Monthly Market Outlook – Mar 2025

21st April, 2025

U.S.

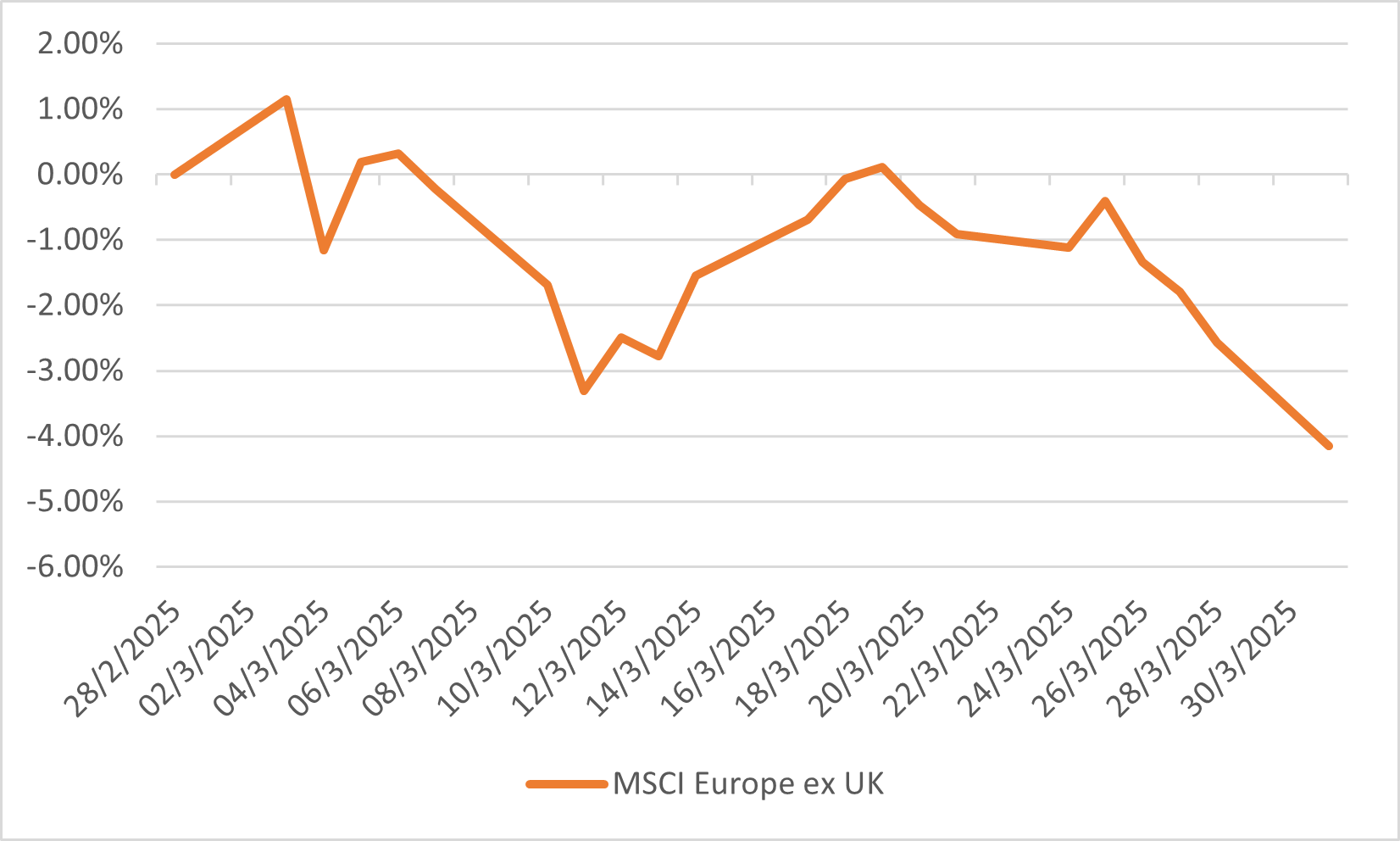

In March 2025, the U.S. equity market experienced a broad decline across major indices, reflecting a challenging environment. The S&P 500 fell 5.75%, bringing its year-to-date (YTD) decline to -4.59%, declining by 10.1% from its peak in February, experienced a notable correction in nearly two years. The Nasdaq 100 and Russell 200 saw a slightly steeper drop of 8.21% and 6.99%. This pushed the VIX to 27.9

The U.S. investment landscape was continuously influenced by President Donald Trump's aggressive trade, with investor concern over inflation and recession. On March 3, President Trump confirmed the imposition of 25% tariffs on imports from Mexico and Canada, alongside an increase of tariffs on China from 10% to 20%, effective March 4. Led to immediate market reactions, with the S&P 500 falling by 1.2%. The University of Michigan consumer sentiment for the US was revised lower to 57 in March 2025 from a preliminary of 57.9, and well below 64.7 in February. Consumer sentiment fell for a third straight month to hit the lowest since November 2022. Despite these challenges, the Federal Reserve maintained a cautious stance, keeping interest rates unchanged at 4.25%–4.5%, while signalling potential rate cuts later in the year if economic conditions deteriorated. Fund Manager Survey from Bank of America research show that US equity allocations dropping 40 percentage points from a 17% overweight to a 23% net underweight, marking the most significant decline in investor sentiment since March 2020.

The labour market showed signs of strain, further adding to concerns about a potential economic slowdown. Unemployment rate slightly increase from 4.1% in February to 4.2% in March, highest level since November 2024.

US Indices Performance in March

Japan

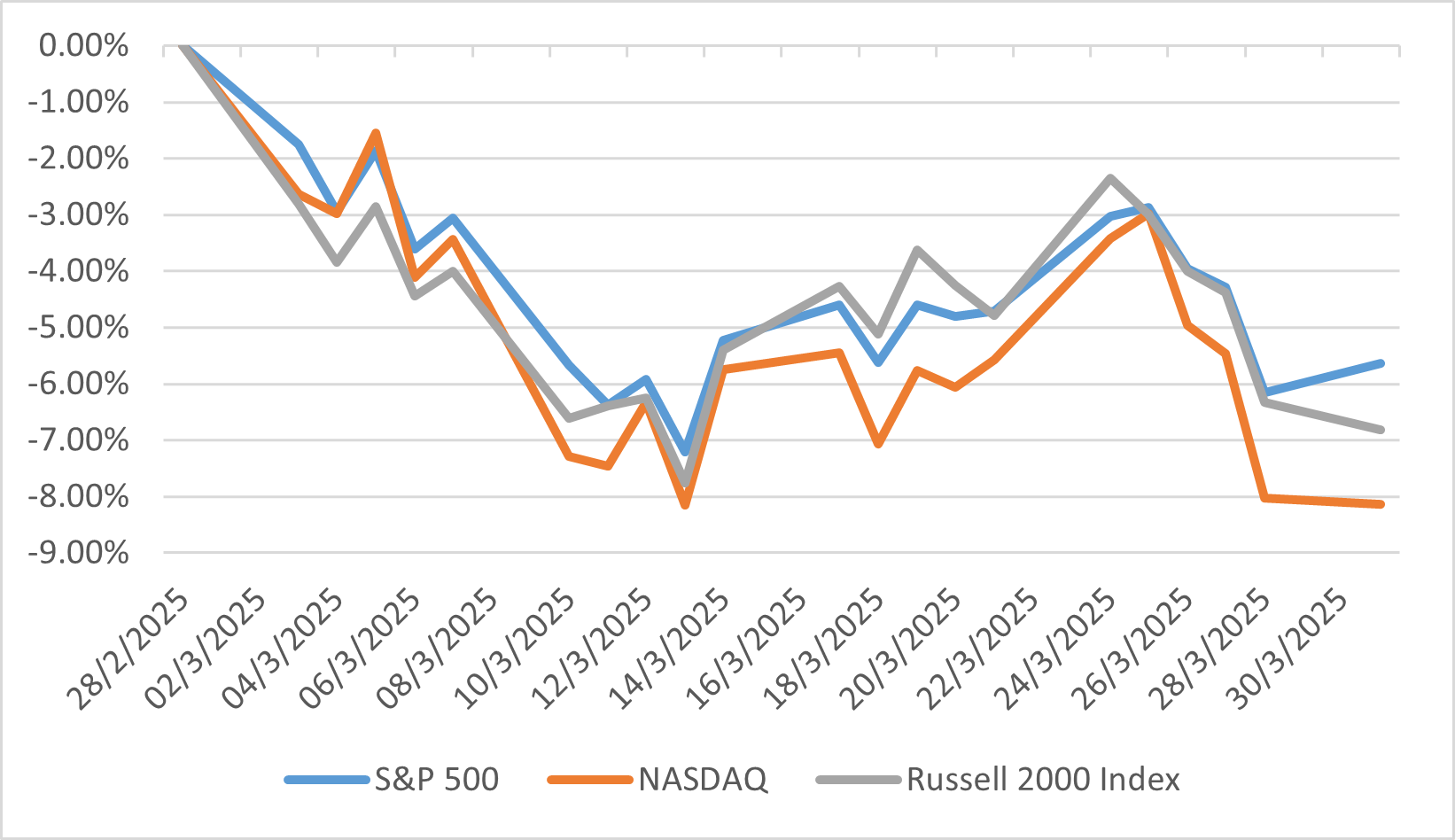

In March 2025, the Japanese stock market experienced significant fluctuations influenced by both domestic developments and international events. The Nikkei 225, a key benchmark of Japanese equities drop by 4.1% in March and closed at 35,617.56 on March 31, marking a 4% drop from the previous day and reaching a seven-month low. The broader TOPIX index also faced challenges, ending March with a 0.2% monthly rise. The decline was driven by concerns over U.S. President Trump’s tariff proposals, a rising yen, and fears of a global economic slowdown. Throughout most of the month movements in the market mirrored those of the U.S. The last day great plunge was due to the announcement of a 25% tariff on Japanese auto imports into the U.S., a key sector of Japan’s economy. This development led to a sell-off in Japanese stocks, particularly in the automotive sector.

Japan's annual wholesale inflation hit 4.2%, accelerating from the previous month. This persistent cost pressure added to corporate concerns amid uncertainty over U.S. tariff policies. The Japanese yen's appreciation also added pressure to exporters' earnings. A stronger yen can erode the competitiveness of Japanese products abroad, affecting corporate profits.

Berkshire Hathaway's decision to increase stakes in Japan's five largest trading houses—Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo—highlighted foreign confidence in Japanese corporations. This move underscored the attractiveness of Japanese companies amid market volatility.

TOPIX and NIkkei Indices Performance in March

China

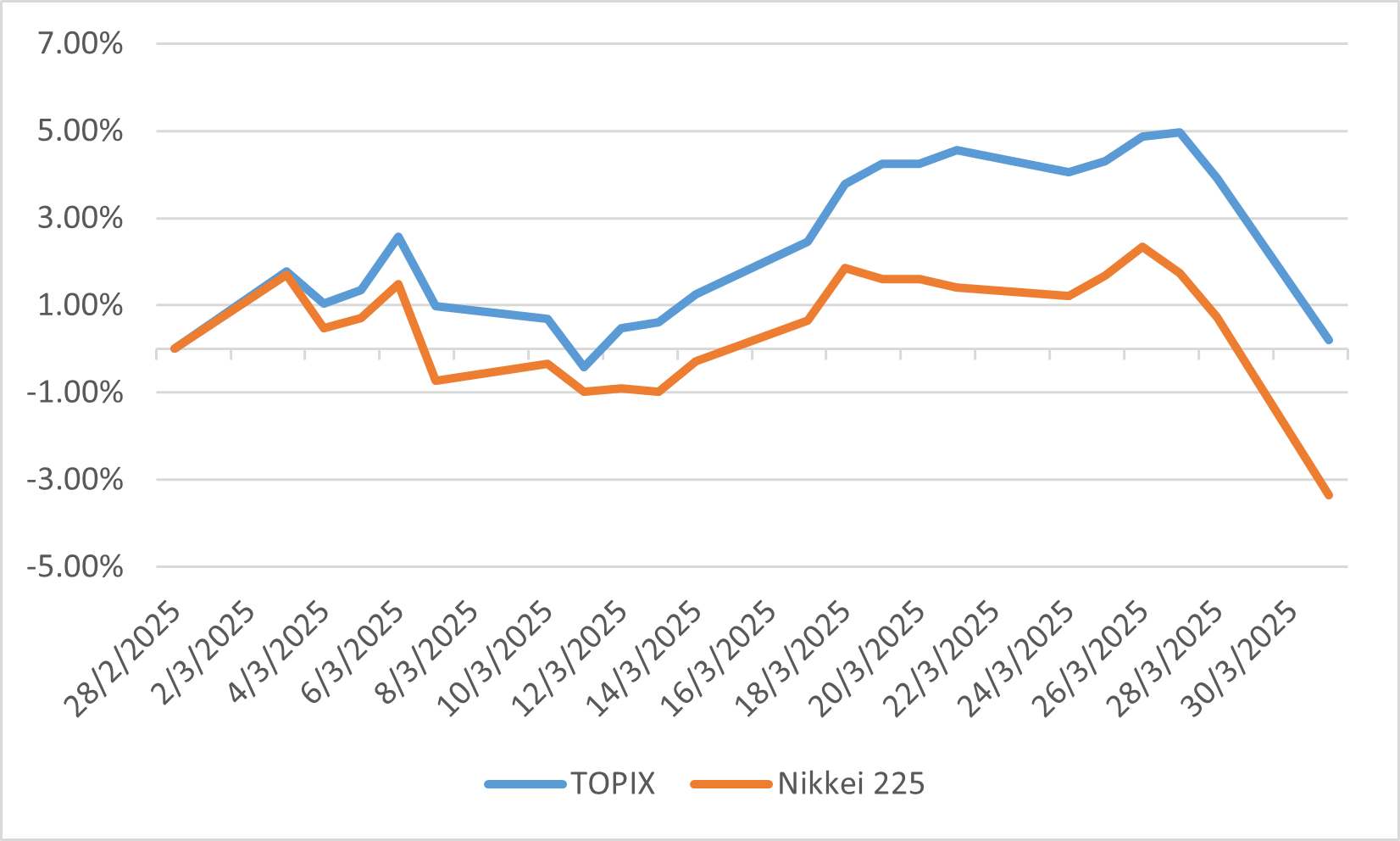

In March 2025, Chinese equity markets show a period of relative stability, with CSI 300 decline about 0.1% and HSI rise 1.1%. China's financial markets in March 2025 were significantly influenced by the government's proactive fiscal and monetary policies aimed at sustaining economic growth amidst external challenges. Chinese banks issued 3.64 trillion yuan ($500 billion) in new loans during the month, significantly surpassing analysts' expectations of 3 trillion yuan and marking a substantial rebound from February's low of 1.01 trillion yuan. The government also implemented measures such as daily restrictions on net share sales by hedge funds and large retail investors To stabilize the stock market. China set the fiscal deficit at approximately 4% of GDP, up from 3% in 2024, to allow for increased government spending. Moreover, It allows local governments to issue 4.4 trillion yuan in special bonds, up from 3.9 trillion yuan in 2024, to finance regional development projects. All these are reflecting the government's commitment to supporting the economy

However, the intensifying trade conflict with the United States posed risks to China's export-driven sectors. In response to U.S. tariffs, China imposed additional tariffs on U.S. goods, affecting a wide range of products. These measures were part of China's strategy to protect its economic interests and counteract U.S. trade actions. Moreover, China's Consumer Price Index fell by 0.1% year-on-year, marking the second consecutive month of decline, while the Producer Price Index dropped 2.5%. This deflationary pressure shows continuous weak domestic demand, reduced energy consumption as China transitioned out of the winter heating season and fading seasonal demand following the Spring Festival in late January.

MSCI China Index Performance in March

Euro

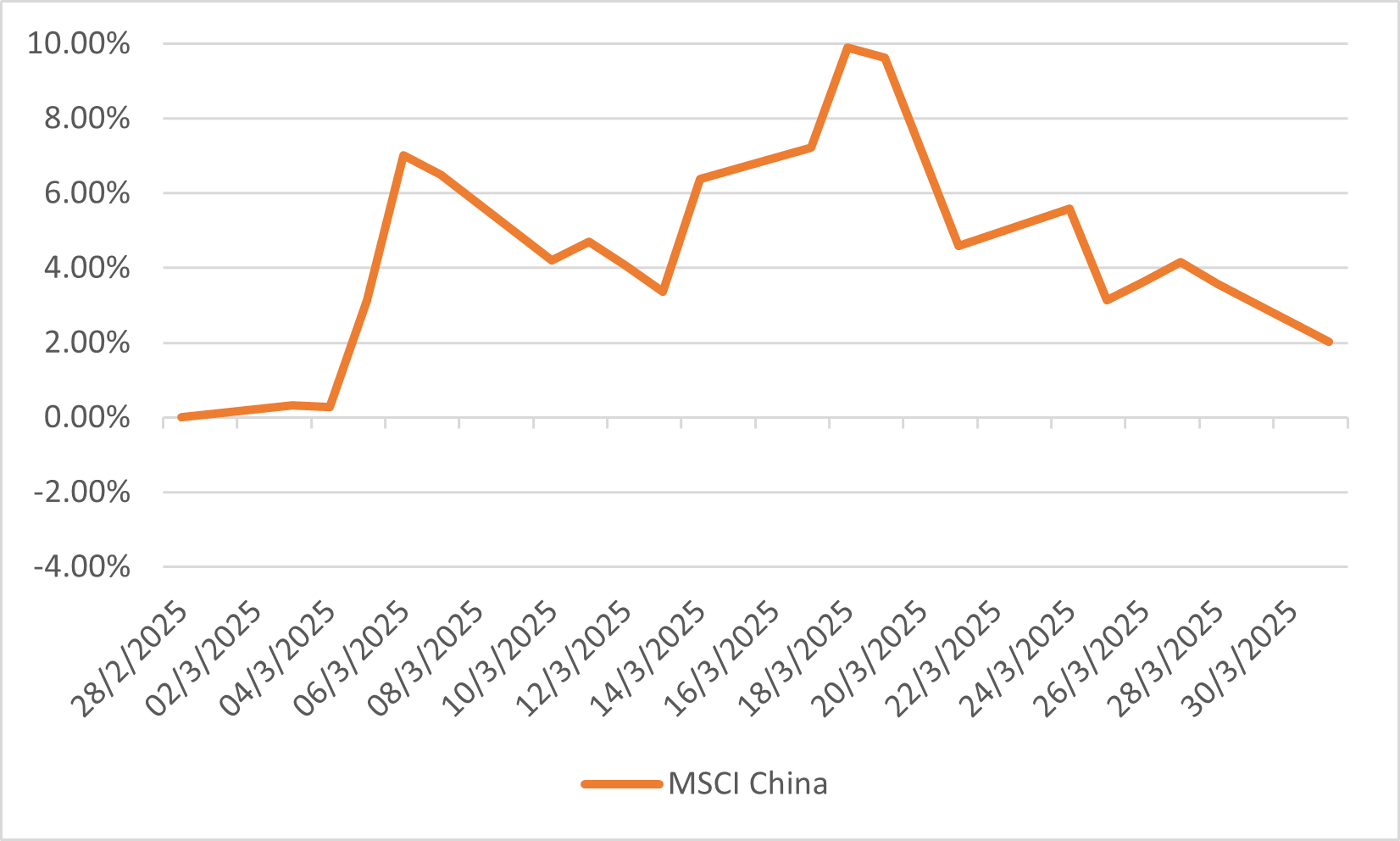

The Eurozone's financial markets in March 2025 were shaped by a complex interplay of economic indicators and geopolitical developments. MSCI Europe ex-UK index drop by 4.15% and UK FTSE 100 declined 2.03%. The announcement of auto tariffs and rumours of a broader-than-anticipated reciprocal tariff in late March triggered a sharp sell-off across European markets.

Furthermore, The European Central Bank (ECB) projected a modest real GDP growth of 0.2% for the first three quarters of 2025, with expectations of strengthening to 1.0% in the medium term. This anticipated growth was supported by consumption, improving investment, and foreign demand. Annual inflation in the Euro Area eased to 2.2% in March 2025, the lowest rate since November 2024. Germany’s approval to reform the constitutional debt break and increase fiscal spending on defence has revived domestic sentiment and been well-received by markets.

The ECB maintained an accommodative monetary policy stance and lowered the three key interest rates by 25 basis points. It is the sixth consecutive rate cut during the quarter to support economic activity. Market expectations priced in further rate cuts by the end of 2025, reflecting the ECB's commitment to fostering growth and addressing inflationary pressures.

MSCI Europe ex-UK Index Performance in March