Monthly Market Outlook – Dec 2024

20th January, 2025

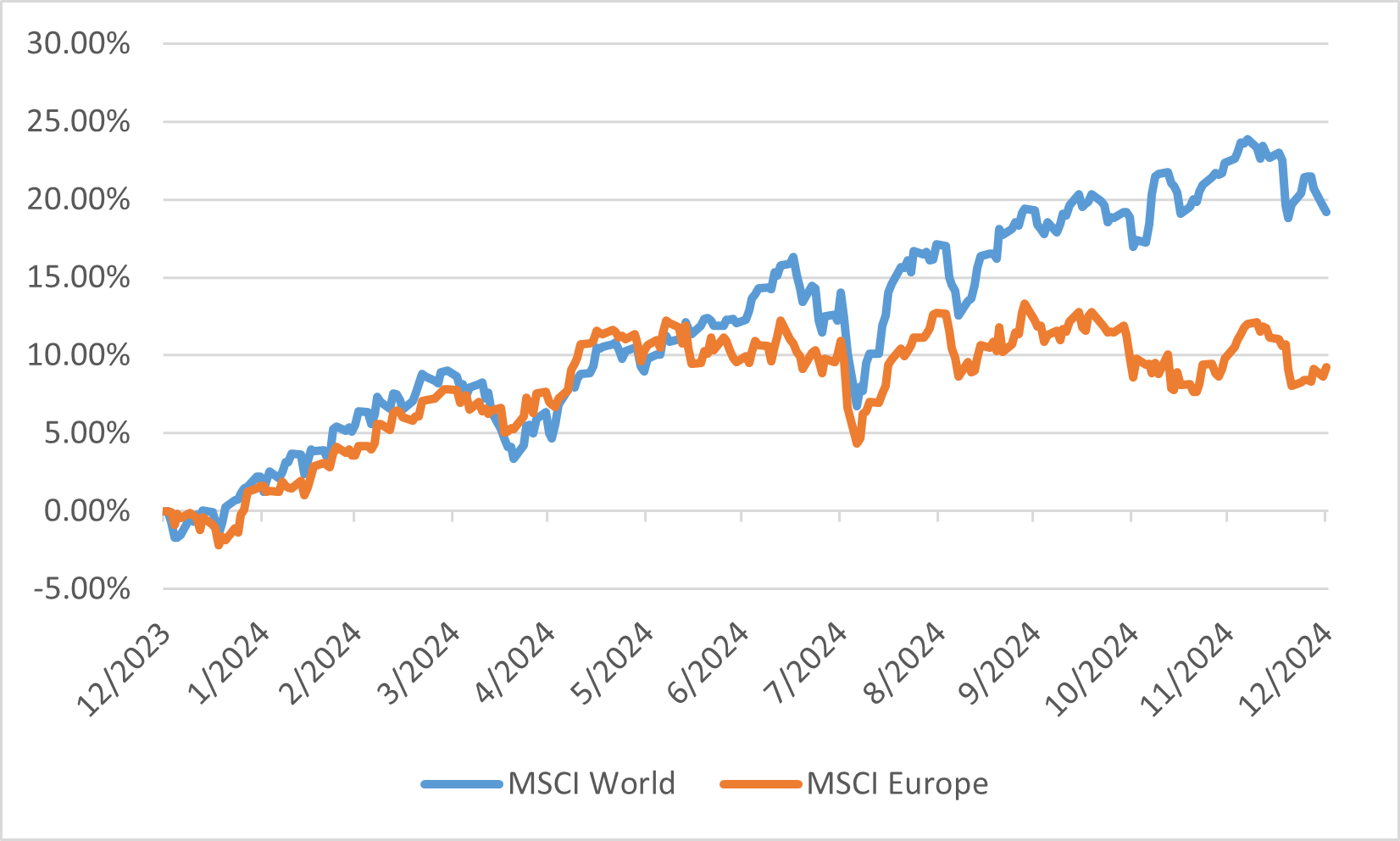

U.S.

In December 2024, U.S. equity markets experienced a modest pullback, with the S&P 500 declining by 2.50% for the month. Despite this dip, the index concluded the year with a robust annual gain of 23.31%. The Dow Jones Industrial Average also faced a monthly decrease of 5.27%, yet achieved a 12.88% increase over the year. Mid-cap stocks, represented by the S&P MidCap 400, saw a 7.29% decline in December, bringing their annual return to 12.20%.

Several factors, including profit-taking after a strong year and concerns over potential interest rate adjustments, influenced the downturn in December. Notably, only three out of eleven equity sectors posted gains during the month. Mega-cap technology stocks demonstrated resilience, continuing their upward trajectory, while small-cap stocks were more adversely affected. The Russell 2000 Index, which tracks small-cap companies, dropped 8.4% in December, reflecting their heightened sensitivity to interest rate fluctuations compared to larger firms.

Despite the December decline, the overall performance of U.S. equities in 2024 was strong. The S&P 500 reached multiple milestones, closing above the 6,000 mark for the first time on November 11, 2024. This achievement was part of a broader trend that saw the index setting new records throughout the year, culminating in an all-time high closing of 6,090.27 on December 6, 2024. Solid corporate earnings, a resilient economy, and investor optimism regarding fiscal policies supported these gains. However, the December retreat served as a reminder of the market's susceptibility to policy changes and economic indicators, underscoring the importance of diversification and risk management in investment strategies.

US Indices Performance in 2024

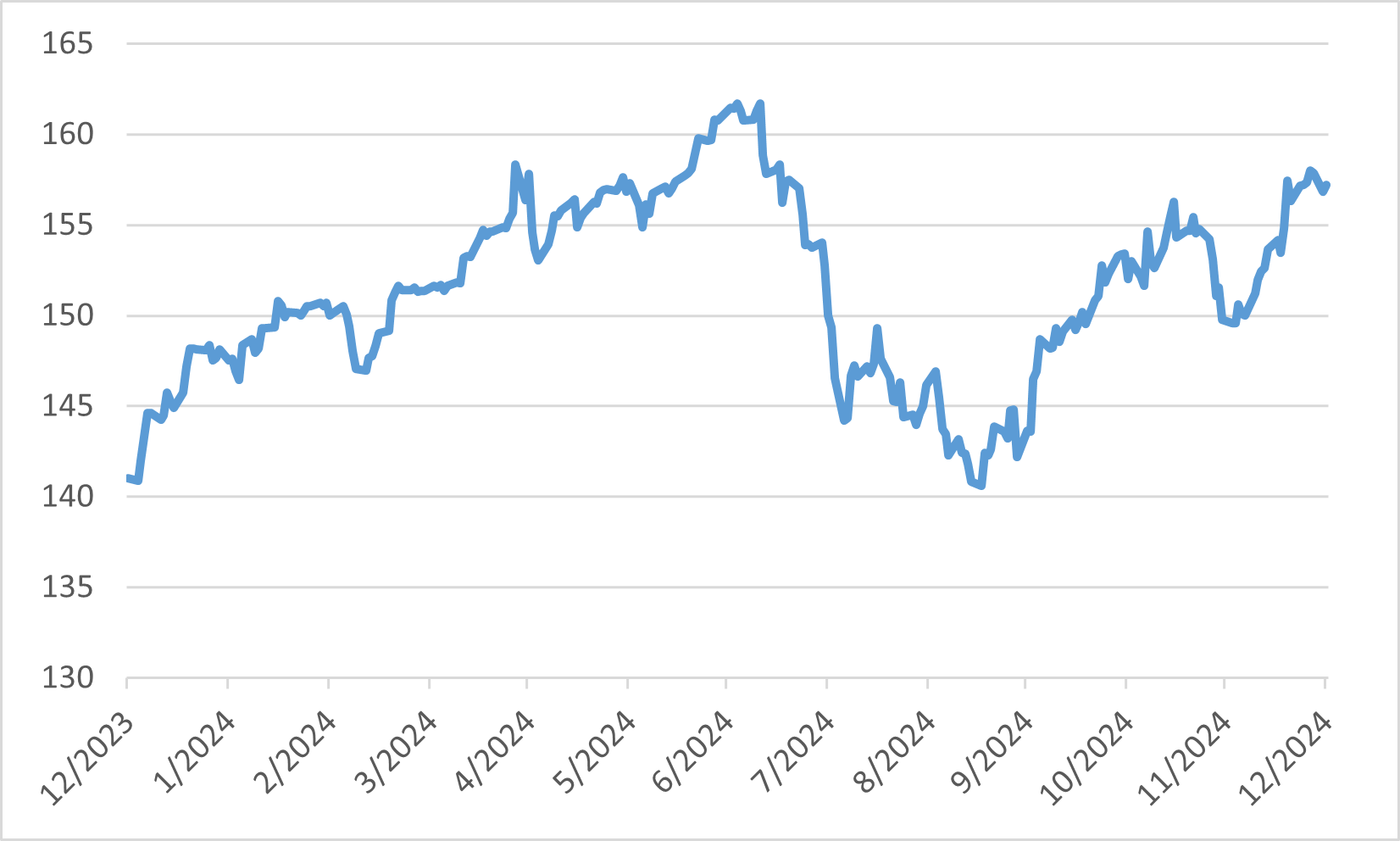

Japan

In December 2024, the Japanese equity market demonstrated notable strength, with the Nikkei Stock Average rising by 4.41%. This upward movement was largely attributed to a weaker yen, which bolstered expectations for improved performance among export-oriented companies. Additionally, reports of management integration talks among major industry players in the transportation equipment sector contributed to a sharp rise in this segment.

Throughout the month, the market experienced fluctuations influenced by uncertainties surrounding monetary policies in the U.S., Japan, and China. Early in the month, financial and infrastructure-related stocks advanced on speculation of a potential interest rate hike by the Bank of Japan and the expansion of AI-related markets. However, as the month progressed, diminishing expectations of a BOJ rate hike and concerns over higher prices due to the weaker yen tempered market gains. Despite these challenges, the transportation equipment sector's strong performance, driven by consolidation talks among industry giants, provided significant support to the market.

Looking at the broader picture, Japanese equities delivered a 21.3% total return over the course of 2024, making them one of the best-performing major equity markets globally. This robust performance was underpinned by continued optimism about the end of deflation, a weak yen enhancing export competitiveness, and ongoing corporate reforms aimed at improving governance and profitability.

USD/JPY in 2024

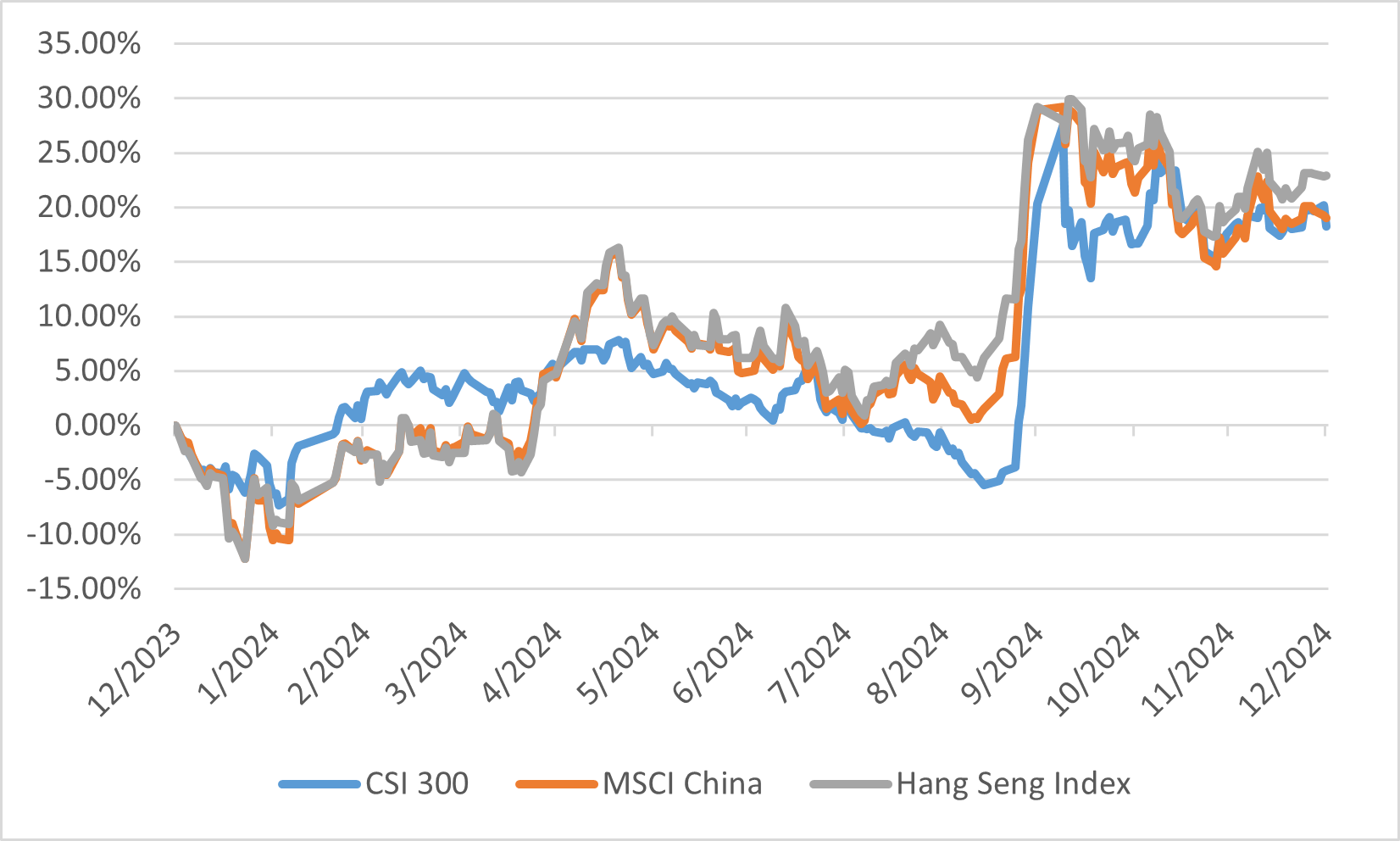

China

In December 2024, Chinese equity markets exhibited a modest recovery, with the Shanghai Composite Index advancing by 0.8% for the month, with an annual return of 12.67%. This uptick was largely attributed to the Chinese government's commitment to implementing "more proactive fiscal policies and moderately loose monetary policies," a stance not adopted since 2011. The Politburo's announcement aimed to stabilize the housing and stock markets, bolstering investor confidence amid a backdrop of economic challenges.

Despite the positive momentum in December, China's economy concluded the year on a subdued note. Data indicated a slowdown in factory activity growth, with the manufacturing sector grappling with weaker domestic and international demand. Consumer spending remained tepid, as retail sales across various sectors declined compared to both the previous month and the prior year. The property market presented a mixed picture; while property sales experienced some growth, home prices continued to decline, adversely affecting consumer confidence. These factors underscored the need for more robust policy interventions to stimulate economic activity and restore market confidence.

In the realm of initial public offerings (IPOs), the Chinese market faced a downturn in 2024. The A-share market witnessed a significant reduction in IPO activity, with total funds raised amounting to RMB 119.1 billion, representing a decrease of approximately 70% compared to 2023. The number of completed IPOs also declined by about 60%, totalling 125 for the year. This contraction was influenced by a combination of stringent regulatory measures and a cautious investor climate. However, looking ahead to 2025, there is cautious optimism for a revival in IPO activity, driven by government support for technology and innovation sectors, as well as initiatives aimed at enhancing the quality of listed companies.

China Indices Performance in 2024

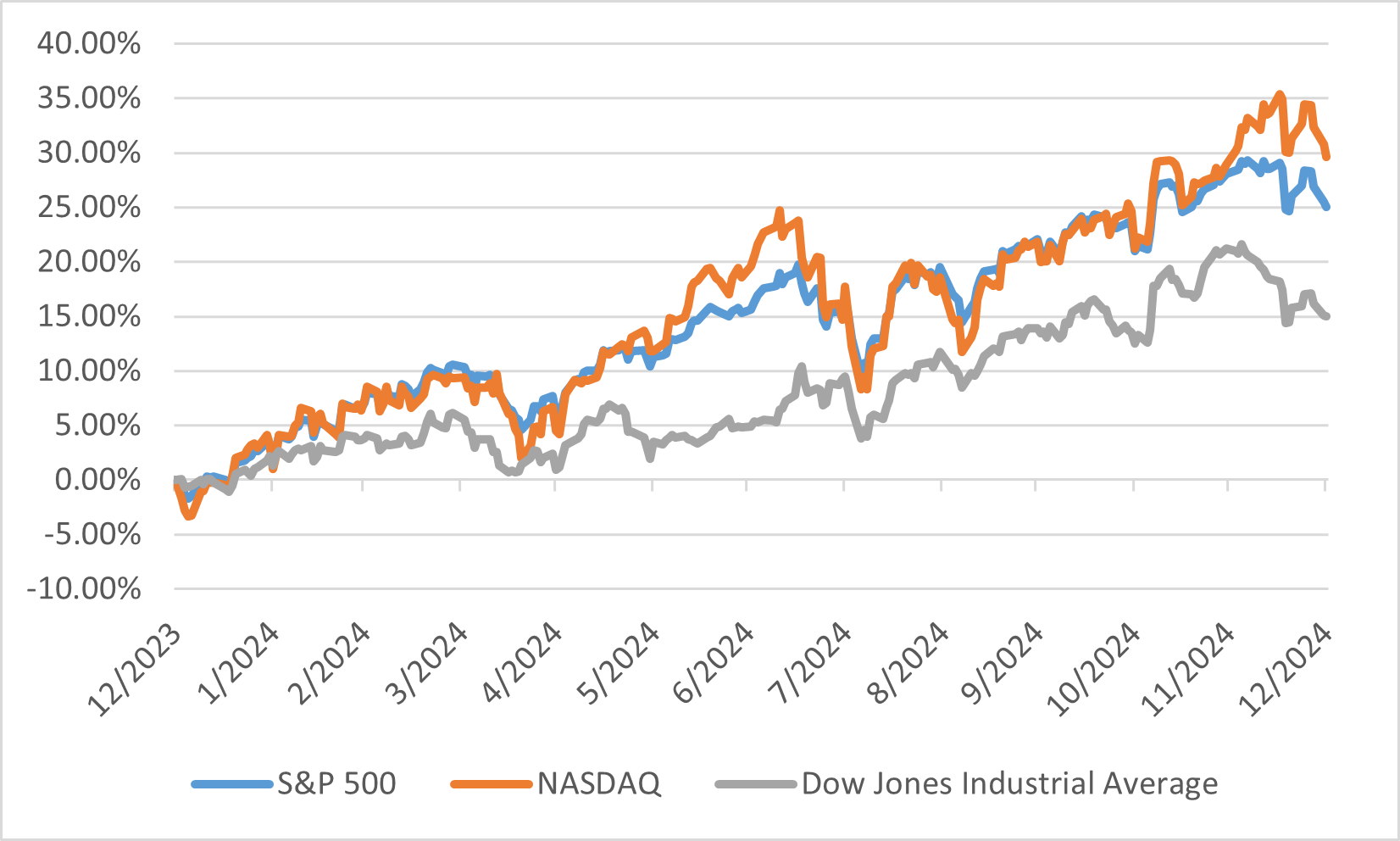

Euro

In December 2024, European equity markets experienced a mild sell-off, concluding a year of overall strong performance. The MSCI Europe Index, which represents large and mid-cap companies across 15 developed European markets, delivered a 9.3% total return for the year. This performance, while positive, lagged behind the global MSCI World Index, which posted a 19.2% total return in USD terms. The underperformance of European equities was partly due to limited exposure to the booming artificial intelligence sector, which significantly boosted markets in other regions.

The United Kingdom's equity market faced particular challenges, with the London Stock Exchange experiencing 18 consecutive months of net listing outflows. Between July 2023 and December 2024, the LSE's main market saw a net reduction of 115 companies, bringing the total number of listed firms below 1,000. This trend raised concerns about the attractiveness of London as a listing venue, especially in comparison to other European markets. In contrast, Euronext, which operates multiple European exchanges, reported higher liquidity and continued to attract and retain listings, suggesting that the issue was more pronounced in the UK than in continental Europe.

MSCI World and Europe Index Performance in 2024