Inflation remains the greatest threat

13th May, 2018

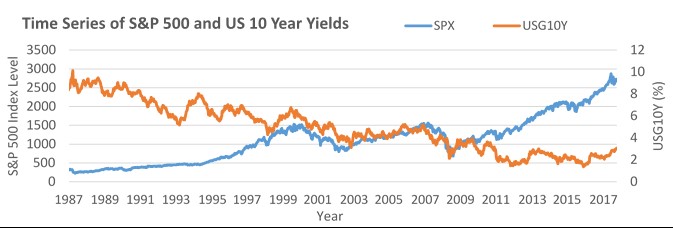

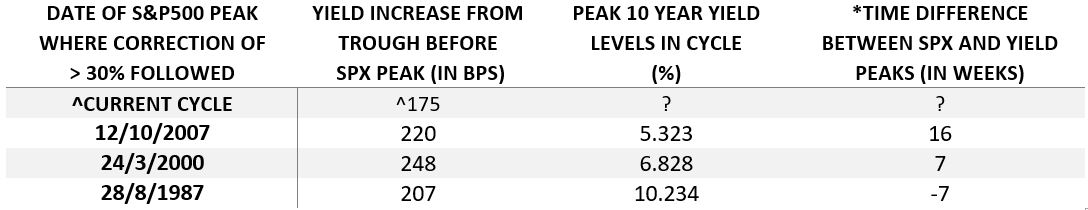

US treasuries have been facing heavy selloff this year as investors are pricing in the possibility of inflation gathering pace under a tightening labor market and thus a steeper rate hike trajectory. The US 10-year treasury yield, a common return gauge of safe-havens, has climbed by more than 50bps year-to-date. We expect the metric to edge up slightly further upon Fed rate hikes and believe it to be a bane for the US equity market. We examined the peaks of the S&P 500 Index in the past 30 years and found that relatively large correction tended to occur after the 10-year yield accumulated an increase of over 200 bps in a cycle. An interpretation for the phenomenon that a yield pickup of such sufficed to make the economy more vulnerable to shocks or to depress equity valuations. If history is of any indication of future, we are now close to the alarm level of 200 bps and 2 to 3 rate hikes by the Fed are likely to bring us there. Investors shall therefore be wary of subsequent movement in yields.

* Positive time difference means that yields peaked earlier than SPX

^ In the current cycle, the yield has picked up from trough by 175bps, as of 18th May, 2018