Monthly Market Outlook – Jan 2025

21st February, 2025

U.S.

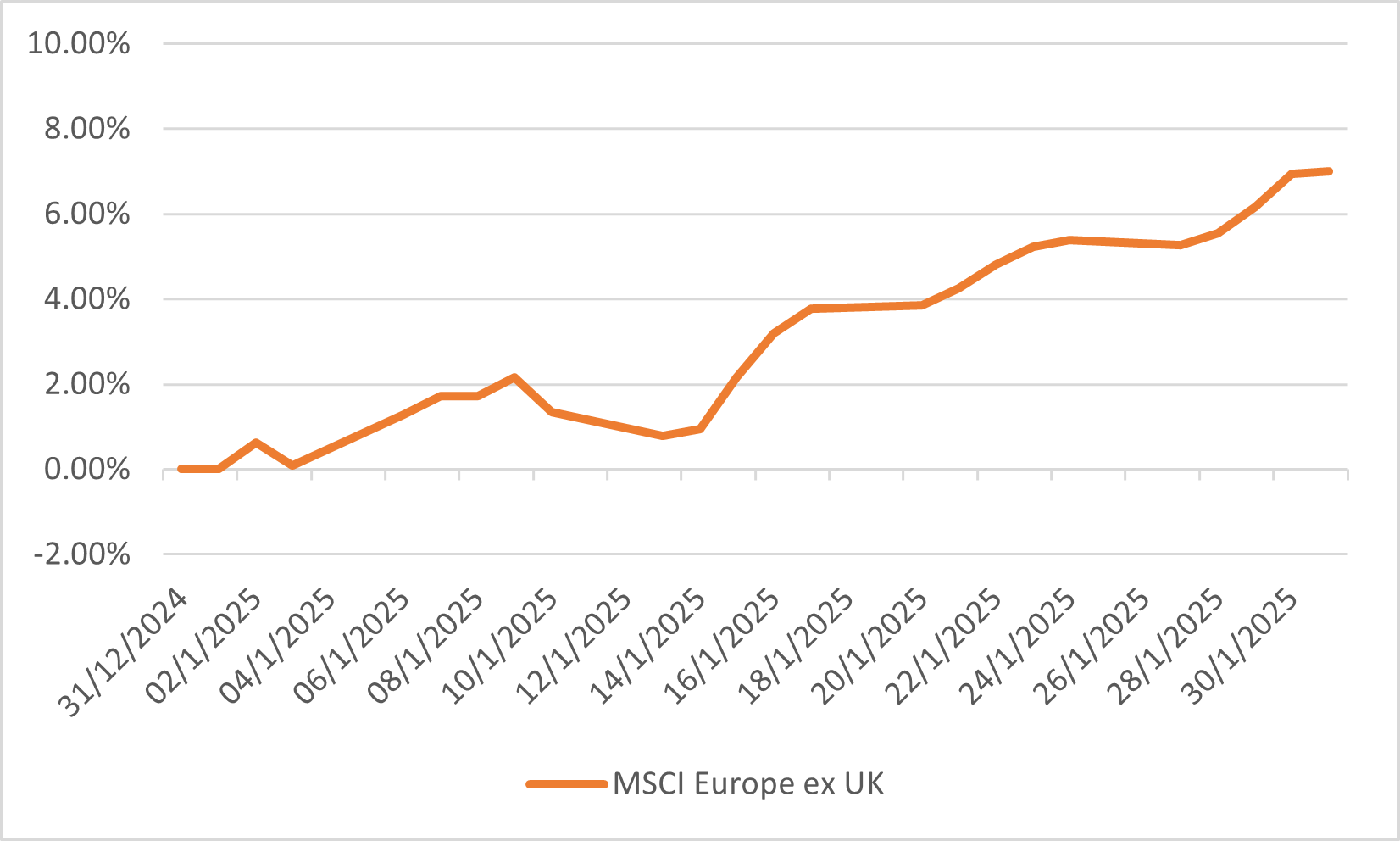

In January 2025, the U.S. equity markets exhibited resilience, with the S&P 500 advancing by approximately 2.8%. This positive performance was underpinned by robust corporate earnings and sustained consumer spending. Notably, mid-and small-cap stocks outperformed their large-cap counterparts, with the S&P MidCap 400 and S&P SmallCap 600 indices rising by 3.9% and 2.9%, respectively. The Dow Jones Industrial Average also demonstrated strength, recording a gain of 4.78% for the month.

However, the month was not without volatility. The release of a new AI model by China's DeepSeek led to a significant, albeit temporary, sell-off in technology stocks, with industry leader NVIDIA experiencing a substantial decline in market value. Additionally, the reintroduction of tariffs by the U.S. administration on imports from Canada, Mexico, and China introduced further market uncertainties. Despite these challenges, the Federal Reserve maintained the federal funds rate within the 4.25%-4.5% range during its January meeting, opting to pause after three consecutive rate cuts in 2024.

Investor sentiment remained cautiously optimistic, buoyed by strong labour market data and a resilient economy. The U.S. economy added 256,000 jobs in December 2024, surpassing expectations, and the unemployment rate edged lower to 4.1%. While inflation ticked up to 2.9% in December 2024, the Federal Reserve signalled a patient approach, emphasizing the need for further progress on inflation before considering additional rate adjustments. Overall, the U.S. equity markets displayed adaptability amid evolving economic indicators and policy developments.

US Indices Performance in January

Japan

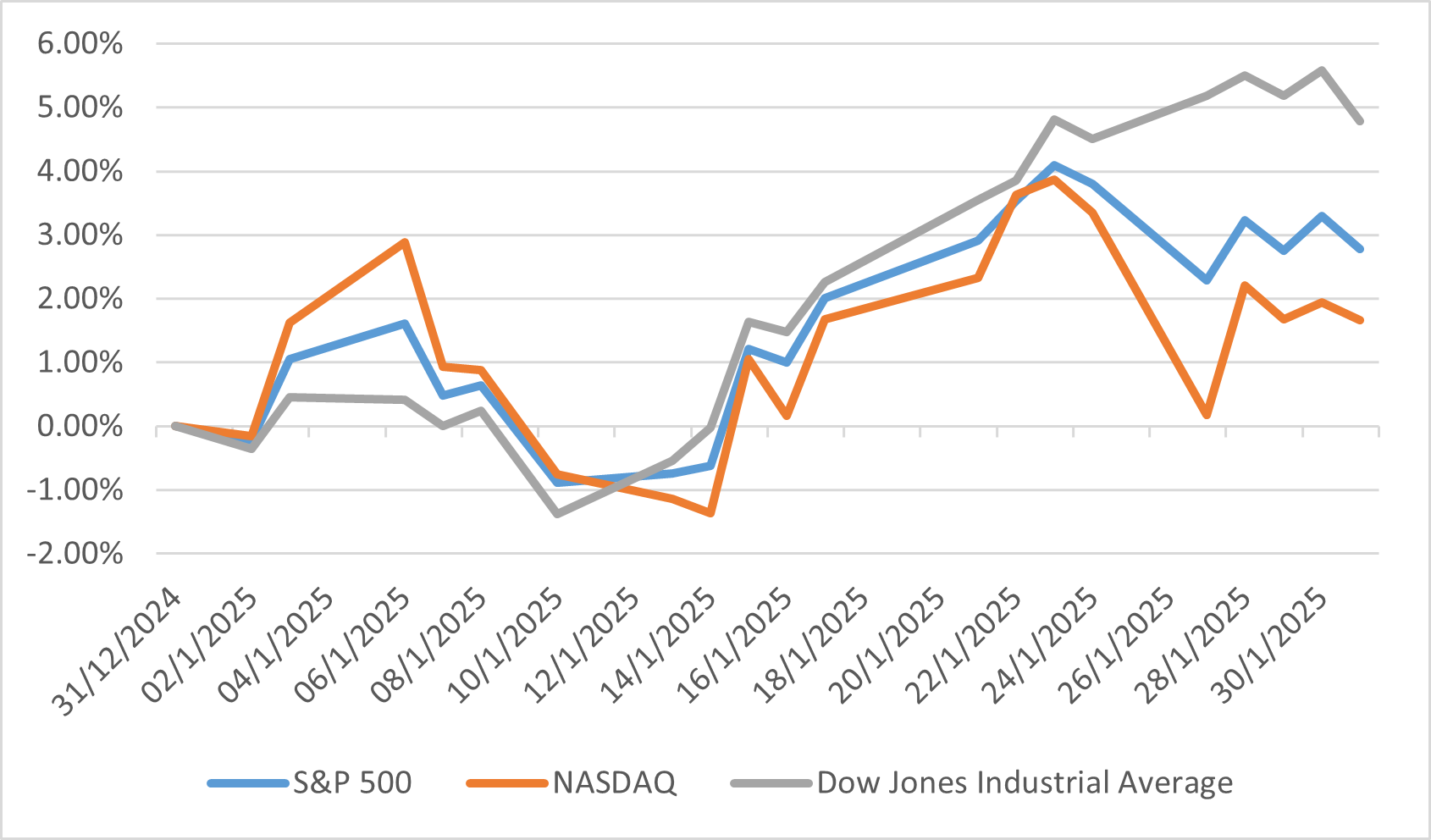

In January 2025, the Japanese equity market experienced modest fluctuations, with the TOPIX index inching up by 0.1% and the Nikkei 225 index declining by 0.8% by month-end. Mid-month, the Nikkei 225 dipped below the 39,000 threshold but subsequently rebounded. This volatility was influenced by several factors, including a 25 basis point interest rate hike by the Bank of Japan, bringing rates to approximately 0.5%, and the Federal Reserve's decision to maintain current rates. Additionally, setbacks in U.S. AI companies contributed to market turbulence. Notably, foreign investors became net buyers of Japanese equities for the first time in three months, despite the yen's appreciation.

Sector-wise, the market displayed varied performance. The insurance sector led gains with a 7.47% increase, followed by securities and commodity futures, other products, banks, and rubber products sectors. Conversely, the real estate sector faced the most significant decline, dropping by 14.71%, with marine transportation, electric power and gas, wholesale trade, and mining sectors also underperforming.

On the monetary policy front, the BoJ's rate hike was a pivotal development, reflecting confidence in stable inflation around the 2% target and ongoing economic recovery. BoJ Governor Kazuo Ueda indicated that further rate increases might be considered if favourable economic conditions persist. This policy shift marks a significant departure from Japan's prolonged ultra-loose monetary stance aimed at combating deflation. The market's response to the rate hike was relatively muted, suggesting investor approval of the central bank's measured approach.

TOPIX and NIkkei Indices Performance in January

China

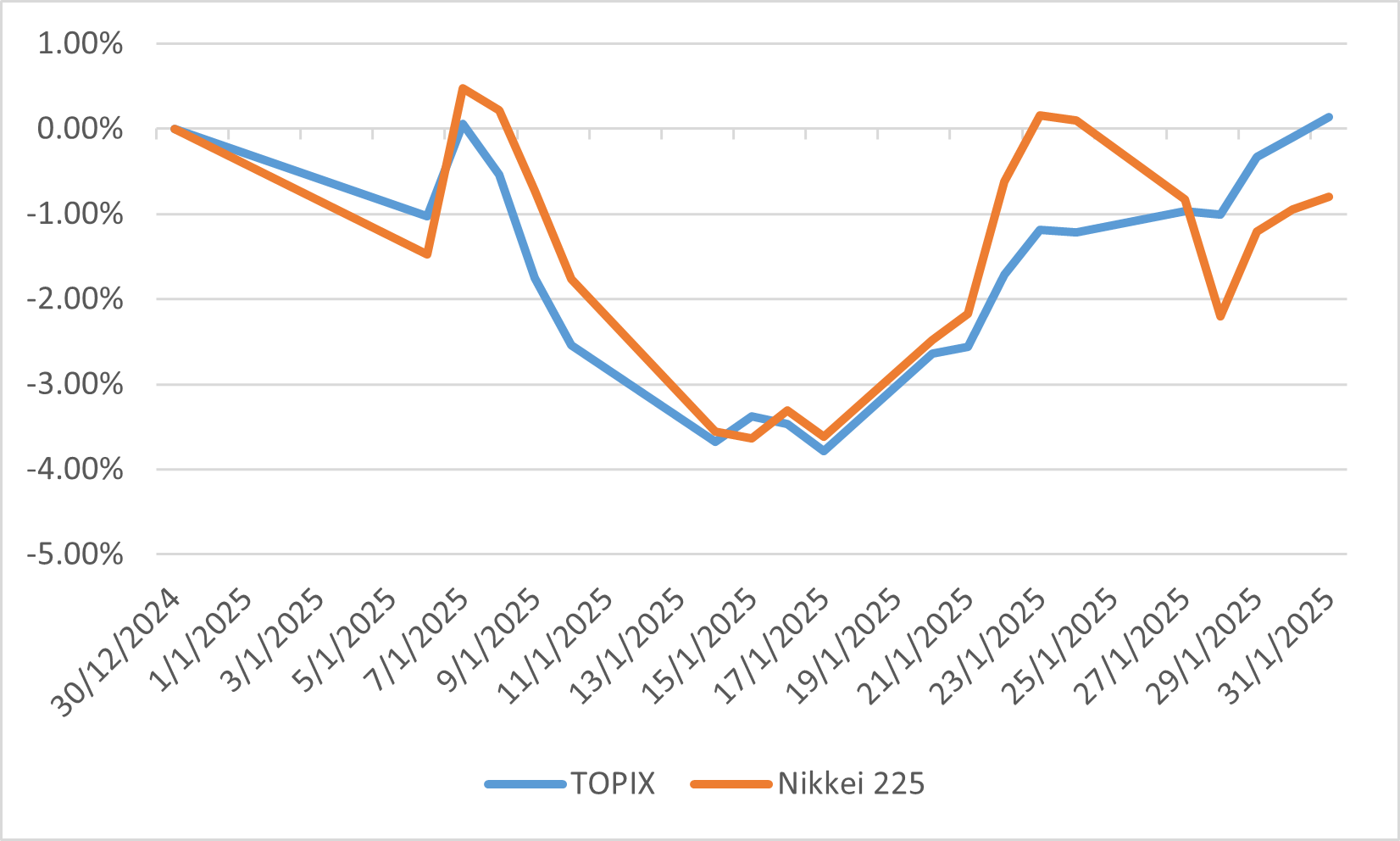

In January 2025, the Chinese equity market experienced modest gains, with the MSCI China Index edging up by approximately 1.3% for the month. This performance was influenced by a combination of domestic policy measures and global economic factors. Notably, the Chinese government implemented stimulus initiatives, including interest rate cuts and support for the property sector, aiming to bolster economic growth and investor confidence. These measures contributed to a positive sentiment among investors, despite ongoing geopolitical tensions and trade uncertainties.

The technology sector emerged as a significant driver of market performance, largely due to advancements in artificial intelligence. The introduction of DeepSeek, a low-cost AI model developed by a Chinese startup, garnered substantial attention and led to a surge in technology stocks. The Hang Seng Tech Index, which tracks major tech companies listed in Hong Kong, recorded a remarkable 12% increase since mid-January. Companies such as Alibaba, Xiaomi, and Lenovo were among the top performers, benefiting from renewed investor interest and confidence in China's technological innovation capabilities.

However, the market faced headwinds from renewed trade tensions, particularly with the United States. In early February, President Donald Trump announced a 10% tariff on Chinese imports, prompting concerns over potential impacts on China's export-driven industries. Despite these challenges, the Chinese market demonstrated resilience, with investors focusing on domestic growth prospects and policy support. The People's Bank of China maintained a stable yuan exchange rate, signalling a commitment to economic stability amid external pressures.

Hang Seng TECH Index Performance in January

Euro

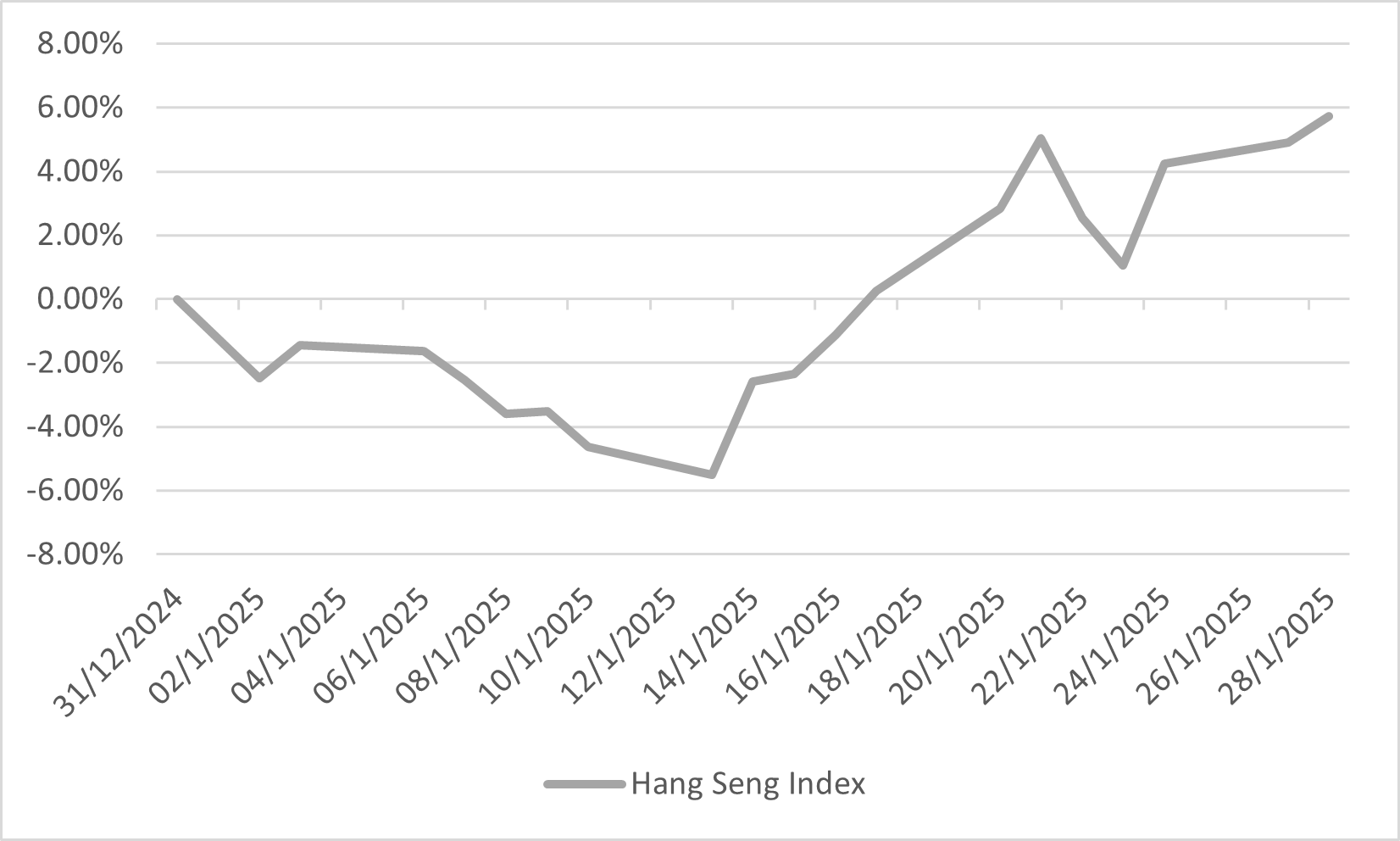

In January 2025, European equity markets experienced a robust performance, with the MSCI Europe ex-UK Index rising by 7% for the month. This surge was primarily driven by the financials and consumer discretionary sectors, buoyed by a solid global economic environment and early signs of improvement in eurozone macroeconomic indicators. Notably, the eurozone composite Purchasing Managers’ Index edged into expansion territory at 50.2 in January, and retail sales increased by 1.6% year-on-year in November, marking the fifth consecutive month of growth. Additionally, the UK's FTSE All-Share Index advanced by 6.2%, supported by a sharp depreciation in sterling, which benefited the predominantly internationally focused UK market.

Investor sentiment towards European equities was notably bullish during this period. A Bank of America Global Research survey highlighted that European stocks saw their second-largest allocation in 25 years, as investors sought to diversify away from U.S. mega-cap technology stocks. This shift was further influenced by geopolitical developments, including the potential easing of tensions in Ukraine, which could lead to reduced energy costs and improved economic stability in the region. Moreover, the emergence of competitive technologies from Chinese firms, such as DeepSeek's advanced AI models, challenged U.S. tech giants, prompting investors to reassess valuations and explore opportunities within the European market.

MSCI Europe ex-UK Index Performance in January