Monthly Market Outlook – Feb 2025

24th March, 2025

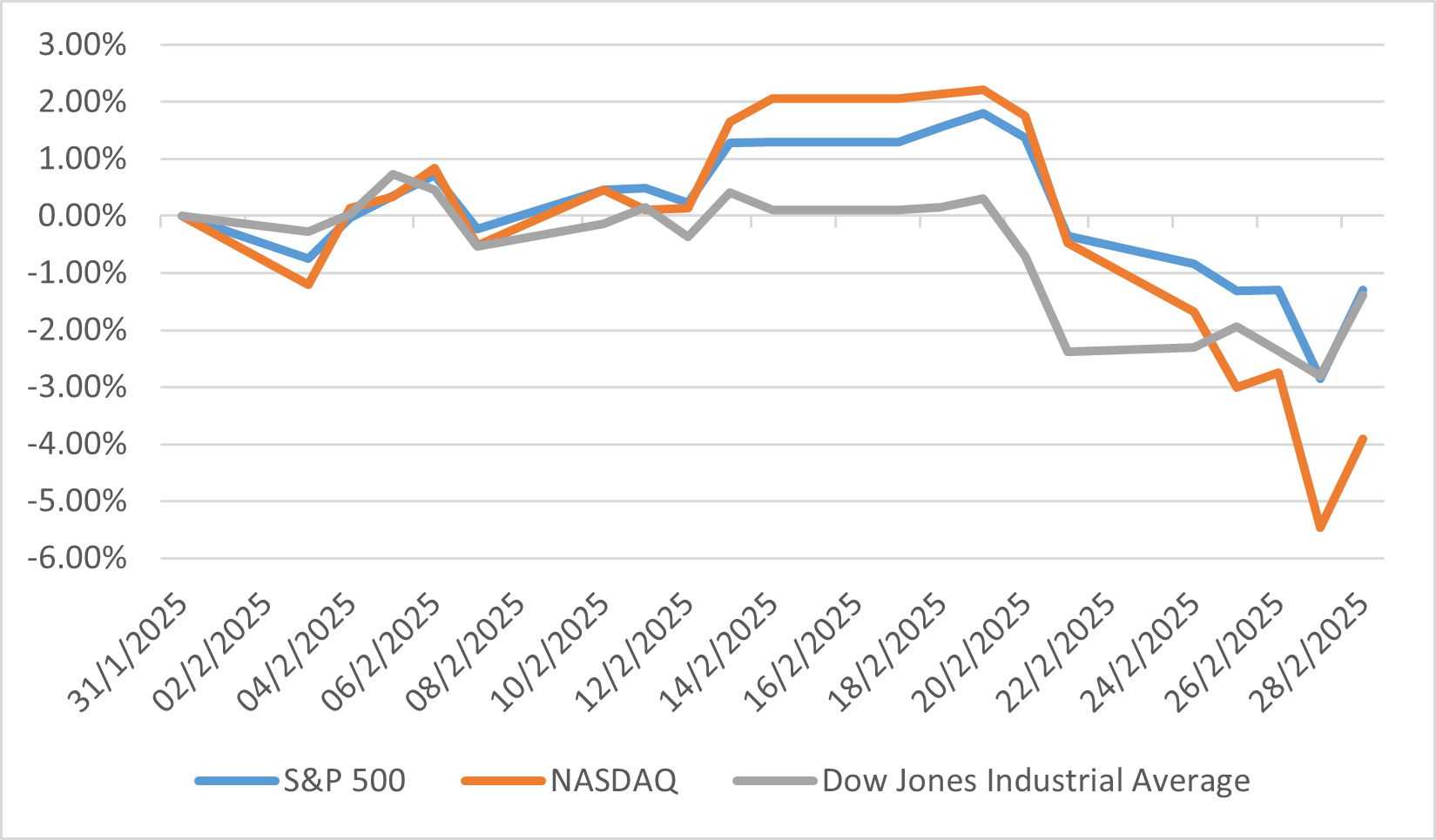

U.S.

In February 2025, the U.S. equity market experienced a broad decline across major indices, reflecting a challenging environment. The S&P 500, a benchmark for large-cap stocks, fell by 1.42% over the month, trimming its year-to-date gain to 1.24%. The Dow Jones Industrial Average saw a slightly steeper drop of 1.58%, though it retained a year-to-date increase of 3.05%. Smaller companies bore the brunt of the downturn, with the S&P MidCap 400 declining 4.44% and the S&P SmallCap 600 dropping 5.84%, resulting in year-to-date losses of 0.83% and 3.16%, respectively. This disparity underscores the heightened sensitivity of smaller firms to economic and policy pressures during the period.

The month was heavily influenced by trade policy shifts, notably the introduction of U.S. tariffs on February 4, imposing 25% on Canadian imports and 10% on Chinese goods. Markets reacted swiftly, with the S&P 500 opening 1.17% lower on February 5 and dipping to a 1.93% intra-day loss before partially recovering after temporary tariff pauses with Canada and Mexico. China’s retaliatory measures, including 15% tariffs on U.S. coal and LNG, added further strain, particularly on trade-exposed sectors. Additionally, an executive order mandating a 90-day plan for a U.S. sovereign wealth fund introduced another layer of complexity, though market responses remained muted, viewing it as part of broader negotiations.

Despite the turbulence, the market exhibited moments of resilience, with the S&P 500 achieving two closing highs early in the month before retreating amid consumer spending concerns. This resilience suggests investors maintained a degree of confidence despite policy uncertainties. The downturn highlighted a market grappling with external pressures, yet still anchored by underlying stability in large-cap segments, as smaller indices faced more pronounced setbacks.

US Indices Performance in February

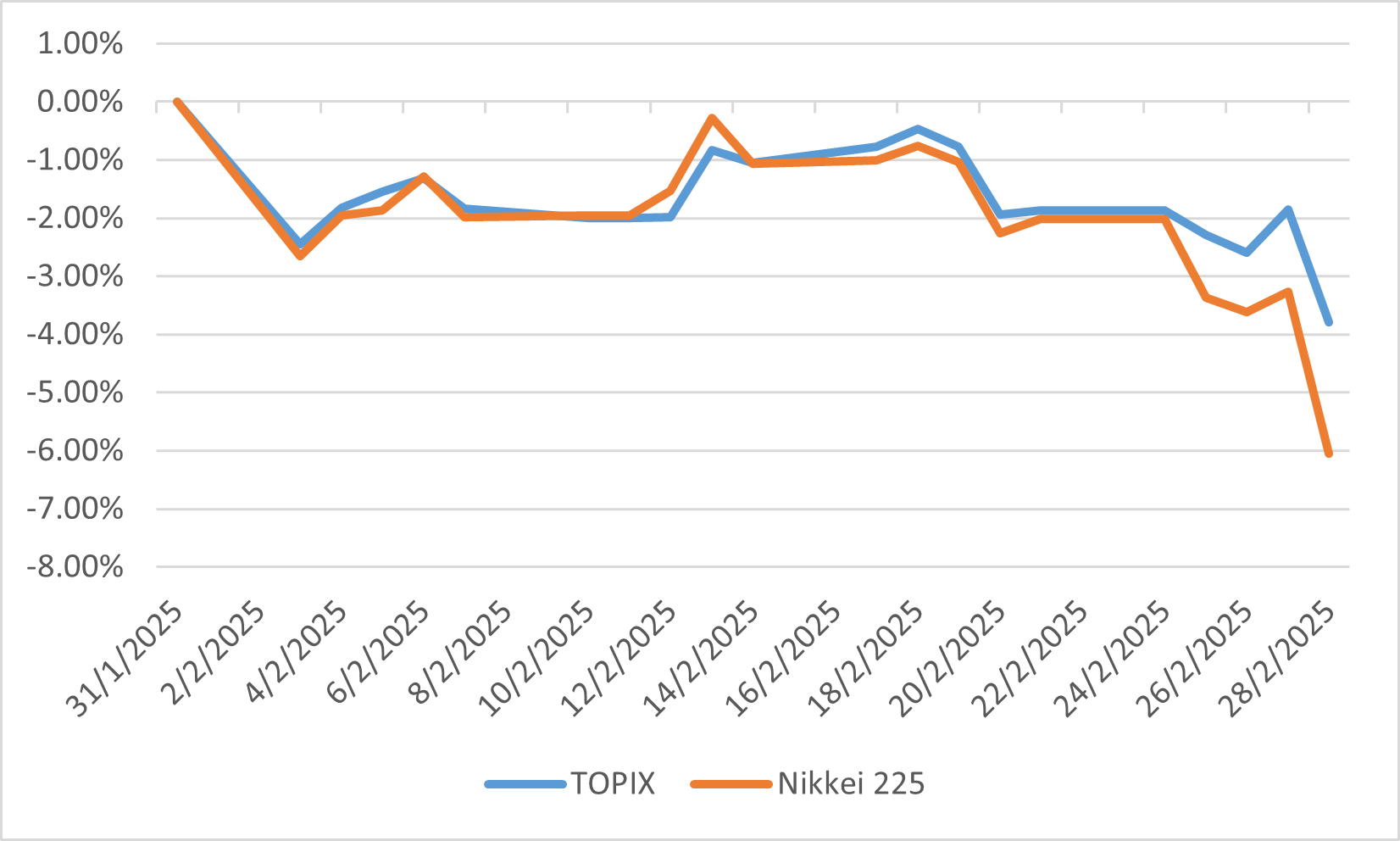

Japan

In February 2025, the Japanese equity market experienced a notable decline, with the TOPIX index falling by 3.82% and the Nikkei 225 index decreasing by 6.11%. This downturn was primarily influenced by a sharp drop in semiconductor-related stocks, which constitute a significant portion of the Nikkei 225. Several factors contributed to market volatility during the month, including ongoing concerns over U.S. President Donald Trump's tariff policies, unsuccessful ceasefire negotiations between Ukraine and Russia, and speculation regarding additional interest rate hikes by the Bank of Japan.

The BoJ's cautious approach to monetary tightening has led market participants to anticipate only one more rate hike in 2025. This expectation has shifted investor focus towards the timing and communication of future rate adjustments. Additionally, Japanese investors adjusted their portfolios in response to global economic uncertainties, increasing their holdings in overseas bonds by a net 3.45 trillion yen, the highest since August 2024, while reducing exposure to foreign equities by 346.4 billion yen.

Despite these challenges, certain sectors demonstrated resilience. Notably, Japanese bank shares attracted significant investor interest, driven by expectations of rising interest rates boosting lending margins and profits. The banking sector index approached an 18-year high, with major institutions like Mitsubishi UFJ Financial Group reaching record stock prices. Furthermore, Japanese trading houses experienced stock surges following Warren Buffett's announcement that Berkshire Hathaway plans to increase its substantial stakes in these companies, reflecting a vote of confidence in their diversified business models and the broader Japanese economy.

TOPIX and NIkkei Indices Performance in February

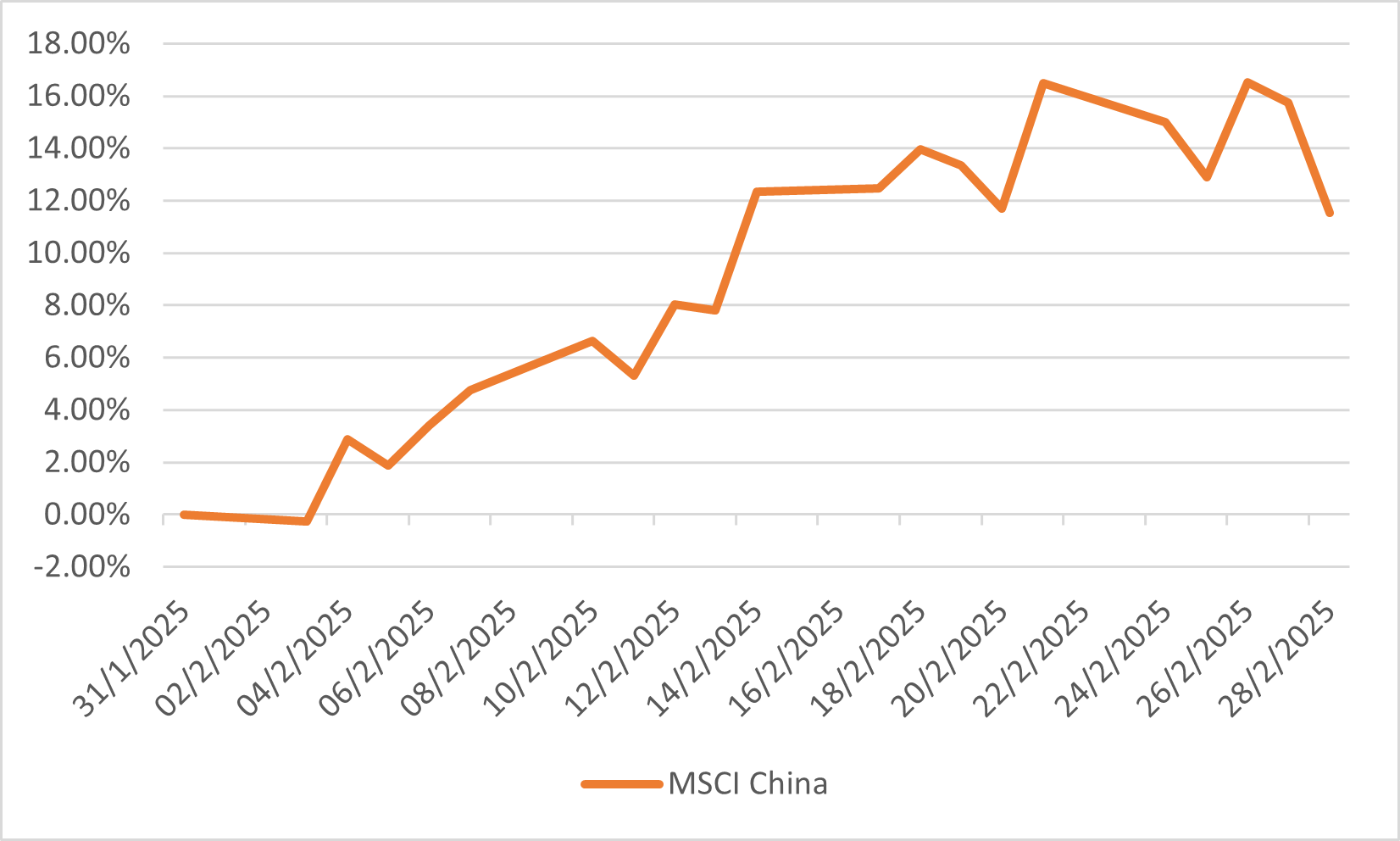

China

In February 2025, Chinese equity markets experienced a significant upturn, with the MSCI China Index advancing by 11.54% for the month. This robust performance was primarily driven by substantial gains in the technology, consumer discretionary, and telecommunications sectors. The technology sector, in particular, benefited from the successful launch of DeepSeek's R1 AI models, which bolstered investor confidence in the AI capabilities of Chinese tech firms. Additionally, positive earnings prospects for consumer tech products and electric vehicles contributed to the rally.

Investor sentiment was further buoyed by supportive government policies aimed at stimulating domestic consumption and technological innovation. Beijing's comprehensive plan to boost consumption, coupled with strong early 2025 economic data, such as a 4% year-over-year increase in retail sales and a 5.9% rise in industrial production, reinforced confidence in the market's upward trajectory. Moreover, the Chinese government's engagement with technology leaders signaled a more favorable regulatory environment, encouraging investments in the tech sector.

The rally was also supported by increased foreign investment, as global investors sought opportunities in China's burgeoning tech industry. The Hang Seng Index, for example, surged by approximately 15% year-to-date, reaching its highest level since February 2022, driven by optimism surrounding China's tech sector and the rise of home-grown AI startups like DeepSeek. This influx of capital underscores the growing appeal of Chinese equities amid global economic uncertainties.

MSCI China Index Performance in February

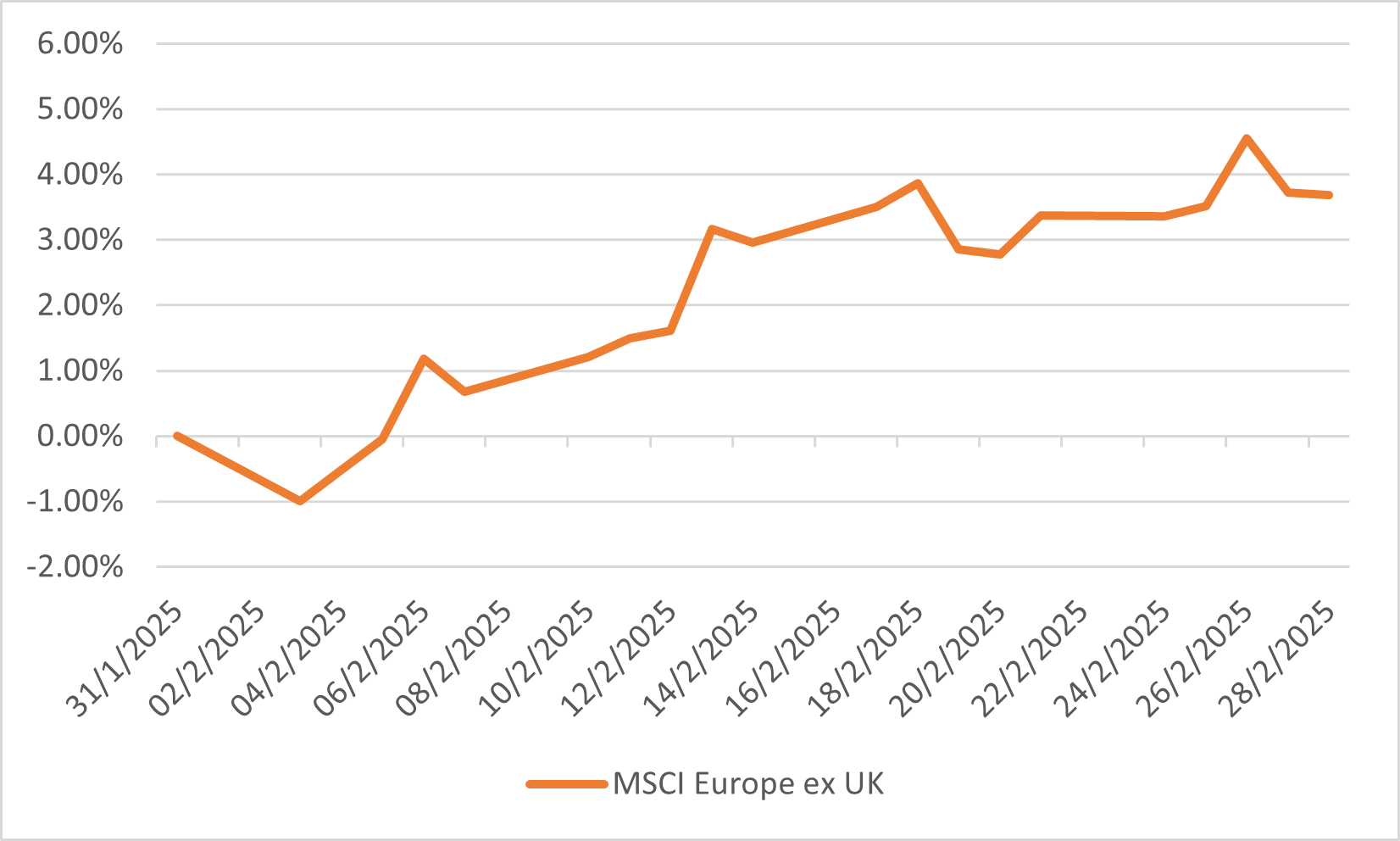

Euro

In February 2025, European equity markets continued their upward trajectory, with the MSCI Europe ex-UK Index rising by 3.4% for the month. This performance was bolstered by investor optimism surrounding a potential ceasefire in Ukraine, which enhanced market sentiment across the region. The financial sector led the gains, maintaining its strong run with returns on equity surpassing those of U.S. counterparts. Additionally, European defense stocks benefited from a renewed focus on domestic production, delivering returns of 9.3%. The UK's FTSE 100 Index also posted a positive performance, advancing by 2.8% in February. This uptick was supported by increased defense spending and infrastructure investments announced by the German government, which contributed to driving European stock markets higher.

Overall, European equities outperformed their U.S. counterparts in February, reflecting a growing investor preference for regions less affected by U.S. policy uncertainties and trade tensions. The Eurozone's economic indicators, including a slight increase in the composite Purchasing Managers' Index to 50.2, signaled tentative signs of improvement, further supporting equity markets. This positive momentum underscores the region's potential for continued growth amid a solid global economic backdrop.

MSCI Europe ex-UK Index Performance in February