Monthly Market Outlook – Nov 2024

23rd December, 2024

U.S.

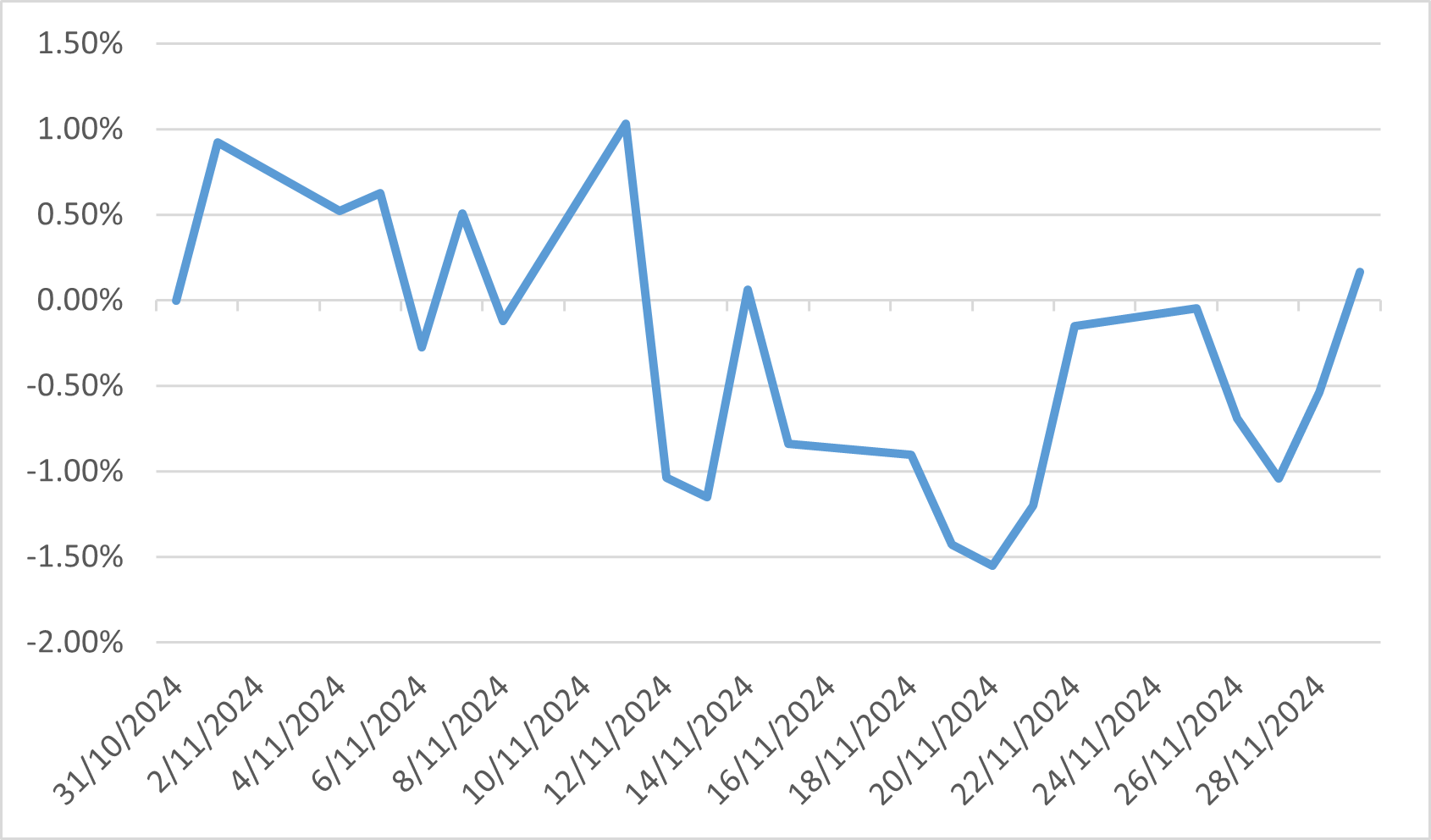

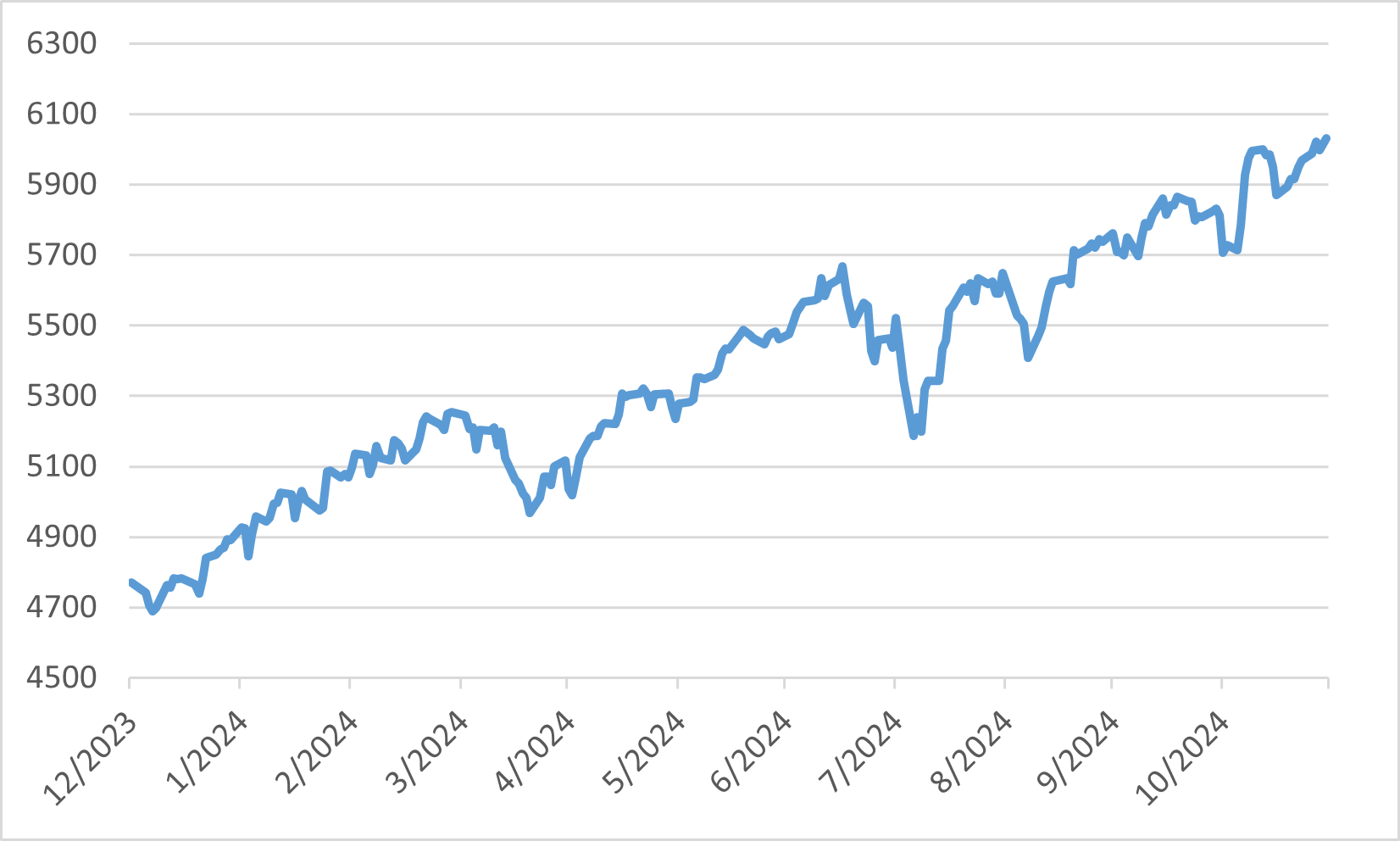

In November 2024, U.S. equity markets experienced a robust rally, driven by the resolution of political uncertainties and optimism surrounding pro-growth policies. The S&P 500 Index achieved multiple all-time highs, crossing the 6,000 threshold for the first time on November 11 and concluding the month with a 5.7% gain. Similarly, the Dow Jones Industrial Average mirrored this performance, each recording four all-time highs during the month. This bullish trend was largely attributed to investor confidence in the incoming administration's economic agenda, which emphasizes tax cuts, deregulation, and substantial infrastructure spending.

Sector performance was broadly positive, with all 11 sectors of the S&P 500 posting gains. The Consumer Discretionary sector led the advance with a 13.24% increase, reflecting heightened consumer spending and confidence. In contrast, the Health Care sector lagged, albeit still recording a modest 0.13% uptick. The Russell 2000 Index, representing small-cap stocks, also reached new all-time highs, surpassing its prior peak from 2021, gaining 11% over the month and indicating a widespread market rally that extended beyond large-cap equities.

Investor sentiment was further bolstered by expectations of expansionary fiscal policies anticipated to stimulate economic growth. The market's belief in a pro-growth agenda contributed to the post-election rally, as political clarity emerged with the election outcome.

S&P 500 in 2024

Japan

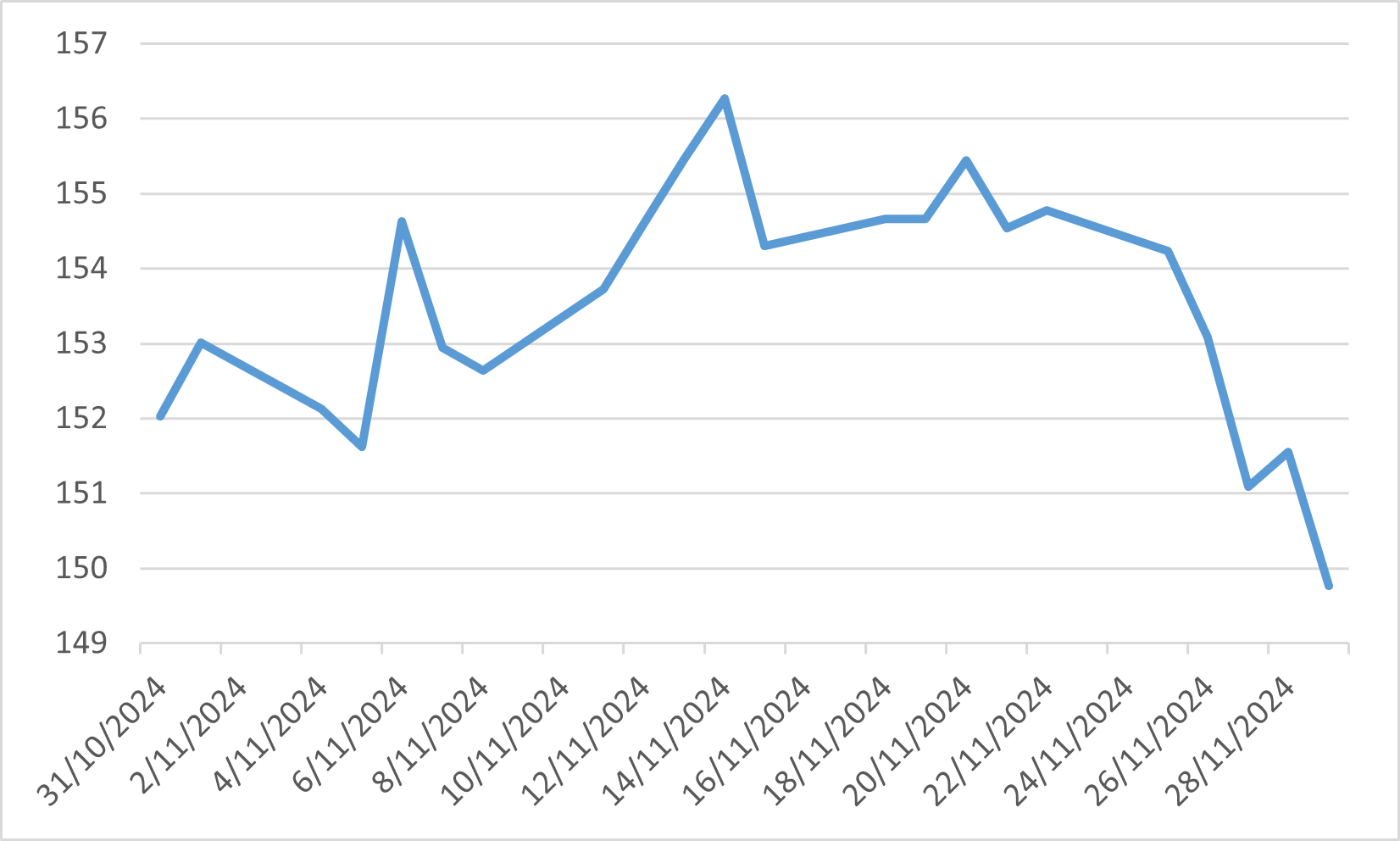

In November 2024, the Japanese equity market exhibited significant volatility, influenced by both domestic and international factors. Early in the month, the market experienced a sharp rise, propelled by a rally in U.S. stocks following President Donald Trump's re-election. This surge was further supported by a depreciation of the yen, which enhanced the competitiveness of Japanese exports. Sectors such as financials and exporters benefited from these developments, reflecting increased investor optimism.

However, as the month progressed, the market's upward momentum was tempered by emerging concerns. Weakness in the Chinese economy, a key trading partner for Japan, raised apprehensions about external demand. Additionally, caution regarding the incoming U.S. administration's policies, particularly the potential implementation of additional tariffs, contributed to market uncertainty. These factors led to a pullback in the Nikkei Stock Average, which declined by 2.23% over the month.

Sector performance was mixed during this period. Industries such as banks, securities, and textiles registered gains, buoyed by favourable currency movements and improved investor sentiment. In contrast, sectors including electric/gas utilities, pharmaceuticals, and transportation equipment faced declines, impacted by concerns over global economic conditions and potential policy shifts. Looking ahead, while domestic consumption and capital investment remain robust, uncertainties surrounding external demand, particularly from China, and the policies of the re-elected U.S. administration are expected to influence market dynamics.

USD/JPY in November

China

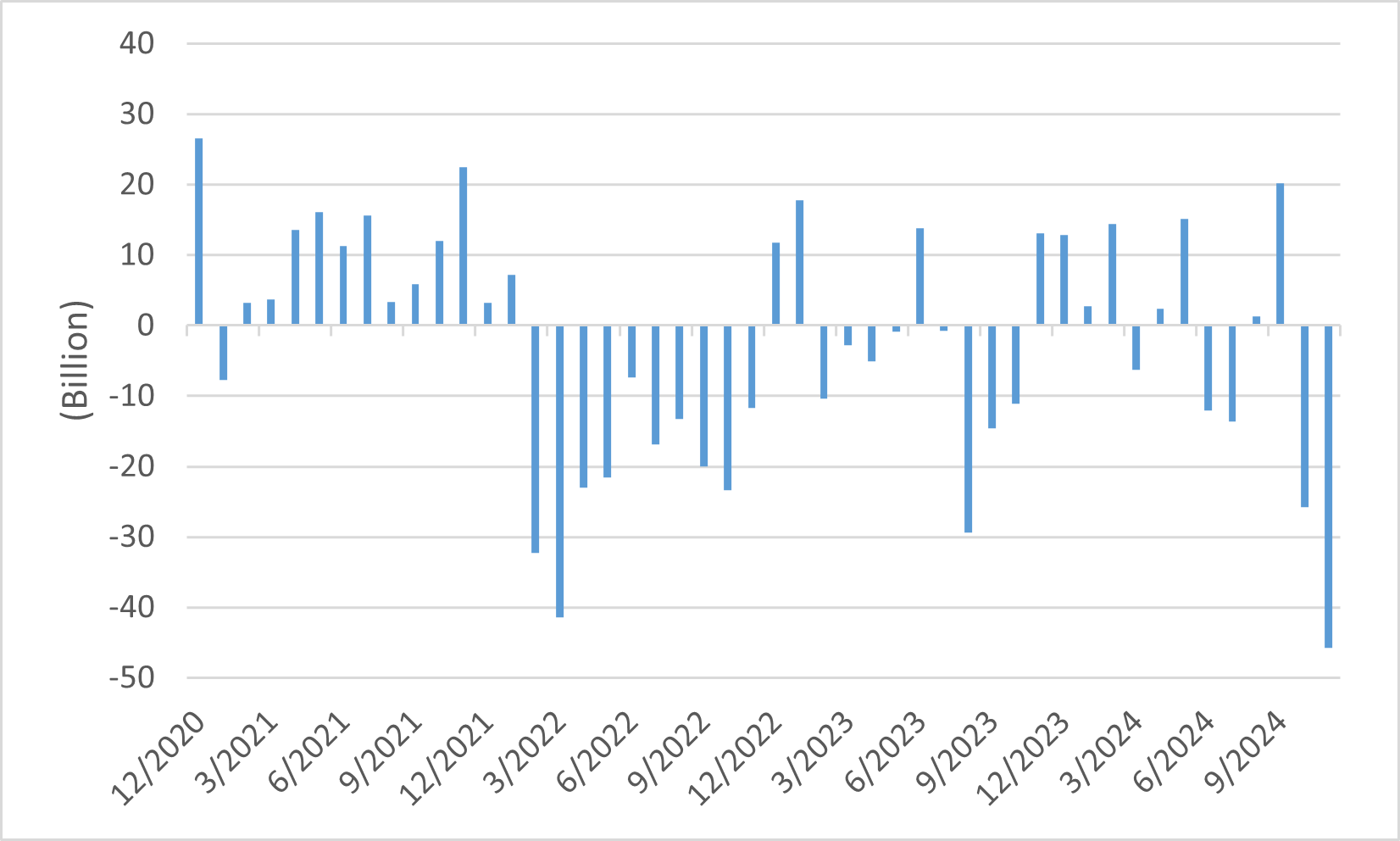

In November 2024, Chinese equity markets continued to struggle, with the MSCI China Index declining by 4.34% for the month, reflecting the impact of both domestic and global challenges. Capital outflows reached a record $45.7 billion, largely attributed to concerns over a slowing economy, persistent deflation, and renewed geopolitical tensions following the re-election of U.S. President Donald Trump. The yuan weakened further, exacerbating investor concerns about China’s economic stability and eroding confidence in domestic financial markets. Beijing’s attempts to stabilize the market, including fiscal and monetary stimulus measures, had limited immediate impact on restoring investor sentiment.

Sector performance in November was mixed. Consumer discretionary and technology stocks saw modest gains, supported by ongoing government investment in innovation and high-tech manufacturing. However, property and financial sectors underperformed due to lingering issues in the real estate market, including liquidity concerns among major developers. Exports also showed signs of slowing, impacted by weak global demand and geopolitical uncertainties, further weighing on equity performance. Despite these challenges, offshore listings in Hong Kong demonstrated resilience, attracting international investor interest.

Additionally, China’s efforts to address its property market crisis included policy adjustments aimed at encouraging home purchases and stimulating demand. Mortgage rates were lowered, and restrictions on second-home purchases were eased. However, these measures had only a limited effect, as consumer confidence remained subdued. Overall, November reflected the deep challenges facing China’s equity markets, with structural reforms and broader economic stabilization needed to regain momentum.

Balance of China cross-border receipts and payment

Euro

In November 2024, European equity markets exhibited mixed performance amid varied economic indicators and geopolitical developments. The Eurozone economy expanded by 0.4% in the third quarter, marking the fastest pace in two years, with Germany avoiding recession and France and Spain showing stronger-than-expected gains. However, Italy's growth stalled, highlighting regional disparities. Year-on-year, the Eurozone's GDP grew by 0.9%.

Despite this economic growth, investor sentiment was tempered by concerns over potential U.S. trade tariffs and political uncertainties, particularly in France following its elections in July. These factors contributed to more modest gains in European markets compared to the robust performance observed in U.S. equities during the same period.

Additionally, the European Central Bank's Financial Stability Review highlighted persistent fiscal challenges in several Euro area countries, exacerbated by structural issues such as weak potential growth and heightened policy uncertainty. These underlying vulnerabilities added to investor caution, influencing market dynamics throughout the month.

MSCI Europe ex UK Index in November