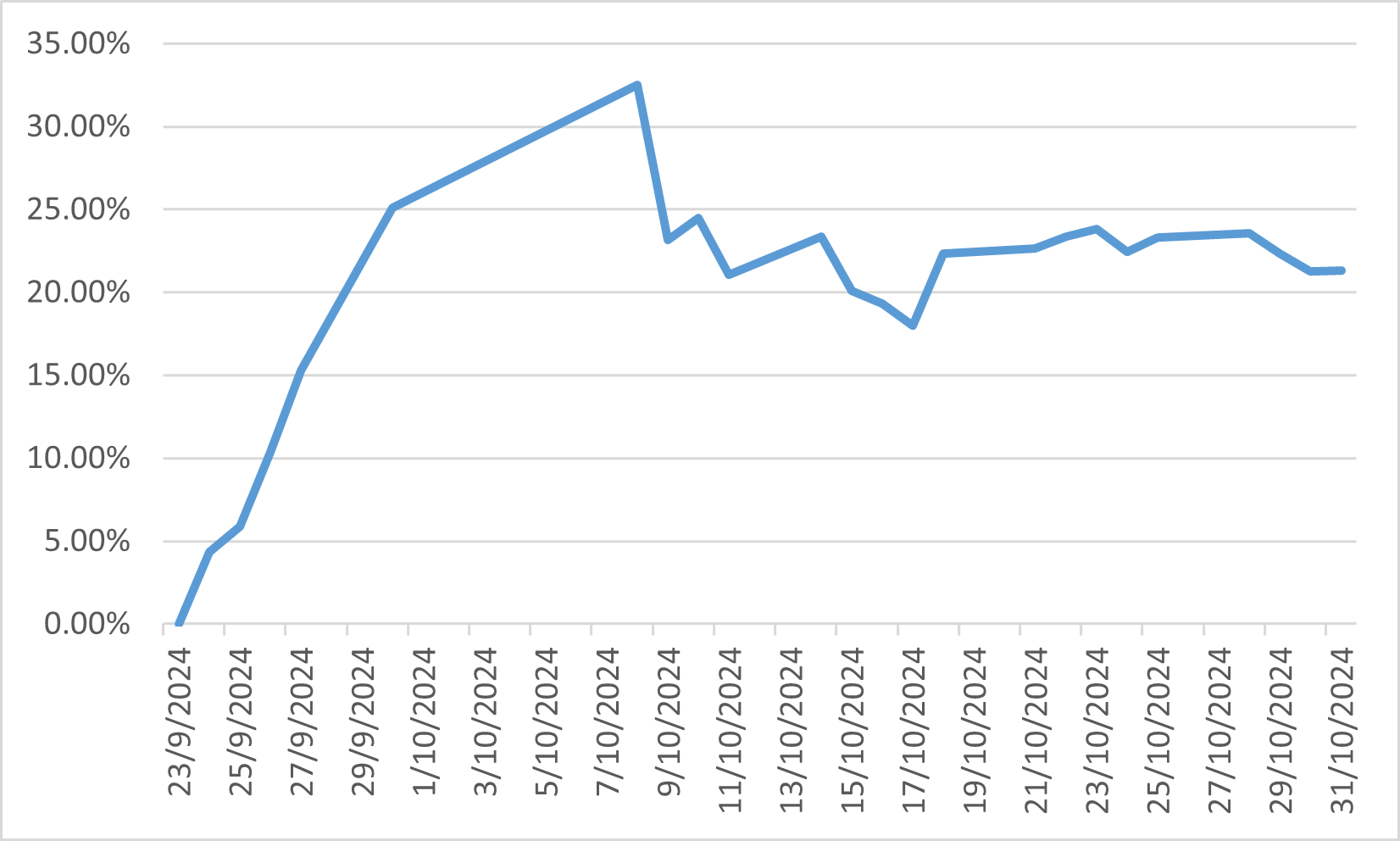

In October 2024, the Chinese equity market experienced significant volatility, influenced by a combination of government stimulus measures and investor sentiment. At the end of last month, the market responded positively to the Chinese government's announcement of a comprehensive stimulus package aimed at revitalizing the economy. This package included debt swaps, borrowing rate cuts, facilitation of property purchases, and corporate buybacks. The market's response to these measures was notably strong. The CSI 300 index demonstrated remarkable performance, with a nearly 30% surge at the end of September following the announcement, followed by an additional 6% increase on the first trading day of October. These substantial gains reflected strong investor optimism regarding the potential impact of the stimulus measures on the Chinese economy.

Despite the initial surge, the market faced challenges as the month progressed. Foreign investors withdrew from emerging market stocks, leading to the largest outflow since early 2020. Chinese equities alone lost $9 billion, indicating persistent concerns about the effectiveness of the stimulus measures and the overall health of the economy. Additionally, the housing crisis and regulatory actions affecting major tech companies like Alibaba and Tencent continued to weigh on investor confidence.

Looking ahead, we suggest that while the stimulus measures have provided a temporary boost, sustained recovery in the Chinese equity market will depend on the successful implementation of these policies and improvements in economic fundamentals. The market's current undervaluation presents potential investment opportunities, particularly in sectors such as technology and consumer goods. However, investors remain cautious, closely monitoring the government's policy actions and their impact on the broader economy.

CSI 300 Index performance after Chinese government announces stimulus package

Euro

In October 2024, European equity markets faced notable challenges, with the Stoxx Europe 600 index declining by 3.2% for the month. This downturn was primarily driven by concerns over economic growth and political uncertainties within key EU nations, notably France and Germany. Investors expressed frustration over the perceived sluggish response to economic challenges, drawing parallels to the decisive actions taken during the Eurozone debt crisis.

Despite the overall decline, certain sectors exhibited resilience. Active equity funds in Europe experienced positive net sales for the second time in the year, contributing to total inflows alongside active fixed-income funds, which garnered €34.1 billion. This shift indicates a growing investor preference for active management strategies amid market volatility and price anomalies. However, the valuation gap between U.S. and European markets widened, with U.S. markets, particularly the tech sector, outperforming their European counterparts. This disparity underscores the pressing need for Europe to implement effective measures to enhance competitiveness and restore investor confidence.

Stoxx Europe 600 Index in October