Monthly Market Outlook – Apr 2025

23rd May, 2025

U.S.

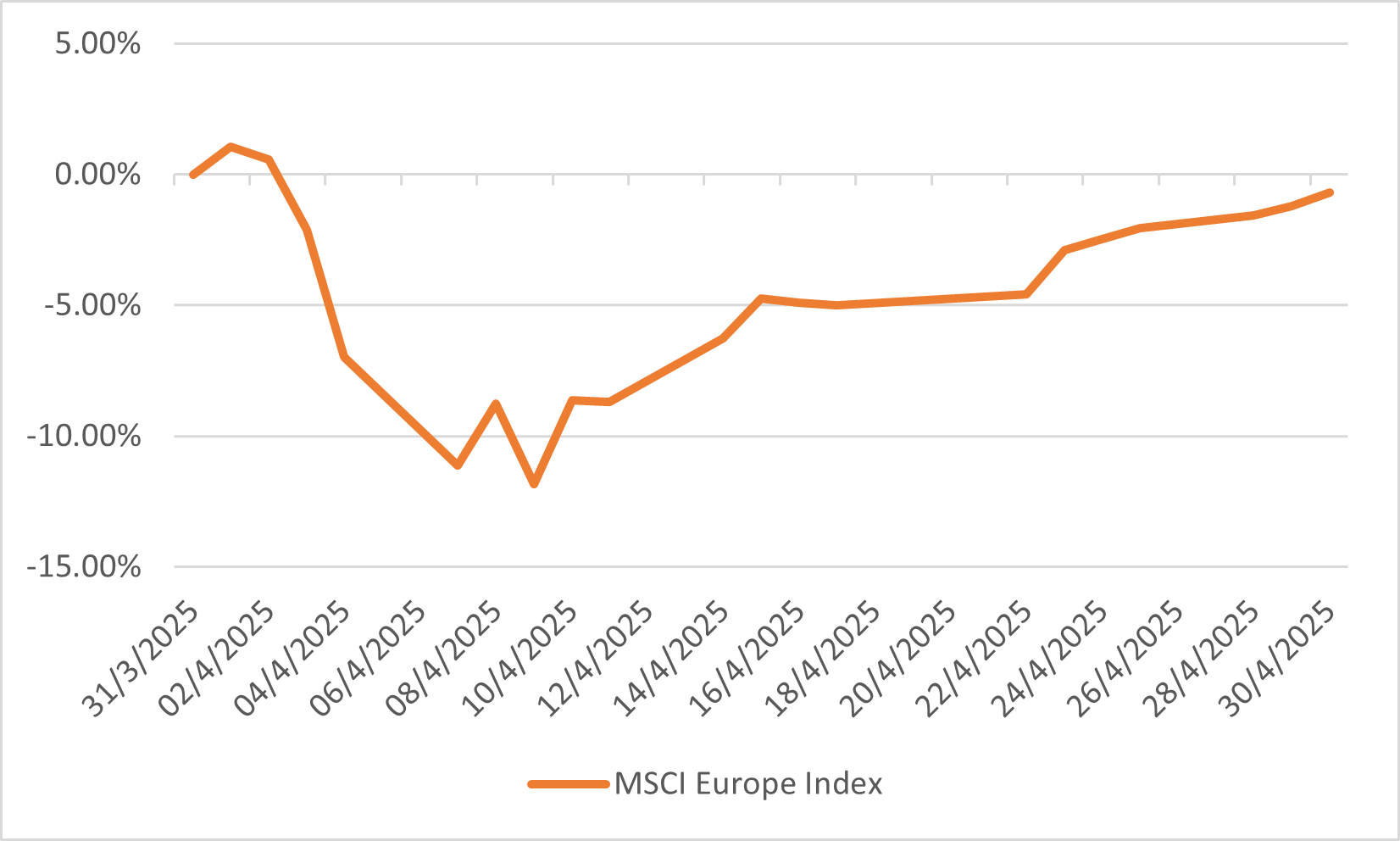

April 2025 was an exceptionally volatile month for U.S. equity markets, primarily driven by profound uncertainty surrounding new U.S. trade tariffs and their potential economic repercussions. The S&P 500 and Dow Jones Industrial Average registered their third consecutive monthly losses, declining by approximately 0.7% and 3.1% respectively. Investor anxiety peaked early in the month following tariff announcements, causing sharp market swings, with the S&P 500 briefly dipping into bear market territory intraday. The CBOE Volatility Index surged to levels unseen since the pandemic, reflecting heightened fear. However, a late-month rally, particularly in technology stocks buoyed by strong earnings, helped the Nasdaq Composite eke out a modest gain of around 0.9%. Despite this partial recovery, U.S. equities generally underperformed global peers.

Sector performance was mixed, reflecting the turbulent conditions. Technology stocks, after an initial hit, rebounded strongly, helping growth stocks outperform their value counterparts. Conversely, the energy and healthcare sectors were notable laggards. The market turmoil also highlighted a challenging start for the current presidential term, with the S&P 500 marking its worst performance in the first 100 days of a presidency since 1974, shedding significant market capitalisation due to tariff-induced uncertainty.

The economic backdrop added to investor concerns. The U.S. economy unexpectedly contracted by 0.3% in Q1 2025, largely attributed to a significant surge in imports as businesses and consumers rushed to acquire goods before anticipated tariffs took effect. Inflation forecasts also rose, with the CPI projected to climb 3.5% in 2025 due to the inflationary impact of these tariffs. This, combined with falling consumer confidence and slowing job growth, signalled increasing pressure on the U.S. economy. The U.S. dollar weakened, and Treasury yields, after an initial spike, settled lower, though concerns about their safe-haven status emerged. The prevailing uncertainty around trade policy suggests continued market volatility remains a significant risk.

US Indices Performance in April

Japan

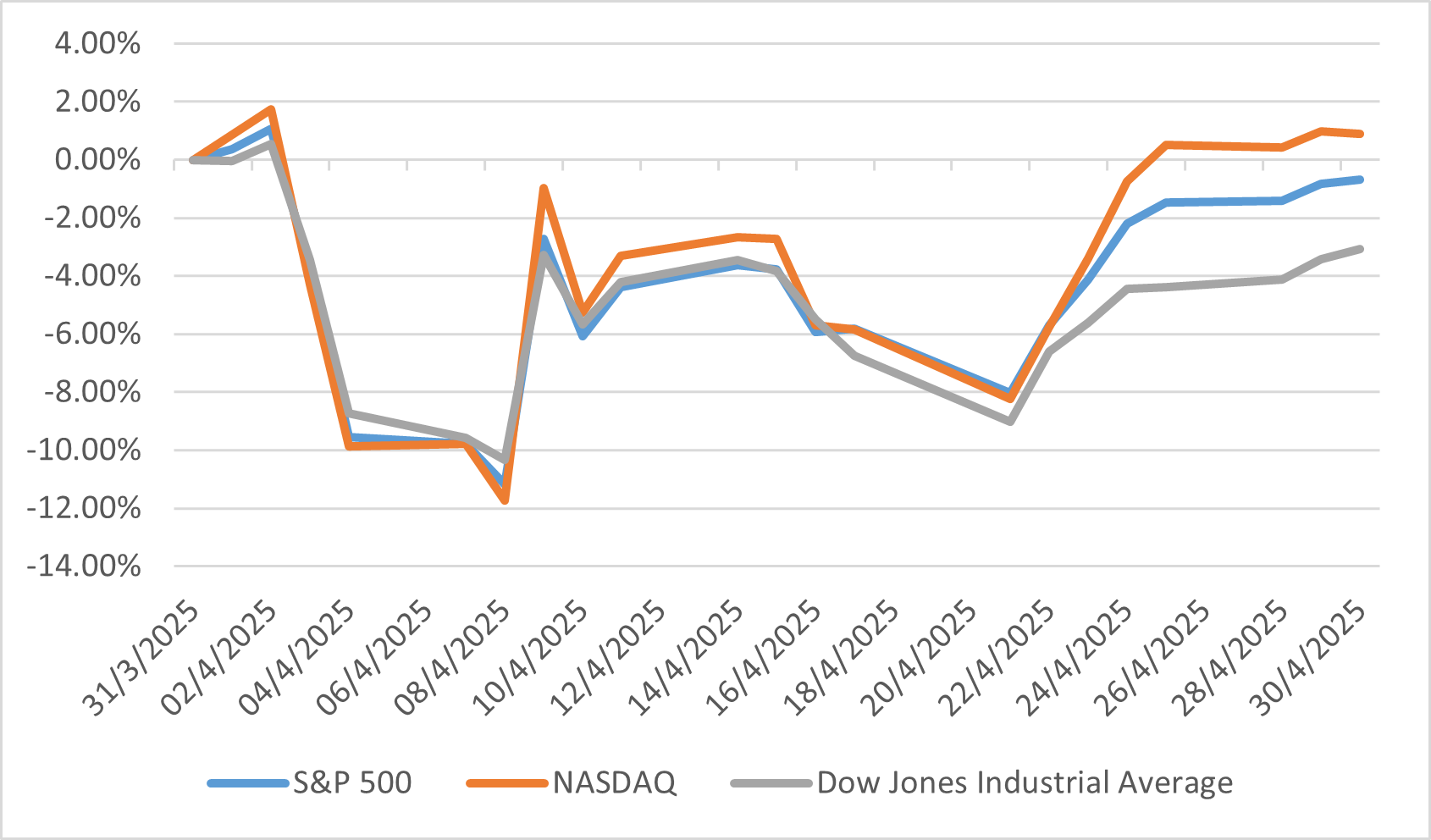

April 2025 saw a modest recovery in the Japanese equity market, with the TOPIX and Nikkei 225 indices rising by 0.32% and 1.20% respectively, after several challenging months. Market volatility was significant, largely influenced by uncertainty surrounding U.S. tariff policies. Early April witnessed sharp declines, with the Nikkei slumping due to worries about the escalating U.S.-China trade conflict and a strengthening yen fuelled by safe-haven flows. However, the market ended the month on a more optimistic note as progress in U.S.-China tariff negotiations eased some concerns. Despite these gains, the Nikkei had experienced extreme daily fluctuations earlier in the month, including an 18-month low followed by significant single-day surges and drops.

A key feature of April was a record net inflow of foreign investment into Japanese equities and long-term bonds, totalling ¥8.21 trillion (approximately $56.6 billion), as investors sought alternatives to U.S. markets amid trade policy shocks. This influx, particularly strong in early April, contributed to the Nikkei's ability to post a monthly gain, contrasting with declines in U.S. indices like the S&P 500. Within the Japanese market, small- to mid-cap stocks outperformed, and domestic demand-related stocks also performed well as the yen strengthened. This investor shift was partly attributed to Japanese assets being viewed as a safe haven.

The backdrop for these market movements included ongoing Japan-U.S. trade negotiations, which had not yet concluded. While U.S. tariffs posed a risk, with analysts estimating a potential 1% hit to Japan's GDP if fully implemented, many believed the worst-case scenario was already priced in. Corporate governance reforms in Japan, encouraging shareholder returns and leading to record share buybacks, continued to be a positive factor, supporting share prices and attracting investment.

USD to JPY Exchange Rate

China

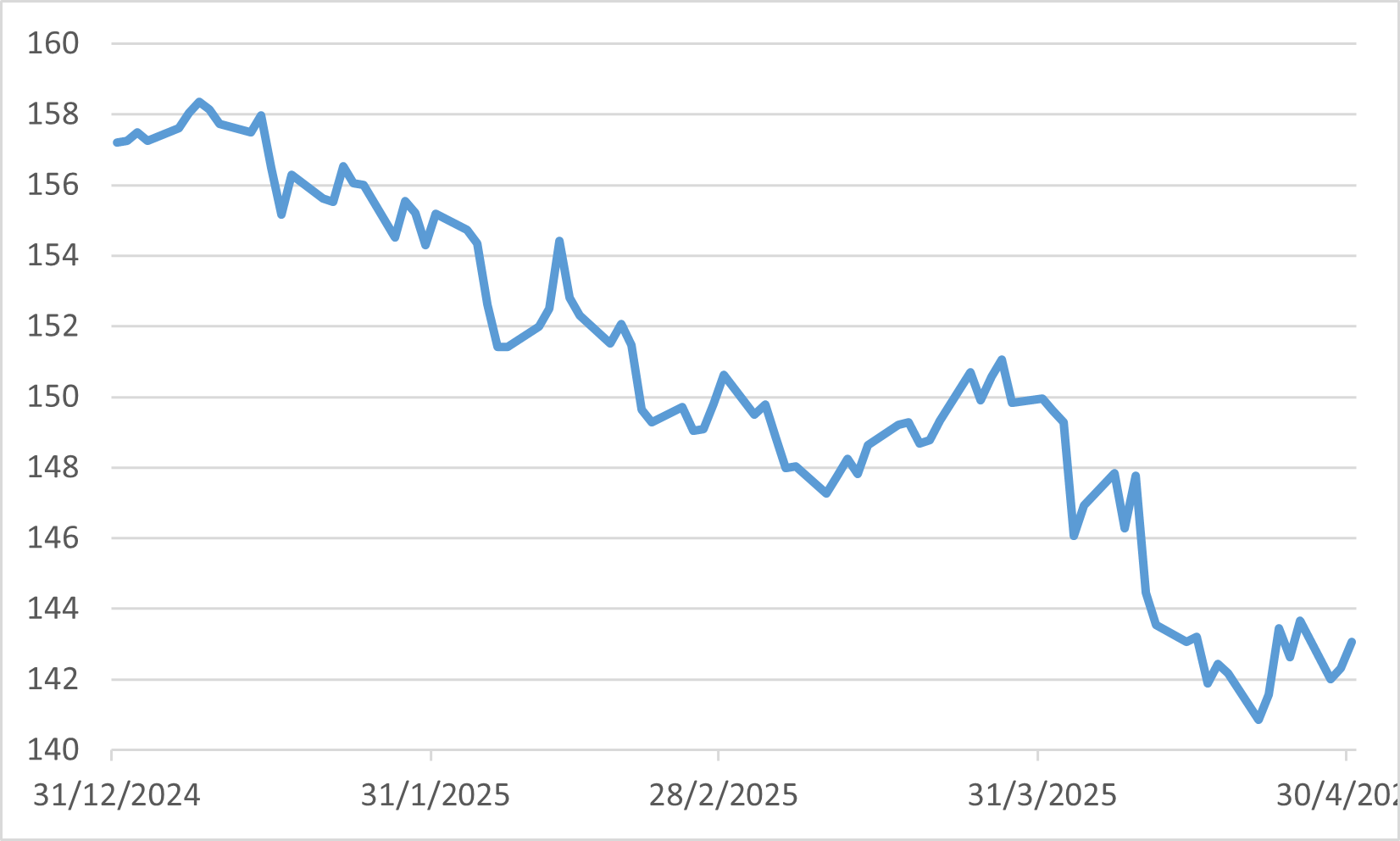

April 2025 proved to be a challenging month for Chinese equity markets, which were largely overshadowed by escalating U.S. tariff policies despite showing more resilience than some global bourses. The benchmark Shanghai Composite Index retreated, falling approximately 1.6% for the month. The Shenzhen Component Index experienced a more significant decline of 5.6%, while Hong Kong's Hang Seng Index shed 4%. A notable event was the sharp single-day drop on April 7th, when the Shanghai Composite fell 7.34% in response to contentious U.S. tariffs on trading partners, marking its worst daily performance. Despite this, trader sentiment was somewhat supported by China's firm stance against the tariffs and government policies aimed at shoring up the economy.

Sector performance during April was mixed, with state-owned companies, technology, and consumption-related stocks providing some support. This occurred even as the broader market, including the Hang Seng Tech Index which had seen strong year-to-date gains leading into April, faced headwinds from the trade tensions and prior regulatory concerns. There was renewed interest from global investors in Chinese equities, particularly offshore listings, driven by supportive policies, the "DeepSeek moment" (a notable AI advancement), and substantial southbound flows from mainland investors. The MSCI China Index, with its mix of offshore and onshore equities, saw earnings stabilise and trend upwards, particularly in technology, consumer discretionary, and financials. State-owned enterprises also played a role in market stabilisation through share buybacks and stake increases.

The economic backdrop in April presented a mixed picture. While industrial output grew by a resilient 6.1% year-on-year, beating estimates despite tariffs, retail sales growth decelerated to 5.1%, indicating softer domestic consumption. China's manufacturing PMI contracted for the fourth consecutive month, signalling persistent structural weaknesses. The People's Bank of China maintained a "moderately loose monetary policy" to balance growth stimulation with financial stability. In response to economic headwinds, Beijing unveiled a new stimulus package in early May, following April's data, combining monetary tools, market support, and fiscal adjustments to revitalise growth and counter trade pressures.

China Indices Performance in April

Euro

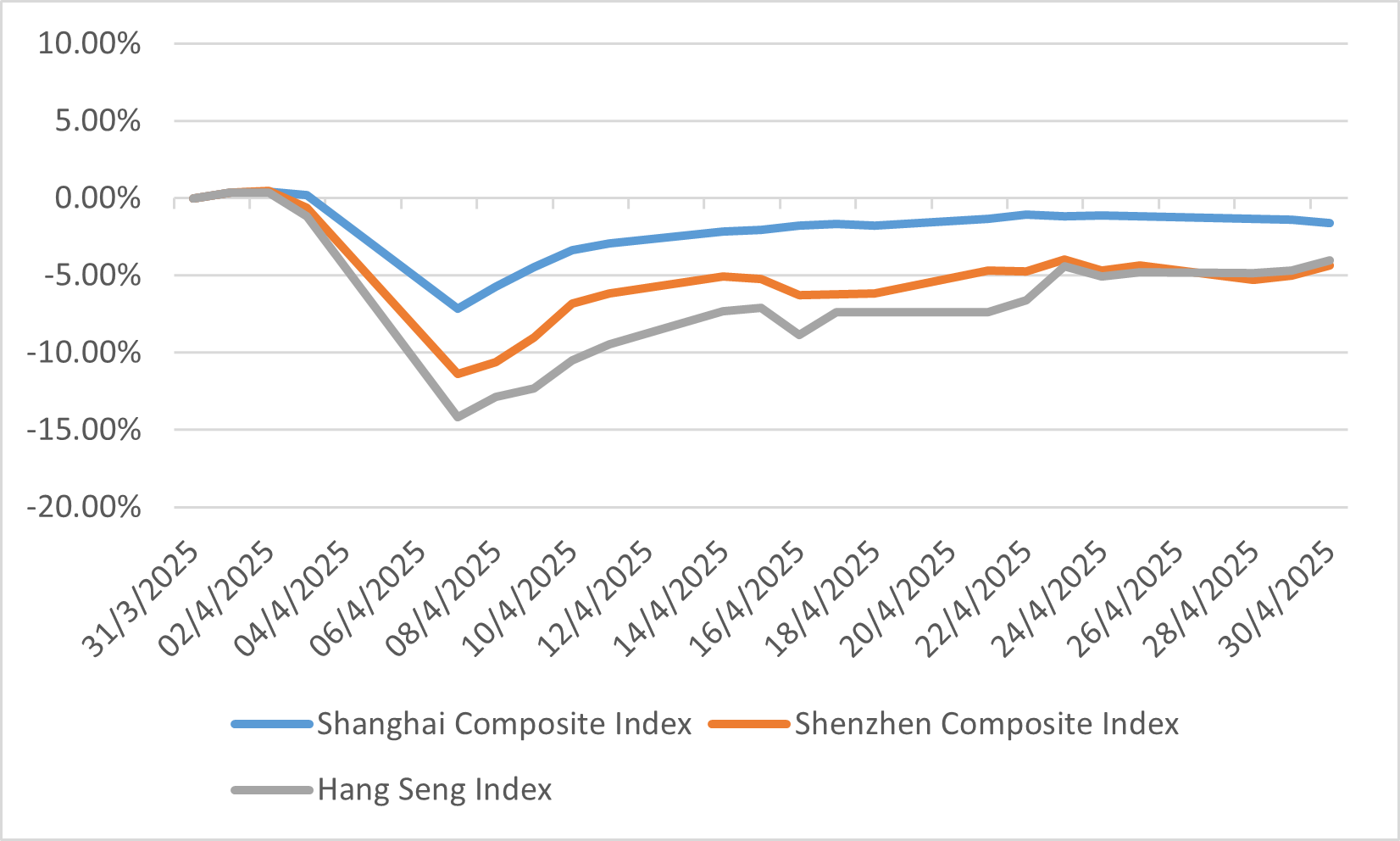

April 2025 brought significant volatility to European equity markets, primarily driven by new U.S. tariff announcements early in the month. This initial shock led to sharp market swings, with the VIX volatility index hitting its highest intraday level since 2020. Although markets stabilised somewhat towards month-end following a temporary U.S. tariff pause, most major European indices finished modestly down; the Stoxx 600 fell 0.5%, and the FTSE 100 declined 0.7%, though the UK's FTSE 250 managed a 2.7% gain. Overall, the European equity market saw a slight decline of 0.7% for the month.

Despite the month's turbulence, European equities continued their year-to-date outperformance compared to U.S. markets, as investors reacted to U.S. policy uncertainty by diversifying away from American assets. Fund manager surveys indicated a substantial rotation out of U.S. stocks. European stock valuations became more appealing, with the MSCI Europe trading below its 20-year average price-to-earnings ratio. However, the market instability muted Equity Capital Markets activity, with few IPOs proceeding.

MSCI Europe Index Performance in April